By Jessica Jones-Gorman

Staten Island Advance, N.Y.

(TNS)

As the 2026 tax season gets underway, the head of the IRS announced a major shake-up, initiating personnel and operational changes intended to improve taxpayer service and modernize the agency.

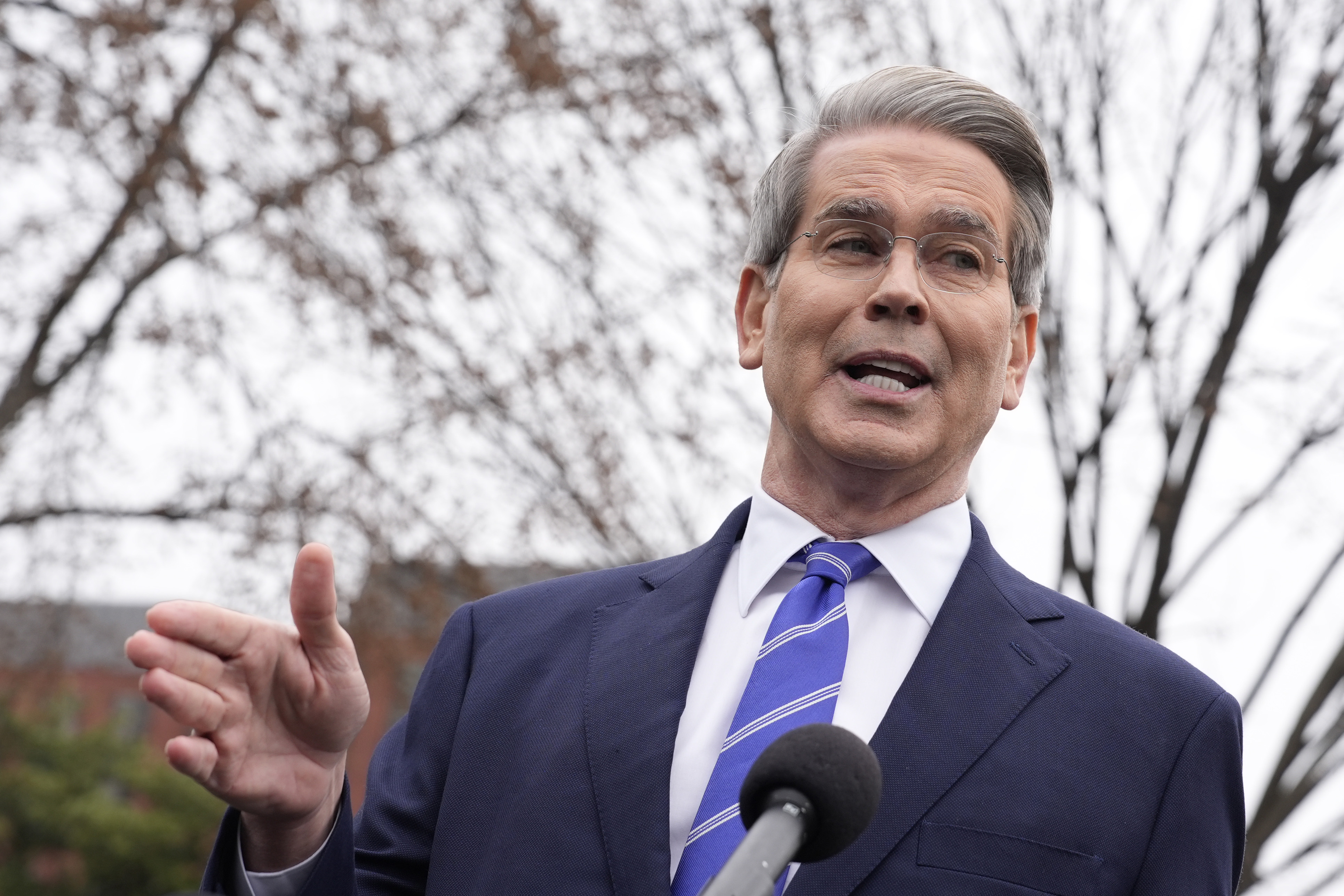

In a letter addressed to the agency’s 74,000 employees and viewed by The Associated Press, Frank Bisignano, CEO of the IRS, announced new priorities and a reorganization of executive leadership.

Gary Shapley, the whistleblower who testified publicly about investigations into Hunter Biden’s taxes and served just two days as IRS commissioner last year, was named deputy chief of the Criminal Investigation division, the letter noted.

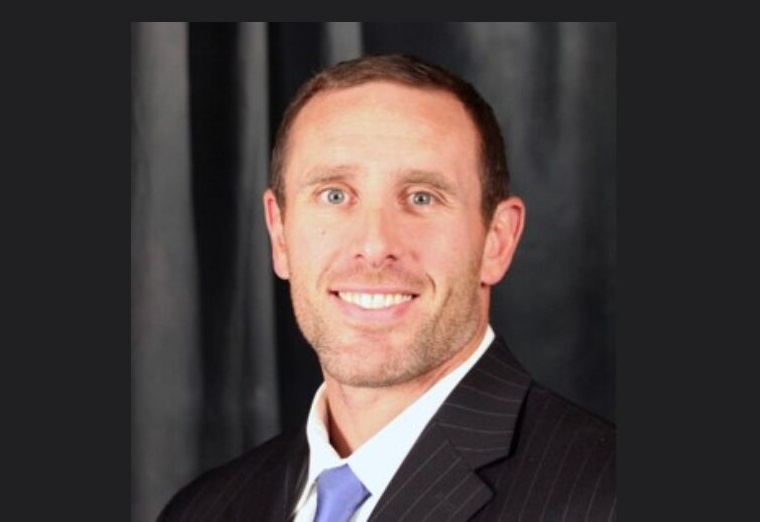

Guy Ficco, head of Criminal Investigation, is set to retire and will be replaced by Jarod Koopman, who will also serve as chief tax compliance officer alongside Bisignano.

Joseph Ziegler, another Hunter Biden whistleblower, was named chief of internal consulting, the letter said.

Recommended Articles

IRS October 6, 2025

Jarod Koopman Named IRS Acting Chief Tax Compliance Officer

Bisignano said in the letter that he is “confident that with this new team in place, the IRS is well-prepared to deliver a successful tax filing season for the American public.”

The timing of the announcement coincides with a critical moment for the agency, as the IRS gets set to process millions of tax returns while simultaneously implementing major tax law changes.

Recommended Articles

Provisions in the One Big Beautiful Bill Act signed last year brought several changes to the tax code that could increase refunds. Taxpayers are advised to explore those provisions on the IRS website before filing their return.

Photo credit: Natalia Bratslavsky/iStock

_______

© 2026 Staten Island Advance, N.Y. Visit www.silive.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs