By Jim Brunner

The Seattle Times

(TNS)

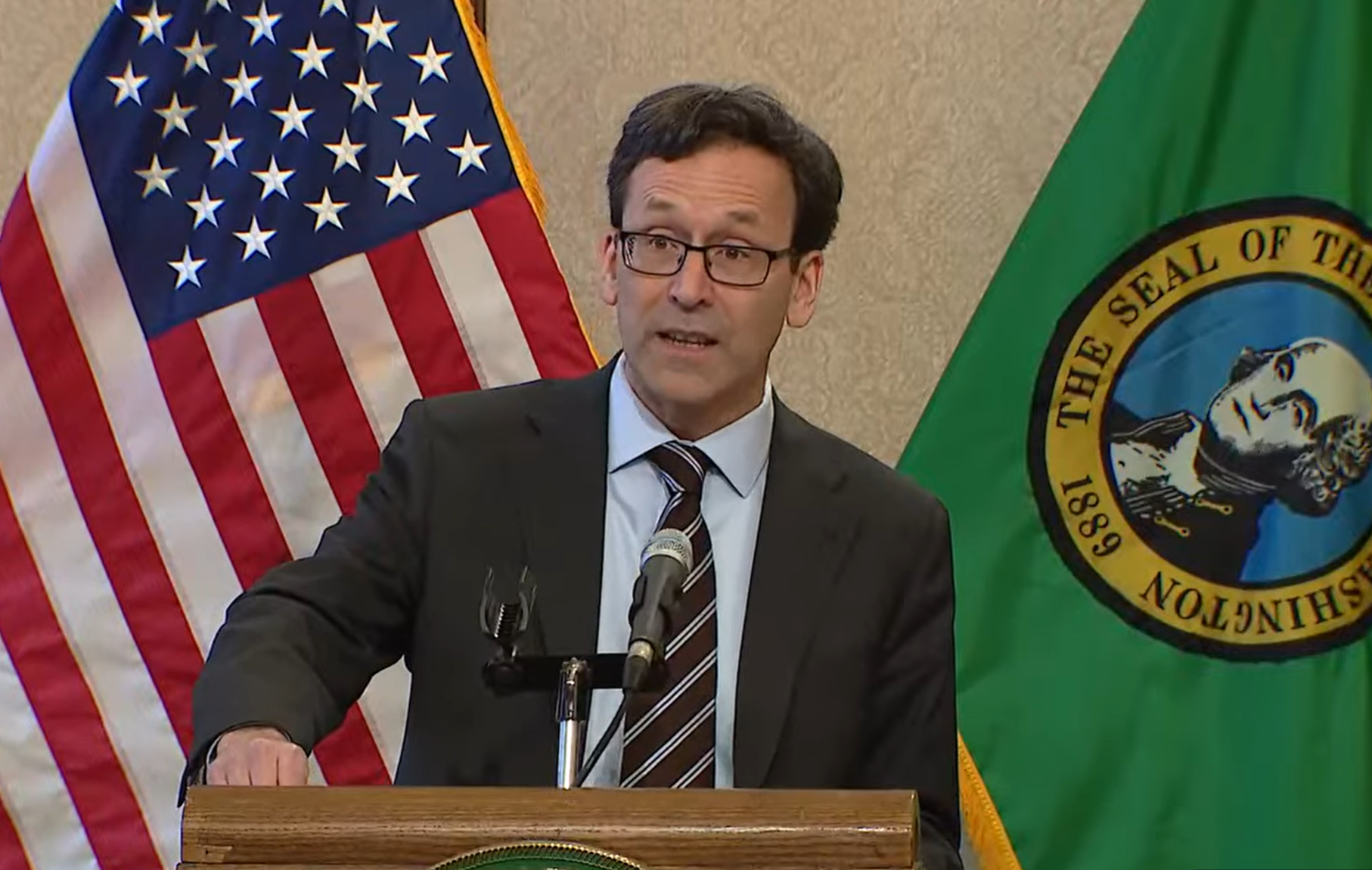

Washington State Gov. Bob Ferguson says he can’t support a proposed income tax on the state’s wealthiest residents without changes.

In a long-anticipated bill, which is getting formally introduced this week, legislative Democrats are proposing a 9.9% tax on annual earnings of more than $1 million starting in 2028.

The so-called “millionaire’s tax” proposal includes some tax breaks for businesses and people, such as elimination of the sales tax on personal hygiene products. But Ferguson says the tax-relief provisions don’t go far enough.

“I appreciate the hard work that went into drafting this initial proposal. It’s a good start, but I cannot support it in this form,” Ferguson said in a statement Tuesday morning.

“I have repeatedly insisted that a significant percentage of the revenue generated by the Millionaire’s Tax must go back into the pockets of Washingtonians to make life more affordable. This proposal does not come close to doing that. I look forward to making sure we change that in the coming weeks, he said.

Recommended Articles

Ferguson had previously announced that he was supportive of a millionaire’s tax in concept. But that support was conditioned on sizable tax breaks for businesses and individuals.

In his State of the State speech last month, for example, Ferguson said he wanted to see the income tax paired with a big break in the state’s business-and-occupation tax that would exempt all businesses with less than $1 million in annual gross receipts.

The bill outlined by Democratic legislative leaders would exempt only businesses with more than $250,000 in gross revenues, according to a summary of the proposal circulated to lawmakers.

Ferguson also has said he wants a major expansion of eligibility for the state’s Working Families Tax Credit, which sends annual rebates of up to $1,330 to lower-income residents.

House and Senate Democratic leaders are expected to discuss their proposal with media at 11 a.m. Tuesday. Ferguson plans a news conference after that.

The governor’s position likely signals the start of negotiations with members of his own party over the tax proposal, which would be a historic shift in Washington’s tax code.

The state is one of nine that does not levy a personal income tax.

_______

© 2026 The Seattle Times. Visit www.seattletimes.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs