By Mitchell Roland

The Spokesman-Review, Spokane, Wash.

(TNS)

Feb. 17—OLYMPIA — Gov. Bob Ferguson said Tuesday that the current legislation to impose a state income tax on millionaires is a “good start,” but called on lawmakers to devote more of the revenue to direct tax breaks and relief for residents.

Ferguson’s comments came a day after the state Senate passed the legislation Monday, sending it to the House of Representatives for further consideration.

“I’ve said multiple times that any bill I sign must send a significant percentage of the revenue back to Washington families and small business owners,” Ferguson said. “We’re not there yet, and we are still not close to being there.”

The legislation would impose a 9.9% income tax on those who make more than $1 million in income a year, not those who have more than $1 million in assets. According to Democratic lawmakers, it would apply to fewer than 0.5% of state residents.

The tax is estimated to raise a projected $3.5 billion a year once it takes effect in 2028.

Recommended Articles

While Ferguson has previously expressed support for imposing the income tax on millionaires, on Tuesday, he focused his remarks on the revenue that would be distributed to Washington residents, and suggested returning about $1.9 billion of the money collected each year to residents via tax breaks and cuts.

“Do I support the concept of a millionaire’s tax? You better believe it,” Ferguson said. “But, and this is a significant but, it can’t just be $3.5 billion that goes into our general fund. That’s not going to work.”

The governor called on using $1 billion from the revenue to give small businesses a “significant tax break.” The plan put forth by Ferguson includes raising the threshold for the small business tax credit to exempt a business’s first $2.5 million from the B&O tax. If adopted, Ferguson said the plan would exempt 170,000 small businesses from the tax, while 30,000 businesses would have their B&O tax reduced.

According to the governor, the plan would mean about a $5,000 tax cut for small businesses.

“So I appreciate the first steps in the Senate proposal to approve a credit of up to $3,000, but we need to do more,” Ferguson said.

The governor also said he supported an amendment introduced Monday by state Sen. Marko Liias, D-Edmonds, that would repeal the sales tax expansion passed by the Legislature last year. The amendment removes the income tax on services, including live presentations, temporary staffing, armored car services and custom website development.

Under the plan, the sales tax on advertising services also adopted by the Legislature would remain.

The governor reiterated his plan to expand the state’s Working Families Tax Credit, which currently applies to around 350,000 families who receive between $300 and $1,300.

“We must dramatically expand both how many working families qualify and the amount of money that they receive,” Ferguson said. “And I need to see both of those things for any bill that I’d be signing.”

Ferguson proposed expanding eligibility for the tax credit to those who earn at or less than the state’s need standards, a figure set by the Department of Social and Health Services that estimates how much a household needs to earn to maintain a basic standard of living.

Ferguson said the expansion would mean an additional 460,000 households would qualify for the tax credit. The plan calls for the credit to be increased by 30%. The expansion of the credit would cost about $380 million a year.

While Ferguson said he supports the Senate’s plan to lower the age of eligibility for the credit to 18 years old, he does not support using money from the millionaire’s tax solely to pay for the program’s current recipients.

“So they’d essentially use the millionaire’s tax to backfill that $300 million,” Ferguson said. “That’s an OK idea, but that does not count as new dollars back in the pockets of Washingtonians.”

Ferguson also proposed the state adopt two sales tax holidays. Under the plan, a two-day and a three-day weekend would be selected, where sales tax would not be collected on items that cost less than $1,000. The plan would cost about $141 million a year.

The governor reiterated his support to exempt hygiene products from sales tax, and proposed expanding the exemption to include diapers and baby products.

While money collected from the income tax would not be collected until 2029 at the earliest, Ferguson acknowledged Tuesday that lawmakers now have more money to work with than initially anticipated.

An updated revenue forecast released by the state Revenue Forecast Council shows Washington is projected to bring in an additional $827 million through June 30, 2027, than previously estimated. The forecast shows the state will bring in $1.8 billion more through June 2029 than previously estimated.

“So, in other words, the Legislature has hundreds of millions of dollars to work with that I did not, so I’m a little jealous. But it’s a good thing that they have that to work with,” Ferguson said. “It’s a challenging budget situation, but that will no doubt help with the challenges that we’re facing.”

Following a vote Monday where three Senate Democrats joined all 19 Republicans in the chamber in voting against the income tax on millionaires, Republican leadership said Tuesday their caucus remains opposed to the plan and argued a graduated income tax is unconstitutional in the state.

Senate Majority Leader John Braun, R-Centralia, said Tuesday the tax plan adopted by the Senate does “almost nothing” to reform the state’s tax code, and while he hoped to hear the governor no longer supports the income tax, he expected to hear that Ferguson was not satisfied with the current tax relief.

“I don’t think this bill could be salvaged,” Braun said. “But if you were going to do it the proper way, there’s an entirely different way you’d go about this.”

State Rep. April Connors, R-Kennewick, said she hoped the latest revenue forecast would give the governor pause and reconsider his support. Connors added that House Republicans would do “everything that we can” to stop it in their chamber.

“I think they’re going to have a harder time passing the income tax in the House than they had in the Senate,” Connors said. “So we will be working all angles to make sure that doesn’t happen.”

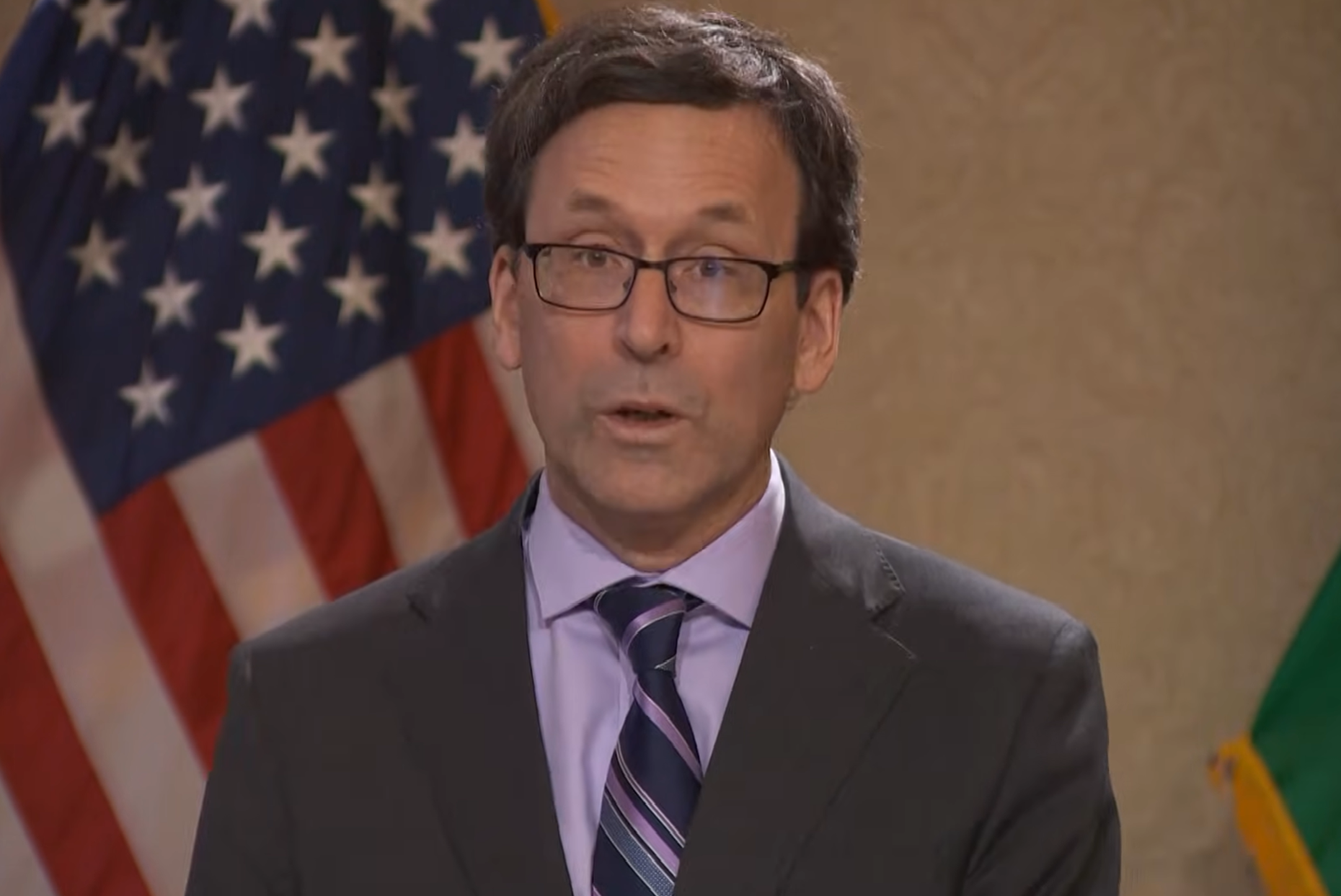

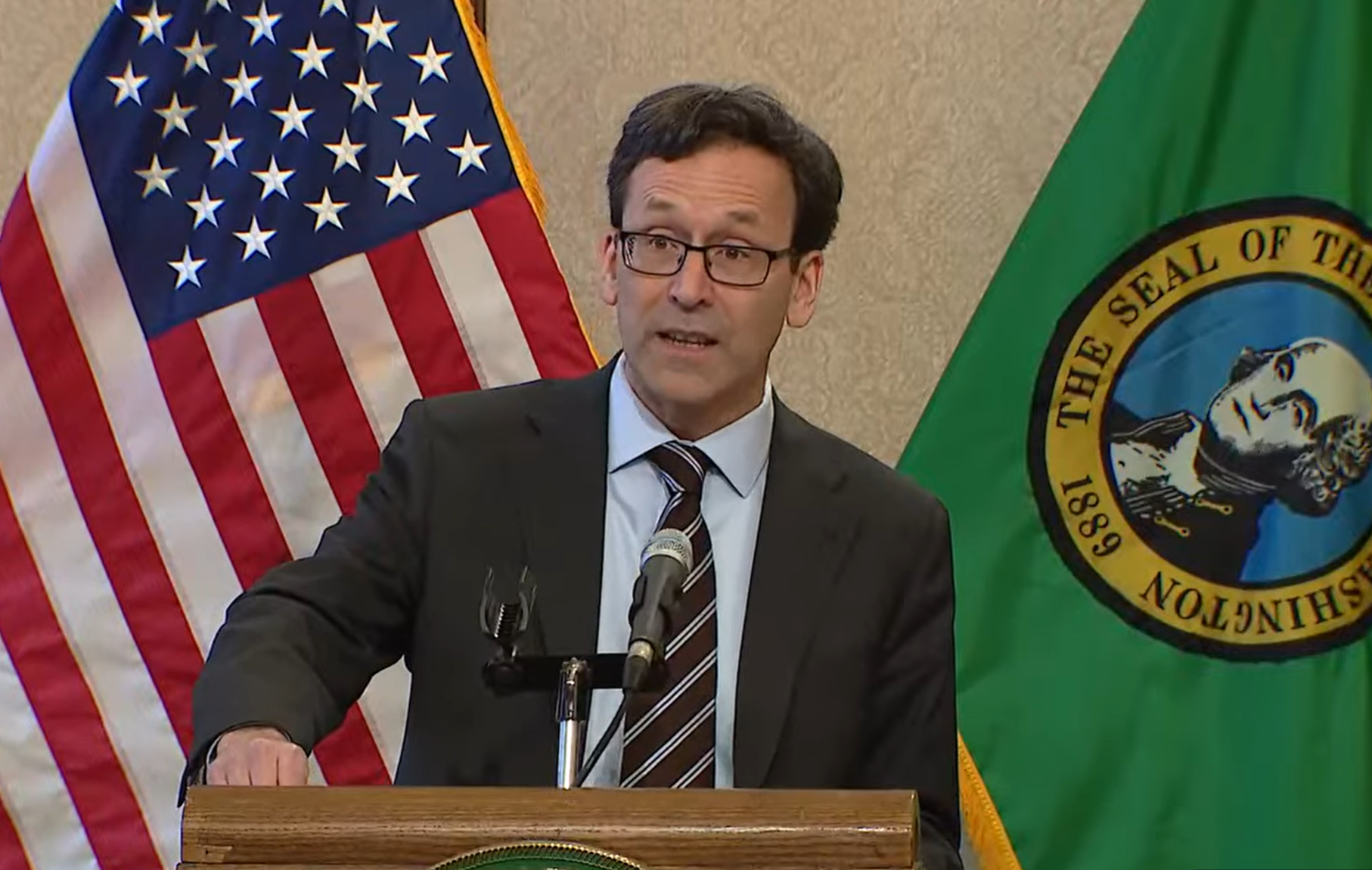

Photo caption: Washington Gov. Bob Ferguson speaks to members of the media during a news conference in the state capitol on Feb. 17, 2026. (Via Youtube)

_______

© 2026 The Spokesman-Review (Spokane, Wash.). Visit www.spokesman.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs