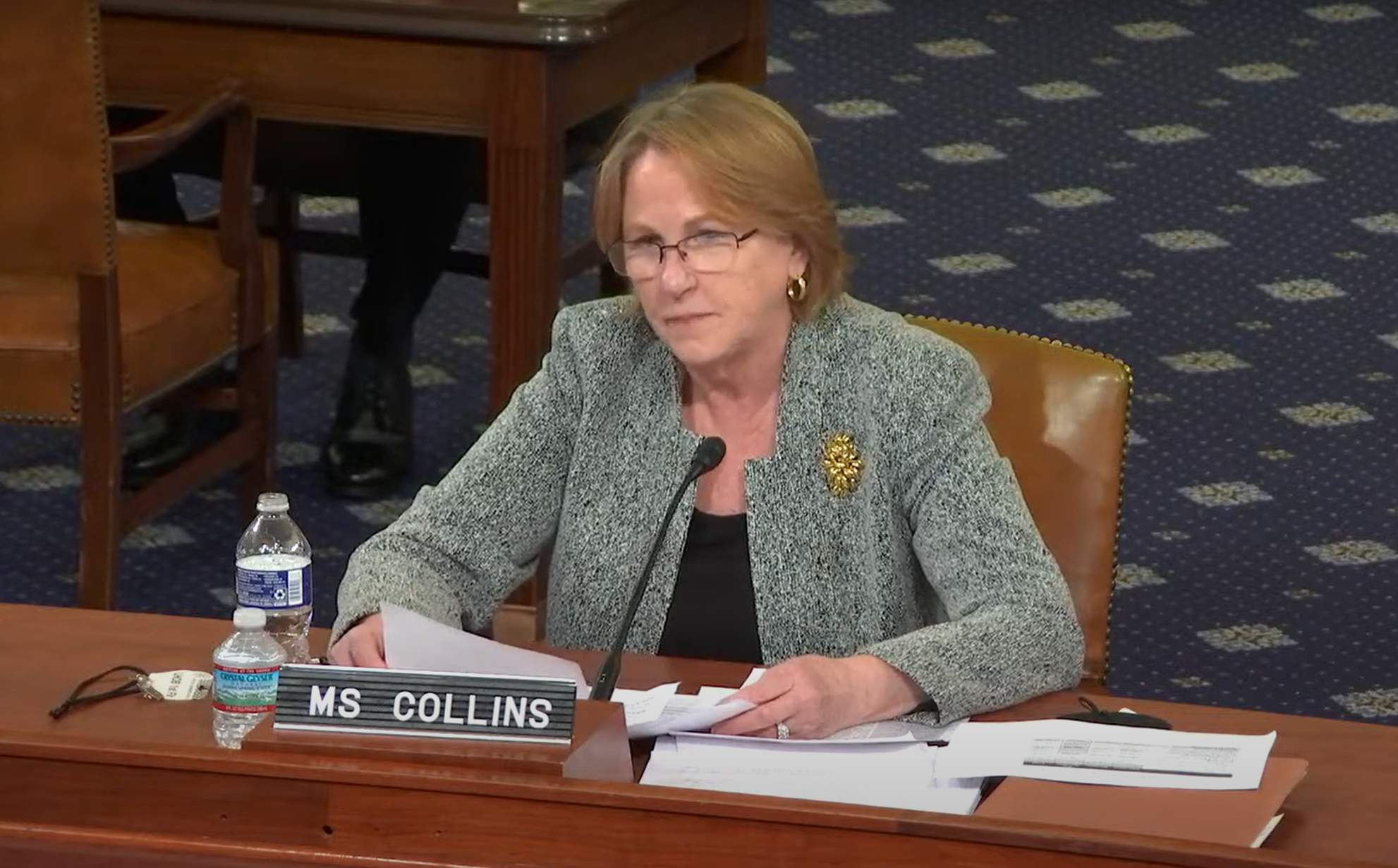

Taxpayers generally fared well in their dealings with the IRS during the 2025 tax year, National Taxpayer Advocate Erin Collins wrote in her 2025 Annual Report to Congress, which was released on Wednesday. The IRS processed more than 165 million individual income tax returns, about 94% of those returns were submitted electronically, and approximately 104 million taxpayers (63%) received refunds, with an average refund amount of $3,167.

She called it a “smooth filing season.”

However, as the IRS enters the 2026 tax season facing workforce reductions and implementing major tax law changes enacted in the One Big Beautiful Bill Act, Collins warns that taxpayers could encounter more challenges when filing their taxes this year.

“Among the reasons the 2025 filing season went well was that the IRS had its largest workforce in many years and faced no major tax law changes that required implementation during the filing season,” Collins said in the report. “Entering 2026, the landscape is markedly different. The IRS is simultaneously confronting a reduction of 27% of its workforce, leadership turnover, and the implementation of extensive and complex tax law changes mandated by the [One Big Beautiful Bill] Act, many of which apply retroactively and require significant IRS programming, guidance, changes to tax forms and instructions, and taxpayer education.”

The convergence of two other major changes in the 2026 filing season is expected to affect millions of taxpayers and materially alter how and when they receive their refunds, Collins wrote.

“First, pursuant to Executive Order 14247, refunds paid during the 2026 filing season generally will be delivered electronically, as the IRS phases out paper refund checks,” she said. “Taxpayers who do not provide direct deposit information may experience significant refund delays, as the IRS will generally hold refunds for up to six weeks while requesting banking information or determining whether an exception applies, with paper checks only issued afterward. This transition is expected to disproportionately affect unbanked, underbanked, disabled, elderly, and other vulnerable taxpayers for whom paper checks have often been the only practical means of receiving refunds needed to cover basic living expenses.

“Second, the 2026 filing season may be the first in several years in which federal tax refunds are again subject to offset for defaulted federal student loan debt, although the timing of that change remains uncertain,” Collins continued. “During the pandemic, student loan offsets were suspended, and many taxpayers came to rely on receiving their full refunds to meet essential household expenses. When student loan offsets resume, some taxpayers will see their refunds reduced or eliminated, creating unexpected financial hardship and frustration. Unsurprisingly, many taxpayers will turn to the IRS seeking explanations or assistance, even though the IRS does not control offset decisions. This change is likely to increase taxpayer confusion and anxiety, generate higher call volumes, and complicate refund administration, particularly as offsets for student loan debt may reduce or displace refunds otherwise applied to other federal obligations during an already demanding filing season.”

Recommended Articles

Despite these challenges, Collins stressed that the majority of taxpayers will be able to file their returns and receive their refunds without delay.

“For the significant majority of taxpayers who file their returns electronically, who include their direct deposit information, and whose returns are not stopped by IRS processing filters, the process will be seamless,” she wrote. “Their returns will be processed quickly, and if they are due a refund, they will receive it without delay.”

However, she notes “the success of the [2026] filing season will be defined by how well the IRS is able to assist the millions of taxpayers who experience problems.”

Taxpayer service in 2025

As previously stated, the IRS processed more than 165 million individual income tax returns, with 6% of those returns (about 11 million) filed on paper, while the other 94% were e-filed. While most tax refunds were issued timely, about 3.6 million taxpayers received their refunds beyond the IRS’s normal processing time, with an average wait time of seven weeks for e-filers and 14 weeks for paper filers.

In addition, longstanding delays in resolving identity theft victim assistance cases persisted during 2025, with hundreds of thousands of taxpayers waiting an average of more than 21 months for the IRS to resolve their cases and issue refunds due. Particularly for lower-income taxpayers, these delays can create or exacerbate financial hardships.

Collins has previously called these delays “unconscionable,” and her report reiterates a prior recommendation to keep the IRS’s Identity Theft and Victim Assistance (IDTVA) employees focused exclusively on identity theft casework until the average case resolution time is reduced to 90 days.

Key 2026 filing season challenges

The report says the combination of staffing reductions and significant retroactive changes in the tax law has created challenges for taxpayers and the IRS alike. It also examines the challenges the IRS will face in balancing telephone service with case processing and the potential risks of outsourcing the processing of millions of paper-filed tax returns.

Impact of staffing reductions

The IRS started 2025 with about 102,000 employees and finished with about 74,000, a reduction of 27%. Reductions were made in virtually all IRS functions, including Taxpayer Services, as shown in the following table:

| IRS Business Operating Division/Function | Staffing as of January 25, 2025 | Staffing as of December 18, 2025 | Percent Change From January 25, 2025 |

|---|---|---|---|

| Chief Counsel | 2,741 | 2,260 | -17.55% |

| Chief Financial Office (CFO) | 578 | 414 | -28.37% |

| Chief Operating Officer (COO) | 139 | 366 | 163.31% |

| Chief Tax Compliance Officer (CTCO) | 10 | 4 | -60.00% |

| Communications and Liaison (C&L) | 379 | 205 | -45.91% |

| Criminal Investigation (CI) | 3,588 | 3,118 | -13.10% |

| Direct File (DF) | 26 | 3 | -88.46% |

| Enterprise Case Management Office (ECMO) | 51 | 12 | -76.47% |

| Facilities Management and Security Services (FMSS) | 1,212 | 889 | -26.65% |

| Human Capital Office (HCO) | 2,927 | 2,057 | -29.72% |

| Independent Office of Appeals (Appeals) | 1,775 | 1,263 | -28.85% |

| Information Technology (IT) | 8,647 | 5,954 | -31.14% |

| IRS Headquarters (HQ) | 50 | 17 | -66.00% |

| Large Business and International (LB&I) | 6,763 | 5,023 | -25.73% |

| Office of Chief Risk Officer (CRO) | 37 | 21 | -43.24% |

| Office of Civil Rights and Compliance (OCRC) | 177 | 85 | -51.98% |

| Office of Professional Responsibility (OPR) | 21 | 14 | -33.33% |

| Online Services (OLS) | 220 | 0 | -100.00% |

| Privacy, Governmental Liaison and Disclosure (PGLD) | 656 | 457 | -30.34% |

| Procurement | 585 | 306 | -47.69% |

| Research, Applied Analytics and Statistics (RAAS) | 619 | 453 | -26.82% |

| Return Preparer Office (RPO) | 119 | 81 | -31.93% |

| Small Business/Self-Employed (SB/SE) | 24,122 | 15,012 | -37.77% |

| Tax Exempt/Government Entities (TE/GE) | 2,286 | 1,590 | -30.45% |

| Taxpayer Advocate Service (TAS) | 1,971 | 1,475 | -25.16% |

| Taxpayer Experience Officer (TXO) | 106 | 48 | -54.72% |

| Taxpayer Services (TS) | 42,122 | 33,264 | -21.03% |

| Transformation and Strategy Office (TSO) | 80 | 0 | -100.00% |

| Whistleblower Office (WO) | 94 | 74 | -21.28% |

| TOTAL | 102,101 | 74,465 | -27.07% |

Of particular importance for taxpayer service are customer service representatives who answer telephone calls and process taxpayer correspondence and casework. The IRS generally receives more than 100 million telephone calls and several million pieces of taxpayer correspondence each year. In 2025, the number of CSRs was reduced by 22%. Although the IRS backfilled some of these positions late in the year, the number of CSRs remains substantially lower than last filing season, and the new hires have less experience than the employees who departed.

“To fulfill its mission, the IRS must align hiring decisions with operational needs and emerging challenges, rather than target a predetermined staffing level,” Collins wrote. “Workforce planning should be guided by the work necessary to provide timely, accurate service to taxpayers and to protect taxpayer rights, as well as by the most effective ways to deliver those outcomes. As the IRS considers its hiring model, it should emphasize process improvements and strategic investments in technology that improve the taxpayer experience, reduce unnecessary burden, and ensure staffing resources are aligned with mission-critical functions that support both compliance and fair treatment of taxpayers.”

Recommended Articles

IRS July 22, 2025

IRS Workforce Has Shrunk 25% Since Trump Took Office

Impact of OBBBA tax changes

The One Big Beautiful Bill Act made more than 100 changes to the tax code. While some will not take effect until 2026, key provisions were made retroactive to the beginning of 2025 and must be reported on 2025 tax returns filed during the current filing season.

“While the OBBB Act is generally taxpayer-favorable in that it expands eligibility for certain deductions and benefits,” Collins said, “the deductions and benefits are subject to complex eligibility rules, income thresholds, and phaseouts that will be difficult for many taxpayers to understand and for the IRS to administer accurately during the filing season.”

These benefits include new tax deductions for tip income, overtime pay, and interest paid on auto loans, as well as an additional standard deduction for senior citizens and an increased maximum deduction for state and local taxes.

The report highlights the complexity of these provisions. For example, the following requirements must be met for a taxpayer to claim a deduction for interest paid on auto loans:

- The vehicle must be new (used car purchases do not qualify);

- The vehicle must have been purchased for personal use (lease payments do not qualify);

- The loan must have originated after Dec. 31, 2024;

- The loan must be secured by a lien on the vehicle;

- The vehicle must carry a gross vehicle weight rating of less than 14,000 pounds;

- The vehicle identification number must be included on the tax return;

- The loan must not have been obtained from a related party; and

- The vehicle must have undergone “final assembly in the United States.”

In addition, the deduction is capped at $10,000 and begins to phase out for taxpayers with modified adjusted gross incomes over $100,000 for single taxpayers and $200,000 for married filing jointly taxpayers at a rate of 20% for each additional dollar of income, fully phasing out for single filers with MAGI over $150,000 and joint filers with MAGI over $250,000.

Other changes in law have similarly complex requirements, Collins said. The report warns these changes are likely to create taxpayer confusion, generate more taxpayer calls to the IRS, and potentially result in errors that will lead to refund delays.

“It takes considerable work for IRS technology personnel to program IRS systems to administer each of these changes (e.g., to distinguish vehicles that underwent final assembly in the United States from those that did not). At the same time, taxpayers and tax professionals must learn and correctly apply dozens of new rules,” she wrote. “Major law changes of this scope historically increase return errors, false positive rates in processing filters, taxpayer correspondence, and taxpayer contacts. These changes will place additional strain on IRS systems and employees at the very moment when staffing levels have been significantly reduced, heightening the risk that the 2026 filing season will be more difficult, frustrating, and costly for taxpayers, practitioners, and the IRS. The good news is the IRS leadership and its employees have worked hard to provide guidance, implement changes to its forms and instructions, and program its systems for the OBBB Act changes in advance of the filing season. The question remains whether taxpayers will understand these benefits and claim them correctly.”

Recommended Articles

Balancing telephone service and case processing

Historically, the IRS has used a “level of service” telephone measure as a primary taxpayer service metric. The report highlights the limitations of that measure.

“I recommend the IRS eliminate the LOS as a benchmark performance measure and replace it with a suite of performance measures that better reflect the taxpayer experience and drive improvements in the quality of taxpayer service,” she said.

As the IRS is unable to shift its CSRs seamlessly between answering the phones and processing correspondence, CSRs during the filing season have spent as much as 34% of their time simply waiting for the phone to ring, the report states. During the 2023 filing season, that translated to nearly 1.3 million hours of idle time. CSRs closed an average of 1.21 cases per hour in the tax adjustments inventory that year. If the telephone idle time of nearly 1.3 million hours had been allocated to resolving paper inventories, the IRS would have processed and closed more than 1.5 million additional cases, she noted.

“It is not practical to eliminate all idle time, but if the IRS set a lower LOS goal, it would get more bang for the buck,” Collins wrote. “[CSRs] would have considerably less idle time and would resolve more taxpayer issues more quickly. In essence, an overly high LOS can create a self-perpetuating cycle: Customer service representatives spend significant time idle rather than resolving underlying account issues, those unresolved issues prompt taxpayers to call repeatedly or submit duplicative correspondence, and the resulting increase in calls and correspondence further strains IRS resources and delays resolution.

“A high LOS achieved at the expense of timely case resolution can worsen the overall taxpayer experience rather than improve it, and combined with recent workforce reductions, it is likely to create a big hole from which the IRS will spend months or years digging out,” she continued. “Because telephone service is often the gateway to resolving tax issues, its effectiveness depends not merely on whether calls are answered but also on whether taxpayers receive timely, accurate, and complete assistance that resolves their concerns. Measuring and improving the quality of telephone service is therefore essential to protecting taxpayer rights, promoting voluntary compliance, and ensuring efficient tax administration.”

IRS outsourcing the processing of paper-filed tax returns

While most taxpayers now file their tax returns electronically, about 11 million individuals continue to file on paper each year, and the IRS receives an additional 11 million paper-filed employment tax returns. In April, the IRS launched a “Zero Paper Initiative” to digitize a wide swath of the agency’s operations, including return processing. Rather than do the work itself, the IRS entered into contracts with several private companies to scan returns using optical character recognition technology.

The report cautions the IRS “not to put all its eggs in one basket by eliminating or severely reducing the Submission Processing employees needed to process paper returns before validating technology performance.” While the Zero Paper Initiative approach has the potential to reduce processing times for paper returns, the report says it introduces operational and confidentiality risks.

“It was just a few years ago that an employee of an IRS contractor, Charles Littlejohn, stole the return information of thousands of taxpayers and sent it to media outlets,” Collins wrote.

Littlejohn was convicted and sentenced in 2024 to five years in prison.

Recommended Articles

In the report, she recommends strengthening penalties on contractors if they fail to protect taxpayer return information.

Most serious taxpayer problems

Among the 10 most serious problems discussed in the report are:

Refund delays and unclear and confusing disallowance notices harm taxpayers and jeopardize their rights to administrative and judicial review: During fiscal year 2025, the IRS processed about 1.6 million business amended returns and took an average of more than13 months to do so. Although delays for individual amended returns were less extreme, it took the IRS an average of over five months to process 3.7 million such returns. Refund delays can cause financial harm for taxpayers, as businesses may need their refunds for cash flow purposes and individuals may require refunds to pay their basic living expenses. When the IRS disallows a refund claim, it often issues a notice that is unclear and doesn’t provide vital information, including the deadline by which the taxpayer must either file a refund suit in court or get the IRS to execute an extension of the filing deadline.

The Taxpayer Advocate Service recommends the IRS take additional steps to automate the processing of amended tax returns so it can process them more quickly, improve the clarity of the information it provides in notices of claim disallowance, and establish procedures to execute Form 907, Agreement to Extend the Time to Bring Suit, to protect taxpayers from missing deadlines and forfeiting their refunds due to IRS delays.

Outdated paper processes and procurement delays harm taxpayers: The IRS’s challenges in modernizing its technology systems are longstanding, and the need to digitize its operations is becoming more critical. When the IRS processes paper-filed original tax returns, amended tax returns, and taxpayer correspondence through paper processing methods, taxpayers must wait longer to receive their refunds or correspondence responses. In addition, transcription errors are often made that create problems and often require additional back-and-forth between taxpayers and the IRS to resolve. The IRS’s struggles in modernizing its technology are largely attributable to the agency’s large number of data systems and the way they interact with each other.

To address the problems created by paper filings, the agency has made its Zero Paper Initiative a top priority. TAS recommends the IRS conduct a comprehensive study of the pros and cons of contracting with external vendors as compared with building in-house capacity staffed by IRS employees to perform scanning and other digital operations, and it recommends the IRS refine its procurement processes to reduce bid protests and consequent delays.

The IRS doesn’t accurately measure the quality of its telephone service: Telephone service remains the primary method by which taxpayers contact the IRS to ask questions or resolve account problems. Taxpayers called the IRS more than 100 million times last year. Despite the importance of this communication method, the IRS doesn’t have adequate measures to assess whether taxpayer needs are being met.

Historically, the IRS has published the LOS performance measure, which TAS, the Treasury Inspector General for Tax Administration, and others have criticized because most calls the IRS receives are excluded from the measure, and the measure doesn’t capture the quality or resolution of the calls. During 2025, the IRS routed about 35 million calls to new voicebot technology; these calls also weren’t included in the IRS’s benchmark LOS telephone performance measure, except for calls transferred to telephone assistors. Taxpayers generally were not satisfied with the voicebots. In taxpayer satisfaction surveys, only about half of taxpayers reported that they found the “Where’s My Refund?” bot helpful and only 40% found the “Where’s My Amended Return?” bot helpful.

TAS recommends the IRS implement comprehensive outcome-based measures for all telephone lines, including measurement of “first contact resolution.”

Other problems identified in the report include concerns about:

- The independence of the IRS’s Independent Office of Appeals;

- The limited functionality of online accounts used by tax professionals;

- IRS delays in responding to Freedom of Information Act requests submitted by taxpayers to obtain their own tax records;

- Deficient procedures for maintaining the IRS’s Centralized Authorization File for tax practitioners;

- Misinformation about tax compliance on social media;

- Compliance challenges faced by U.S. taxpayers living abroad; and

- The ineffectiveness of IRS processes designed to offer taxpayers relief from international withholding requirements.

Purple Book legislative recommendations

The National Taxpayer Advocate’s 2026 Purple Book proposes 71 legislative recommendations intended to strengthen taxpayer rights and improve tax administration. Among the recommendations:

Authorize the IRS to establish minimum standards for federal tax return preparers and revoke the identification numbers of sanctioned preparers: The IRS receives more than 160 million individual income tax returns each year, and most are prepared by paid tax return preparers. While some tax return preparers must meet licensing requirements (e.g., CPAs, attorneys, and enrolled agents), most tax return preparers are not credentialed or subject to minimum competency requirements. Numerous studies have found that non-credentialed preparers disproportionately prepare inaccurate returns, causing some taxpayers to overpay their taxes and other taxpayers to underpay, which subjects them to penalties and interest charges. Non-credentialed preparers also drive much of the high improper payment rate attributable to wrongful Earned Income Tax Credit claims. In FY 2024, 27.3% of EITC payments, amounting to $15.9 billion, were estimated to be improper, and among tax returns claiming the EITC prepared by paid tax return preparers, 96% of the total dollar amount of EITC audit adjustments was attributable to returns prepared by non-credentialed preparers.

By contrast, federal and state laws generally require professionals, such as lawyers, doctors, securities dealers, financial planners, actuaries, appraisers, contractors, motor vehicle operators, barbers, and beauticians, to obtain licenses or certifications. The Obama, first Trump, and Biden administrations each recommended that Congress authorize the Treasury Department to establish minimum standards for federal tax return preparers.

To protect taxpayers and the public, TAS also recommends that Congress provide the Treasury Department with this authorization, as well as authorization to revoke the preparer tax identification numbers of preparers who have been sanctioned for improper conduct.

Expand the Tax Court’s jurisdiction to hear refund cases: Under current law, taxpayers seeking to challenge an IRS tax due adjustment can file a petition in the U.S. Tax Court, while taxpayers who have paid their tax and are seeking a refund must file suit in a U.S. district court or the U.S. Court of Federal Claims. Litigating in a U.S. district court or the Court of Federal Claims is generally more burdensome: filing fees are more costly, procedural rules are more complex, the judges generally lack tax expertise, and proceeding without a lawyer is difficult and uncommon.

By contrast, taxpayers litigating their cases in the Tax Court face a low $60 filing fee, face fewer formal procedural rules, benefit from judges with tax expertise, and thus can more easily represent themselves without a lawyer. For these reasons, the requirement that refund claims be litigated in a U.S. district court or the Court of Federal Claims effectively deprives many taxpayers of the right to judicial review of an IRS refund disallowance. In FY 2024, about 97% of all tax-related litigation was adjudicated in the Tax Court.

TAS recommends Congress expand the jurisdiction of the Tax Court to give taxpayers the option to litigate all tax disputes, including refund claims, in that forum.

Enable Low Income Taxpayer Clinics to assist more taxpayers in controversies with the IRS: Low Income Taxpayer Clinics represent low-income taxpayers in controversies with the IRS and inform individuals who speak English as a second language about their rights and responsibilities under the tax law. When the LITC grant program was established in 1998, the law limited annual grants to no more than $100,000 per clinic. The law also imposed a 100% “match” requirement, so a clinic cannot receive more in grants than it raises from other sources. The nature and scope of the LITC Program have evolved considerably since 1998, and those requirements are preventing the program from expanding assistance to a larger universe of eligible taxpayers.

TAS recommends Congress remove the per-clinic cap and allow the IRS to reduce the match requirement to 25%, where doing so would expand coverage to additional taxpayers.

Require the IRS to timely process claims for credit or refund: Millions of taxpayers file refund claims with the IRS each year. Yet under current law, there is no requirement that the IRS act on these claims. It may simply ignore them. A taxpayer’s only remedy in that circumstance is to file suit in a U.S. district court or the Court of Federal Claims. For many taxpayers, that is not a realistic or affordable option. The absence of a processing requirement is a poster child for non-responsive government. While the IRS generally does process refund claims, the claims can and sometimes do spend months and even years in administrative limbo.

TAS recommends Congress require the IRS to act on claims for credit or refund within 1 year and impose certain consequences on the IRS if it fails to do so.

Allow taxpayers to claim the Child Tax Credit and Earned Income Tax Credit for a child who meets all statutory requirements, except having a Social Security number by the due date of the tax return: For taxpayers to claim their children for purposes of the CTC or EITC, their children must have Social Security numbers by the tax return filing deadline. The intent of this requirement is to limit the refundable tax credits to U.S. persons, but in a variety of circumstances, taxpayers can’t or don’t obtain SSNs for their children in time and lose out on thousands of dollars of tax credits for which they otherwise qualify. For example, a taxpayer may otherwise be eligible to claim a child born on December 31 but not receive the child’s SSN by April 15 and therefore forfeit the credits.

Taxpayers who lose out on the credits include:

- Military and other expatriate families stationed overseas who must take additional steps to obtain SSNs;

- Parents who don’t obtain SSNs in time when a birth takes place outside a hospital setting and the parents don’t file a timely SSN application, when a hospital misplaces the paperwork, when the Social Security Administration makes a processing error, or when the parents move and their mail isn’t forwarded;

- Parents of adopted children who have not yet received SSNs;

- Parents of children who are born and die before the SSA issues an SSN (although the IRS has provided administrative relief in this circumstance); and

- Taxpayers who do not obtain SSNs for their children due to religious beliefs (e.g., some Amish sects).

In these circumstances, U.S. citizens are being denied valuable benefits intended by Congress, the report says.

TAS recommends Congress allow taxpayers who obtain SSNs after the filing deadline to timely file amended returns to claim CTC and EITC benefits or, in the case of those opposed to SSNs for religious reasons, to submit alternative forms of substantiation.

Provide consistent and predictable tax relief for victims of federally declared disasters: After a hurricane, flood, wildfire, or other natural disaster has destroyed homes or businesses, Congress often passes legislation to provide tax relief to those affected, but the relief granted varies widely in scope, timing, and form. Similarly situated taxpayers may receive different treatment, and relief, if provided, is often authorized months after a disaster occurs. This ad hoc approach creates uncertainty for disaster victims and their communities.

TAS recommends Congress establish a consistent framework for disaster tax relief, either by providing automatic relief for federally declared disasters or by authorizing a menu of relief options and directing the Treasury Department to determine which forms of relief apply based on the nature and severity of each disaster.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs