By Christian M. Wade

Gloucester Daily Times, Mass.

(TNS)

BOSTON — A proposal to cut Massachusetts’ personal income tax to 4% would cost the state government an estimated $5 billion a year in lost revenue, according to a new report from a left-leaning policy group, which warns the move would trigger deep cuts in public services.

Inching toward the Nov. 3 ballot is a proposal by the Massachusetts High Technology Council, Pioneer Institute and other groups to reduce the personal income tax rate from 5% to 4% over three years, which backers say would save the average individual taxpayers an estimated $4,000 during that period.

But the Massachusetts Budget and Policy Center says cutting the income tax rate would mean an estimated $5 billion less revenue for the state government.

“Income taxes provide the largest single source of revenue to the Commonwealth, enabling support for everything from schools, parks, libraries, roads, and health care, to aid for cities and towns,” the report’s authors wrote. “The loss of these public funds would force deep cuts to public programs and infrastructure.”

Likewise, the group said the rate cut would deliver unequal relief for Massachusetts households, with middle- and low-income taxpayers is seeing only “modest benefits” while those with the highest incomes would see “large windfalls” in tax savings.

“By delivering large windfalls to the state’s most affluent and only small or modest benefits to everyone else, the tax cut would widen Massachusetts’ already large inequalities of income and wealth,” the report’s authors wrote.

Recommended Articles

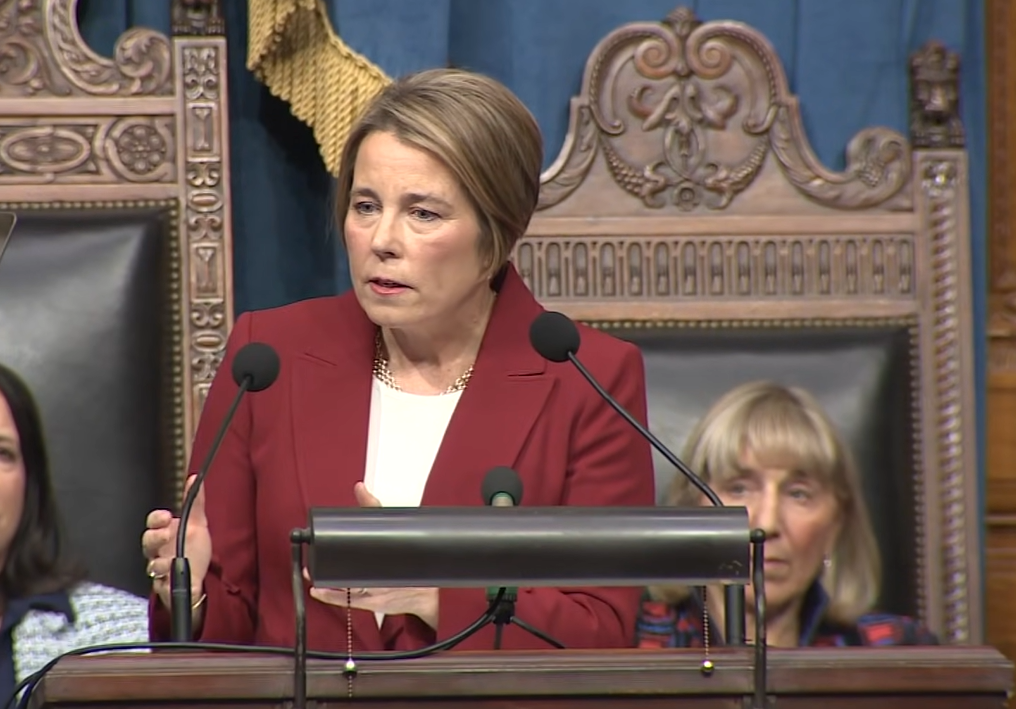

Taxes January 27, 2026

Massachusetts Governor Seeks to Delay Federal Tax Cuts

The Mass Opportunity Alliance, a coalition of business groups, are pushing the proposal to cut the state’s personal income tax rate and cap spending as part of broader efforts to create more jobs and improve competitiveness.

The group argues that the state’s high tax burden is contributing to an exodus of taxpayers and businesses, which has long-term economic implications.

A recent report by the coalition cited analysis showing that lowering the Massachusetts income tax rate would deliver long-term benefits to the state’s economic growth. The report said the short-term drop in revenue from a tax cut would be made up as the economy grows and people spend more of their own money.

Christopher R. Anderson, a MOA co-organizer and president of the Massachusetts High Technology Council, said the research “suggests that sometimes taxpayers can have their cake and eat it too.”

“An income tax cut would put more money in people’s pocketbooks while also laying the foundation for stronger future revenue growth,” he said. “Voters already say a tax cut would be good for their family’s finances—this data shows it would be good for state coffers, too.”

Another initiative petition filed by the coalition would overhaul the voter-approved 62F law, which requires Massachusetts to refund money when tax revenues grow by more than wages and salaries.

Both referenda recently cleared a major hurdle to the Nov. 3 ballot after proponents turned in tens of thousands of certified voter signatures to the Secretary of State’s office.

To be sure, Massachusetts voters overwhelmingly approved a ballot question in 2000 to cut the personal income tax rate to 5%. At the time the rate was 5.85%.

Two years after its passage, however, the Legislature outraged supporters of the rollback by freezing the personal income tax at 5.3% to plug budget shortfalls.

Lawmakers approved a process to reduce the tax rate if growth in the state’s annual revenue met certain benchmarks. But it took nearly two decades for the rate to come down to 5%, which happened in January 2019.

Republicans, including Senate Minority Leader Bruce Tarr of Gloucester, have filed bills every legislative session to lower the rate, but their proposals have been stymied in a Legislature controlled by Democrats.

Lawmakers who oppose dropping the rate say the state would take a major hit, with less money for schools, transportation and other needs.

Income tax collections represent more than 58% of the revenue used to keep state government running.

Photo credit: APCortizasJr/iStock

_______

© 2026 the Gloucester Daily Times (Gloucester, Mass.). Visit www.gloucestertimes.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs