By Lee Welborn and Eric Bardwell

When administering estates and trusts, fiduciaries must balance competing objectives: preserving wealth for future generations, meeting current distribution obligations, and minimizing tax burdens. Accountants, as trusted advisors, play an integral role in achieving these goals. While many professionals are familiar with the benefits of a cost segregation study for investment assets acquired during life, fewer recognize the value this tool brings in the context of estate or trust administration.

Cost segregation can accelerate depreciation deductions, reduce income tax liabilities, create permanent tax savings in certain scenarios, and enhance cash flow to support both beneficiaries and long-term trust administration.

Cost segregation: A tax-saving opportunity for accountants

Cost segregation is a tax planning strategy that allows property owners to accelerate depreciation deductions and reduce taxable income in the early years of real estate ownership. From an accountant’s perspective, this creates a timing difference in when allowed depreciation deductions are realized, offering significant financial benefits.

Per the Internal Revenue Code (IRC), residential investment properties are typically depreciated over 27.5 years and commercial properties over 39 years. Cost segregation studies are engineering-based analyses that identify, quantify, and reclassify certain components of real estate into shorter depreciation categories (e.g., five, seven, or 15 years). Reclassifying costs from longer depreciation periods to shorter ones creates larger depreciation deductions earlier in the asset’s life. This reduces current-year income tax liability and improves liquidity for the estate or trust.

Illustration: Depreciation without and with cost segregation

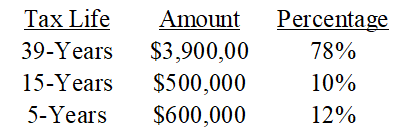

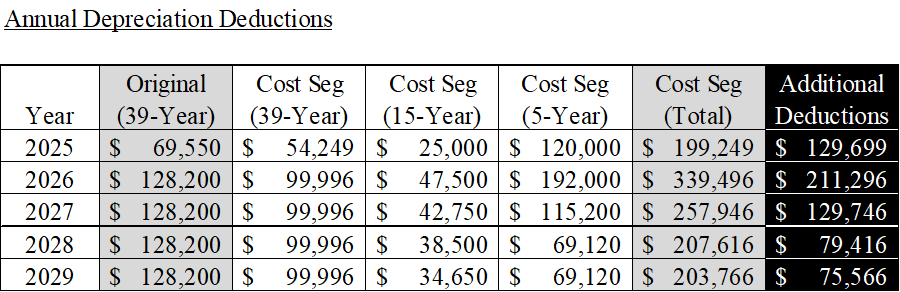

Consider an office property acquired for $5,000,000 (excluding land) in June 2025. Without a cost segregation study, the entire purchase price would be depreciated over 39 years. However, a cost segregation study reallocates the purchase price as follows:

The reallocation accelerates deductions, as shown in the table below, providing a tax benefit in the early years:

Maximizing benefits with bonus depreciation

Accountants must stay attuned to evolving tax legislation that impacts estates and trusts. For example, the One Big Beautiful Bill Act (OBBBA) reinstated 100% first-year bonus depreciation for qualified assets acquired and placed in service after Jan. 19, 2025.

Using the same $5,000,000 example above, the inclusion of 100% bonus depreciation would enable the estate or trust to fully expense the $1,100,000 allocated to five- and 15-year property in the first year. This results in greater tax deferral benefits and improved cash flow for the fiduciary.

Addressing liquidity challenges through cost segregation

Estates and trusts often face significant liquidity challenges, particularly when balancing income distributions with administrative expenses and estate tax obligations. Accountants can address these challenges by leveraging cost segregation to reduce taxable income, thereby increasing available cash flow. This additional liquidity provides fiduciaries with the flexibility to:

- Meet income distribution requirements,

- Pay estate, generation-skipping transfer, and property taxes, and

- Cover ongoing administrative expenses.

By helping fiduciaries optimize cash flow, accountants ensure compliance with distribution obligations and enhance the overall financial health of the estate or trust.

Step-up in basis

Generally, the price a taxpayer pays for an asset is considered its basis for income tax purposes. When a capital asset is disposed of, the difference between the taxpayer’s basis and the sales price will result in a capital gain or loss. With some exceptions, IRC Section 1014 provides that the basis of an asset acquired from a decedent is generally equal to the fair market value of the asset as of the decedent’s death. In the case of an appreciated asset, this rule essentially erases unrealized gains that the original taxpayer would have incurred had they disposed of the asset during their lifetime.

Consider a taxpayer who acquired real estate for $100,000 in 1990. At the time of their death in 2025, the value increased to $1,000,000. Had the property been sold prior to death, a gain of $900,000 would be realized (the difference between the $1,000,000 sales price and the $100,000 cost basis). Instead, the property is bequeathed to a beneficiary who sells the property for $1,050,000 six months later, and the beneficiary’s taxable gain is limited to $50,000.

While the step-up in basis is commonly understood, accountants have a unique opportunity to add value by focusing on the decedent’s original tax basis. By performing a cost segregation study on the original basis before the final income tax return is filed, accountants can create permanent tax savings.

Turning timing benefits into permanent tax savings

Accelerated and bonus depreciation provide taxpayers with the ability to take deductions in the current year that would otherwise be spread over decades. For estates and trusts, this strategy becomes even more powerful when applied to the decedent’s final income tax return.

- Accelerated deductions during life: A cost segregation study allows the fiduciary to claim larger depreciation deductions on the decedent’s final income tax return.

- Elimination of depreciation recapture: At the decedent’s death, the step-up in basis erases any depreciation recapture liability that would otherwise apply upon the asset’s disposition.

- Fresh-start depreciation for beneficiaries: The beneficiary begins depreciating the asset anew based on stepped-up basis, creating additional deductions in the future.

Accountants have a one-time opportunity to perform a cost segregation study on the original basis of assets before the decedent’s final income tax return is filed. This transforms what would typically be a timing benefit into a permanent reduction in taxable income, delivering significant long-term value to beneficiaries.

Conclusion

Accountants play a vital role in ensuring that fiduciaries administer estates and trusts prudently and in the best interests of beneficiaries. Cost segregation aligns perfectly with these responsibilities by minimizing unnecessary tax burdens, improving cash flow and liquidity, and enhancing long-term value for beneficiaries.

Collaborating with qualified cost segregation professionals and legal counsel, accountants can integrate cost segregation into broader estate and trust planning strategies. In doing so, they position themselves as indispensable partners in achieving tax efficiency and wealth preservation.

ABOUT THE AUTHORS:

Lee Welborn is a Managing Director and Head of Cost Segregation at Stout, specializing in real estate tax deferral strategies across a range of property types and ownership structures. Contact her at LWelborn@stout.com.

Eric Bardwell is a Partner in the Taxation, Trusts & Estates Group at Jeffer Mangels Butler & Mitchell LLP. He advises individuals, families, and their businesses in wealth-transfer strategies that efficiently minimize taxes. Contact him at EBardwell@jmbm.com.

Illustration credit: uzenzen/Vector Stock

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs