By Alice Yin and A.D. Quig

Chicago Tribune

(TNS)

Mayor Brandon Johnson on Thursday proposed a $16.6 billion budget for next year that reinstates Chicago’s corporate head tax while scaling back an extra pension payment, kicking off what could be the freshman executive’s most grueling budget process yet.

The recommendation is a mishmash of fixes that leans on $438 million in new taxes and fees. It avoids unpopular ideas such as a property tax hike, a grocery tax or a garbage fee increase but adds a new charge on social media tech giants and a monthly $21-per-employee tax on larger companies, according to a Wednesday briefing with reporters.

Johnson’s proposal—a 3% decrease from this year’s spending plan—slashes 446 city jobs, a cut that includes layoffs of some whose pay is funded by federal grants or pandemic relief money that is set to run out.

Other one-time tricks—a record $1 billion sweep of tax increment financing funds, refinancing old debt, borrowing money to pay for settlements and labor contracts and a continued hiring freeze—would help cover another significant chunk of the deficit. That gap is newly projected to be $1.19 billion, $40 million higher than Johnson initially disclosed.

The mayor also wants the city to not make its full extra pension payment, which is designed to cut down future costs for taxpayers.

Johnson’s initial version of the spending plan is likely to undergo significant changes as he tries to round up votes before the City Council passes it, but his Thursday budget speech to aldermen went all out in embracing his progressive values.

And while the budget fight with council members over the next few months will come down to the thorny politics of dollars and cents and who pays what, his remarks endeavored to tie the urgency of his wishlist to an existential fight against President Donald Trump, whose toxic reputation among most Chicagoans provides timely political cover for the mayor during a difficult first term.

“They are trying to militarize and occupy our city. But it’s not just the boots on the ground, y’all. What is even more devastating is the economic attacks: the Trump cuts,” Johnson said on the council floor. “The Protecting Chicago budget protects Chicagoans from Trump’s cuts and his attacks on our city.”

Johnson would go on to invoke Trump more than a dozen times in his speech.

Recommended Articles

Taxes, new and old

The mayor opted to skip even an inflation-tied property tax hike next year, a remarkable sea change from fall 2024, when he broke a campaign promise by coming out the gate proposing Chicago’s largest hike in almost a decade. Aldermen wouldn’t go along with that, and Johnson abandoned it for the 2025 budget.

To steer clear of that third rail entirely reflects how much pressure the looming February 2027 election adds on him and the City Council. But Johnson refused to tell reporters his move if aldermen nonetheless pressed for a property tax increase over other levies or cuts.

While it might seem unlikely for aldermen to now support higher property taxes, they will certainly feel intense pressure from bigger businesses to dump the head tax and find another way to raise the $100 million Johnson projects from it.

“I did give you my answer. I am not proposing a property tax. Like, I can’t make it any more emphatic than that,” the mayor said when asked Wednesday if he’d sign a budget that raised that tax. “If I’m open to it, I would be proposing it. I’m saying I’m not offering one. That is my answer.”

Aldermanic opposition apparently killed the mayor’s previous call to reinstitute the 1% grocery tax that was phased out by Gov. JB Pritzker, and to hike garbage collection rates, which was proposed by his handpicked budget working group.

Instead, after a bold corporate payroll tax hit legal snags, the mayor pitched his $21-per-employee tax on corporations as the next frontier in his largely-stalled leftist economic agenda. It would be charged on companies with more than 100 employees who work more than half their time in Chicago.

The $100 million would be set aside in a “Community Safety Fund” to pay for existing violence reduction programs that have been heavily subsidized by federal pandemic relief money that is nearly tapped out. $18.4 million would go to new community violence interruption or reduction grants to outside agencies.

A head tax of $3 and later $4 per employee was put in by Mayor Richard J. Daley and chugged along for nearly four decades before Mayor Rahm Emanuel phased it out by 2014 as part of his administration’s pro-business agenda for downtown.

Johnson said the tax is dual-purpose. The money would address what business groups say is their top concern: crime. And it would weaken some of the Trump tax breaks granted to the wealthiest across the country. Johnson’s team estimates only the top 3% of businesses in the city would be subject to it.

The mayor’s progressive base has already embraced a revival of the head tax in lieu of other nickel-and-dime charges that hit the city’s middle and lower class. Even so, more moderate and big-business opponents are expected to deem the head tax dead on arrival over fears it would kill jobs.

Johnson sought to rebuff that attack in his Thursday speech.

“To those who say this is a fee that is anti-business, I say that investing in building a much safer city is the most pro-business investment,” the mayor said. “If we defund the programs that have helped us make this past summer the safest summer in a generation, we will … play into the hands of the far right who want to paint our city as a dangerous and lawless destination.”

In all, a slew of new or expanded “revenue enhancements” including the head tax would fill $437.5 million of the 2026 budget gap.

The biggest chunk would come from another hike to the city’s personal property lease tax, which includes a tax on cloud software and infrastructure. The levy goes up from 11% to 14% under Johnson’s proposal. That “tax on big tech” would net $333 million.

The mayor plans to expand the zone where Lyft and Uber riders must pay a congestion surcharge, bringing in an extra $65 million. A hike to the boat mooring fee, dubbed by Johnson as a “yacht tax,” is expected to bring in another $4.1 million. An online sports betting tax—details still undisclosed—is projected to raise $26.2 million, while a long-pending hemp tax that still needs state approval would yield an estimated $10 million.

Another bold Johnson idea is to charge the country’s largest social media companies— including TikTok, Meta, YouTube, and X—$0.50 per active user over 100,000 in Chicago. He’s counting on the “social media tax” to raise $31 million and help fund mental health services that were also largely paid for with pandemic relief money.

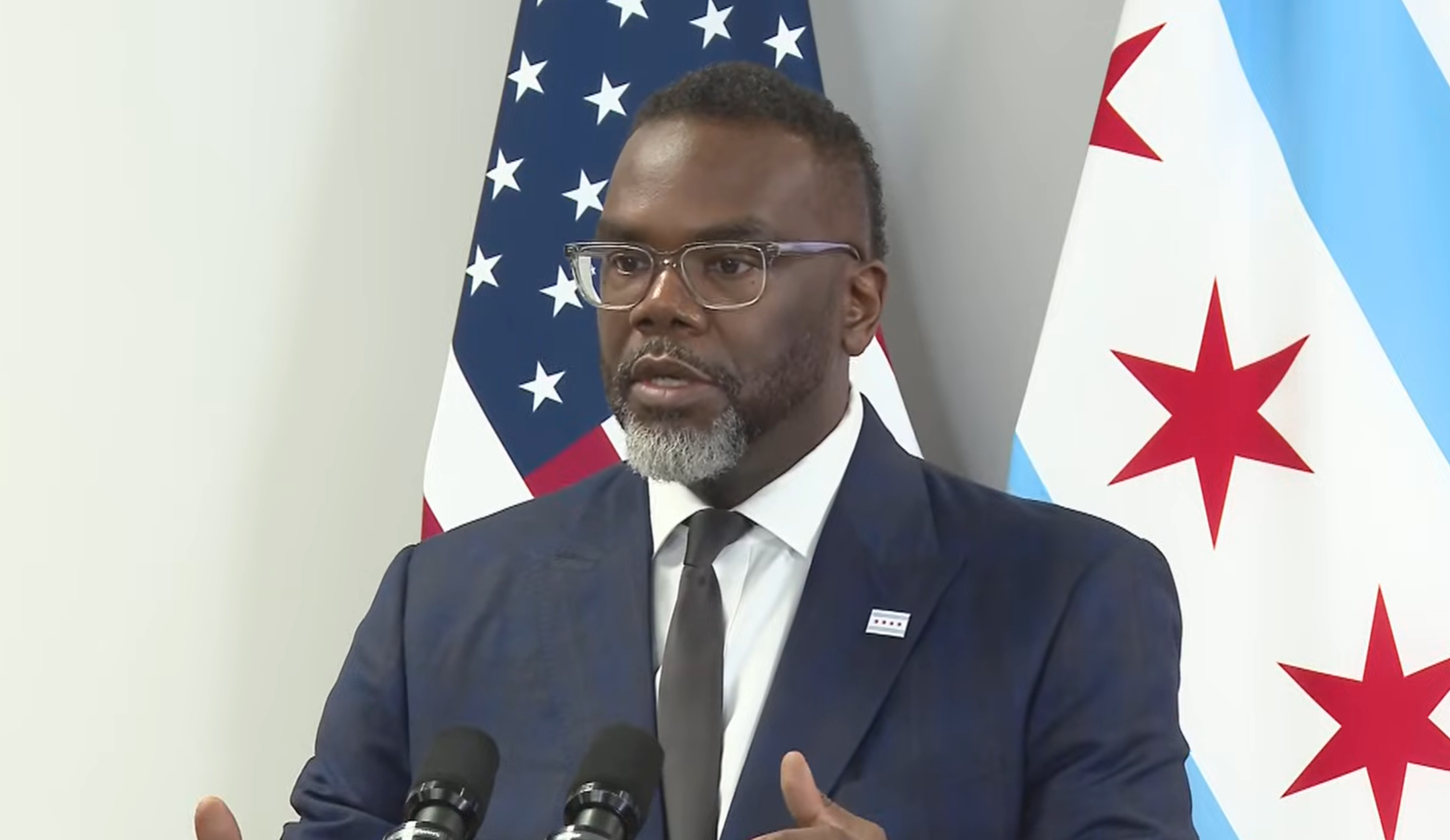

Photo caption: Chicago Mayor Brandon Johnson delivers his budget address to the City Council, Oct. 16, 2025, at City Hall. (Brian Cassella/Chicago Tribune/TNS)

_______

©2025 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs