The IRS has published the draft version of a new form that will allow taxpayers to claim specific tax deductions enacted in July by the One Big Beautiful Bill Act.

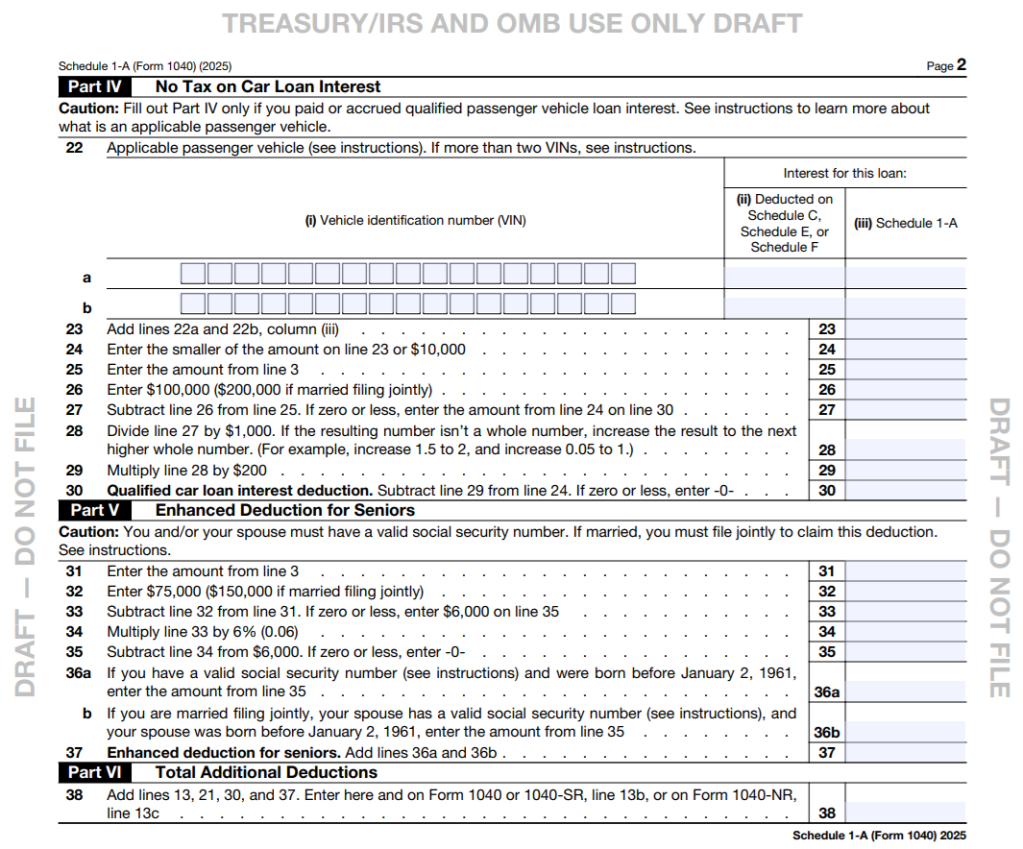

Schedule 1-A, Additional Deductions, for Form 1040 will be used during the 2026 tax season to calculate new deductions for tips, overtime, car loan interest, and senior citizens.

The draft Schedule 1-A was released weeks after the IRS unveiled the draft W-2 form, Wage and Tax Statement, for 2026, which contains three new codes for Box 12, as well as changes to Box 14. The draft 2026 W-2 form referenced the Schedule 1-A in its instructions for employees.

- Related article: IRS Unveils 2026 Draft W-2 Form with Trump Tax Law Provisions

In his Tom Talks Taxes blog, Thomas Gorczynski, EA, provides some insight into the new draft schedule:

Tips Deduction

For tax year 2025, transitional guidance will likely permit employees to use the Form W-2, box 7 social security tips amount as the qualified tips amount. The draft 2026 Form W-2 has a box 12 code for qualified tips.

For non-employees, qualified tips must be reported on Form 1099-NEC, Form 1099-MISC, or Form 1099-K; however, the IRS announced it will not adjust the forms for tax year 2025 for this new reporting requirement. The draft schedule indicates that the deduction is allowed for qualified tips if the amounts are included in gross income reported on those reporting forms. This will require taxpayers to use their records in addition to information returns to calculate their deduction.

The draft schedule also confirms that non-employee tips not reported on one of those three information returns will not be eligible for the tips deduction even if the income is reported on their tax return; this is consistent with the statute as written.

For non-employees, the tips amount cannot exceed the “net profit from the trade or business,” consistent with the statute. However, what deductions will factor into the net profit calculation (e.g., self-employed health insurance deduction, self-employed retirement plan deductions, one-half of self-employment tax deduction)?

Overtime Deduction

For tax year 2025, transitional guidance will likely permit employees to use their records to determine the qualified overtime compensation amount from the Form W-2, box 1 amount; if true, this will make accurately claiming the deduction much more difficult. The draft 2026 Form W-2 has a box 12 code for qualified overtime compensation, as the employer will determine the correct amount.

The draft schedule allows non-employees to claim a deduction for qualified overtime compensation reported on Form 1099-NEC and Form 1099-MISC. It should be extremely uncommon for a contractor to have overtime compensation under §7 of the Fair Labor Standards Act unless they are misclassified as a contractor and should be an employee under federal law.

Car Loan Interest Deduction

The draft schedule confirms that this is the only new personal OB3 Act deduction available for married taxpayers who file a separate tax return. A married taxpayer must file a joint return to claim the tips, overtime, and senior deductions, unless considered unmarried under §7703(b) (like claiming the head of household status).

Senior Deduction

The draft schedule confirms that if both taxpayers are 65 and older, the modified adjusted gross income (MAGI) phase-out is simultaneously applied to each taxpayer’s $6,000 amount. Therefore, on a joint return, the senior deduction will fully phase out at $250,000 MAGI, whether the base deduction is $6,000 or $12,000.

“The draft Schedule 1-A provides great insight into how the IRS will approach these deductions in guidance or proposed regulations,” Gorczynski wrote.

Photo credit: Westy72/iStock

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Elizabeth Remble September 15 2025 at 8:09 pm

Know this is draft but also saw same form on IRS.gov. Not sure if you have a way to inform IRS of error. For line 38, there is no line 13C on 1040-SR form. Should be 13B.