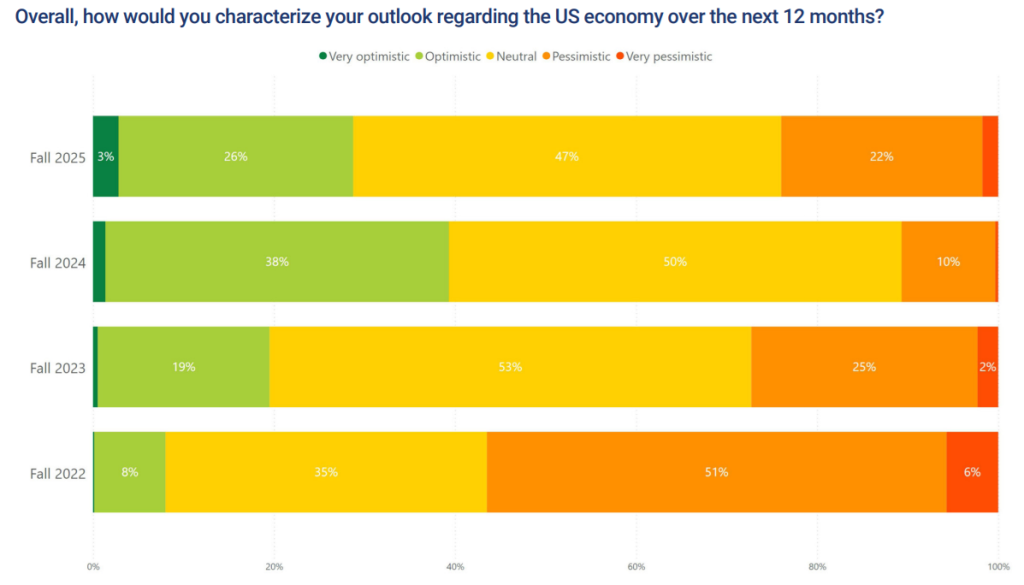

Audit partners have a better attitude about the economy after reporting concerns last spring, as pessimism fell from 44% to 22% and economic optimism and neutrality both grew by more than 10%, according to the Fall 2025 Audit Partner Pulse Survey from the Center for Audit Quality.

This shows a continued recovery from fall 2024, when pessimism stood at just 10%, neutrality at 50%, and optimism at 38%, suggesting that while sentiment has improved from spring 2025’s lows, the accounting and auditing professions haven’t yet returned to the confidence levels seen in late 2024, the CAQ said.

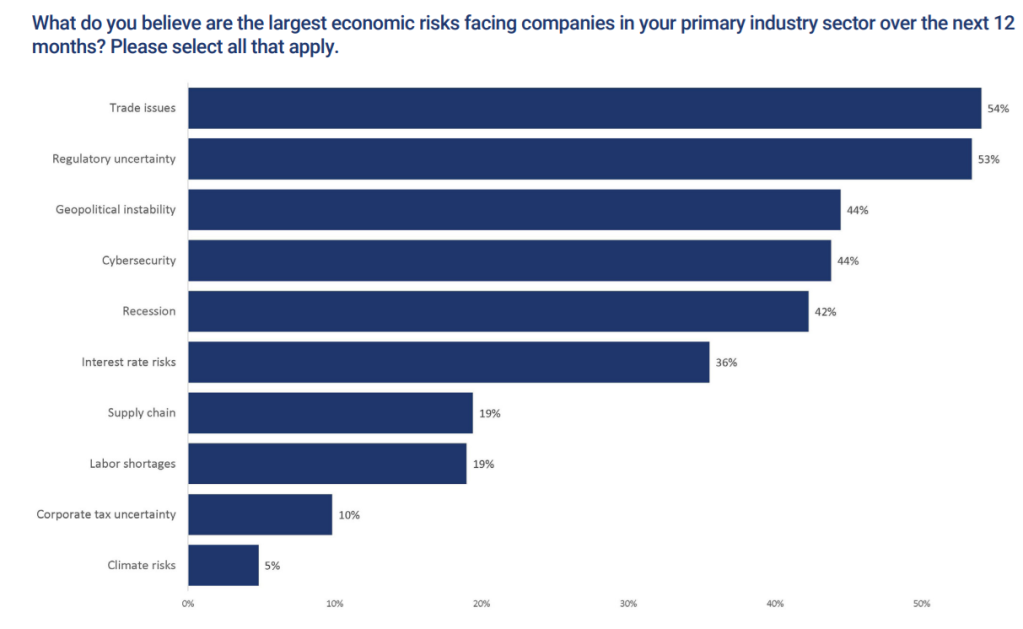

Trade tensions and regulatory uncertainty now top the list of risks identified by audit partners at 54% and 53%, respectively, marking a significant shift from the spring 2025 CAQ survey where recession was a top concern. While audit partners previously cited increased regulations as a risk to companies in the industries they audit, current concerns center on unpredictability itself, the report says.

Recommended Articles

Despite the unpredictability, the survey shows companies are proactively expanding their disclosures in three key areas: 61% are increasing business strategy disclosures, 58% percent are increasing financial performance disclosures, and 48% are increasing artificial intelligence integration disclosures.

“Companies are offering more details about business strategy as they navigate shifting policy priorities and meet investors’ rising demand for transparency,” the CAQ says. “Similarly, financial performance disclosures remain robust even as the debate on quarterly reporting continues, reflecting investor’s reliance on this information.”

Recommended Articles

In addition, artificial intelligence-related disclosures are increasing as companies seek to demonstrate near-term efficiency gains as well as long-term positioning as innovators within their sectors, the report says. The CAQ’s analysis of recent 10-K filings confirms this trend: 90% of S&P 500 companies now reference AI-related information, up nearly 25% from 2023.

Of the 459 audit partners at public accounting firms who responded to the CAQ’s survey, 43% said their clients are holding steady, either simply seeking guidance or making no strategic modifications while they prepare for regulatory change.

“This inward-looking recalibration underscores an ongoing shift toward cost discipline,” the CAQ said. “As the general economic outlook settles into an equilibrium and companies are pursuing resilience-focused strategies, many industries are settling into a holding pattern and are prioritizing financial performance, cost management, and strategic AI investments.”

The combination of regulatory ambiguity and unfolding policy impacts continues to drive conservative operational approaches, and cost-control measures are widespread, according to the report. Fifty-eight percent of companies are reportedly pursuing a reduction in headcount, 53% are focusing on targeted upskilling, and 43% are moving toward tighter hybrid work policies to reshape the workforce for a more efficient future.

But even as organizations cut costs across nearly every function, AI investments continue to climb, viewed less as discretionary spending and more as essential to long-term efficiency and resilience, the CAQ said.

When audit partners were asked how clients in their primary industry sector utilized AI technologies, their responses included:

- Process automation (65%)

- Customer experience, service, and support (54%)

- Predictive analysis (31%)

- Targeted marketing (30%)

- Content creation (26%)

- Fraud detection (26%)

- Cybersecurity (24%)

- Hiring and recruitment (19%)

- Financial reporting or planning and analysis (13%)

- Supply chain management (10%)

- Clients not making AI investments (7%)

- Workplace safety (4%)

Recommended Articles

“Regulatory ambiguity continues to shape corporate strategy, prompting caution, cost-conscious, and conservative decision making, even as equilibrium returns,” the CAQ said. “The pivot toward AI-driven innovation underscores an emerging belief that resilience in the next economy will not come from austerity, but rather from smart, strategic investments. For investors, auditors, and policymakers alike, these findings suggest a business community recalibrating, cautious yet creative, defensive yet determined.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs