By Dallas Gagnon

masslive.com

(TNS)

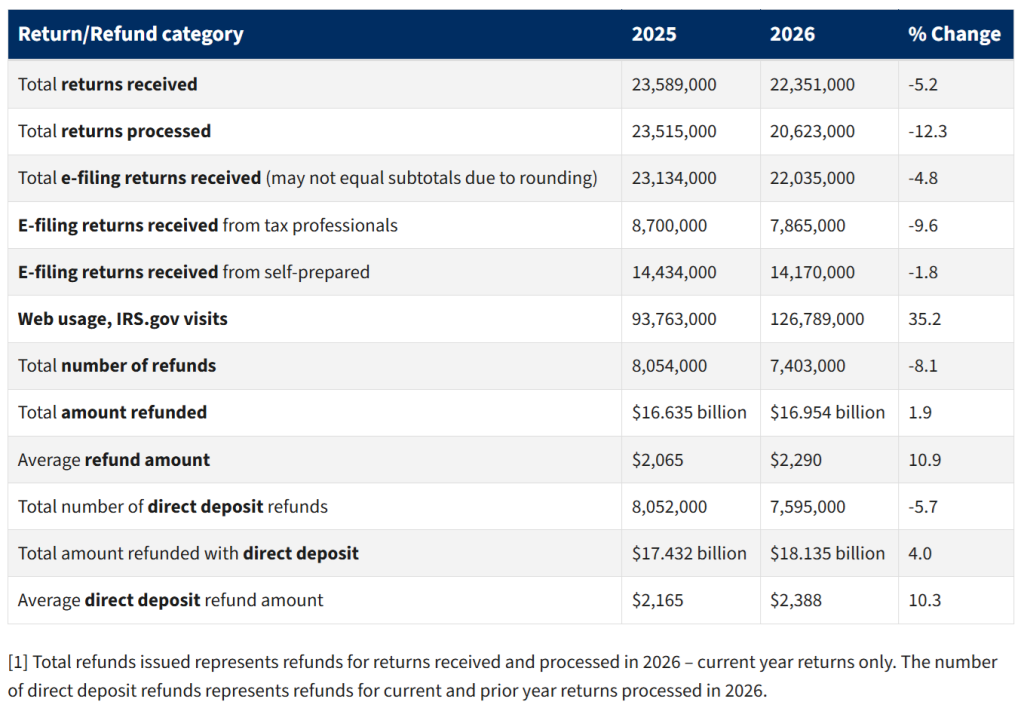

Early filers in the 2026 tax season are receiving larger tax refunds on average compared with last year, according to the latest weekly statistics released by the Internal Revenue Service.

As of the week ending Feb. 6, 2026, the average federal tax refund issued was $2,290—up about 10.9% from roughly $2,065 from the same filing period last year, IRS data shows.

Refund amounts are expected to increase even more later in the season

The IRS said it expects the average refund to increase further later in the season, as these early numbers do not include millions of filers claiming key credits, such as the Earned Income Tax Credit or the Additional Child Tax Credit.

“This means the refund numbers expected to be released Feb. 27, for refunds processed through Feb. 20, are expected to be higher,” the IRS said.

“The IRS emphasizes it continues to see a strong filing season with refunds continuing to reach taxpayers as planned.”

The official IRS filing season updates show that although the number of refunds issued so far is slightly lower than last year, the total refund amounts and average refund sizes are trending higher.

What’s driving larger refunds this season?

The increase is tied to a slew of recent policy changes.

During a Dec. 11 briefing, White House Press Secretary Karoline Leavitt told reporters that Americans should expect an additional $1,000 in their tax refunds.

“Americans can expect another boost in their bank accounts in the months ahead,” she said, adding 2026 refunds are “projected to be the largest ever,” citing President Trump’s passage of the “One Big Beautiful Bill” on July 4, 2025.

Contributing policy changes include a larger child tax credit, increased standard deductions and no tax on tips or overtime.

According to Leavitt, projected refunds are expected to grow by $91 billion with an additional $30 billion in tax relief from reduced tax withholdings in 2026, citing an analysis by Piper Sandler.

Treasury Secretary Scott Bessent echoed similar sentiments in early December, telling reporters that working Americans could expect “very large refunds,” ranging from $1,000 to $2,000 per household, a claim new IRS data has supported thus far.

Photo credit: LPETTET/iStock

_______

©2026 Advance Local Media LLC. Visit masslive.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs