By Andrew Graham

The Sacramento Bee

(TNS)

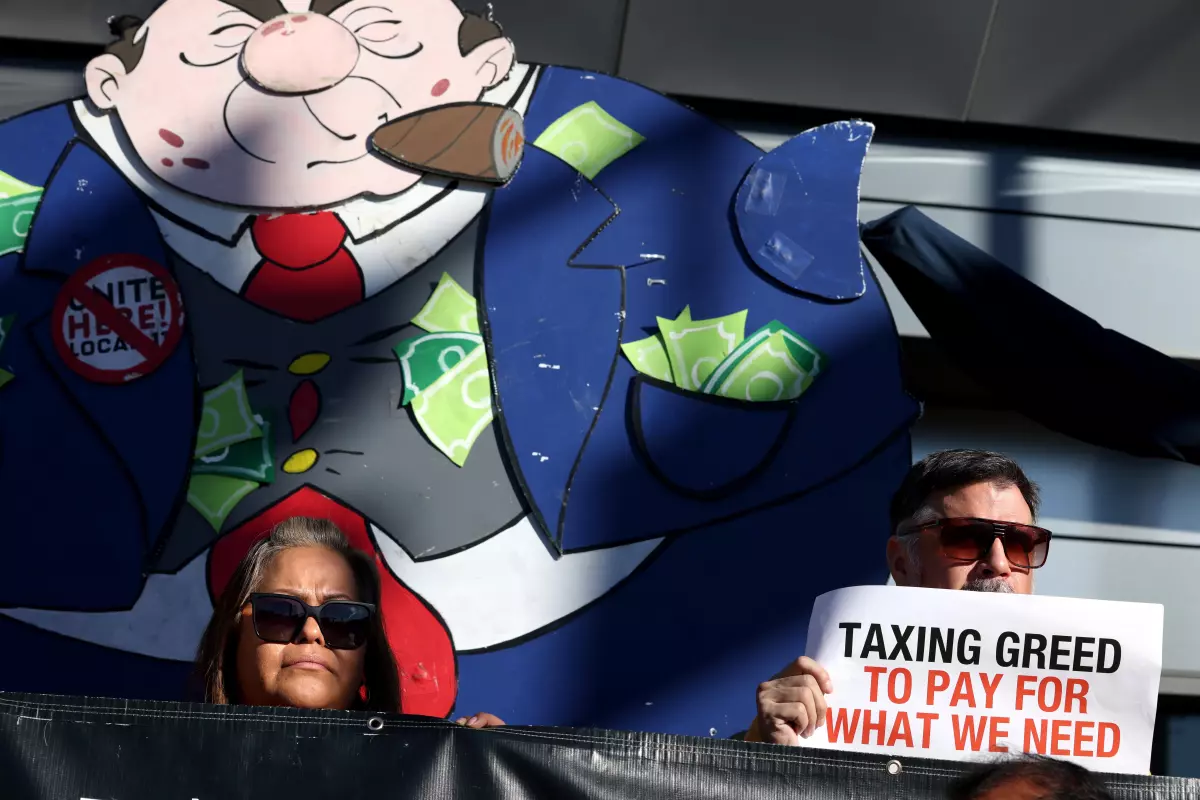

Ahead of what will likely be a grueling campaign if California’s controversial billionaire tax proposal reaches the ballot, a new poll paid for and touted by some of the measure’s wealthy opponents found less than 50% of likely voters support it.

Just 48% of the 800 likely voters surveyed told the polling firm they would vote yes on the tax if the election were held now, according to the polling firm Mellman Group, and the support dropped as potential messaging from both sides was tested on respondents. An undisclosed group of “high-net worth folks” commissioned the firm, according to Mike Murphy, a Republican strategist involved in the polling effort.

The poll comes as the ballot measure proposal, which is being pushed by the health care worker labor union SEIU-UHW, draws howling fury from some vocal billionaires who have threatened to leave the state and, in some cases, taken steps toward divesting from California. It also comes as Gov. Gavin Newsom becomes an increasingly loud voice against the measure—saying it would cost the state income tax in the long run and that he hopes to stop it from reaching the ballot.

The ballot measure’s proponents quickly labeled the poll as slated in favor of a preordained response. The case pollsters provided respondents in favor of the tax measure did not emphasize that hospitals and emergency rooms could close if Californians don’t find a revenue source to prop them up, as the union has and will continue to argue, proponents said.

“Everyone would feel these effects, regardless of how and where they get their healthcare, and that is not made clear in this one-sided poll that waters down every major argument for the billionaire tax which enjoys broad support from the public,” Suzanne Jimenez, the union’s chief of staff and the ballot measure’s sponsor, told The Bee in a statement.

In a phone call with The Bee, Murphy declined to name the individuals who paid for this week’s poll, but said they were wealthy residents of both Northern and Southern California.

It was, “nobody notorious,” Murphy said, “nobody who has been tweeting about (the ballot proposal).”

He defended the results and said people could see for themselves how the pollsters framed the argument. “If we cooked it, it’s hard to find a frying pan here,” he said.

The union proposed the wealth tax as a measure to replace federal funding Republican lawmakers and the Trump administration gutted in the One Big Beautiful Bill Act. Proponents say it is critical the state find funding to prevent hospitals and emergency rooms from closing in the wake of cuts to Medi-Cal and other subsidies that have kept health insurance affordable for many Californians. And they say it’s logical to pursue that money from ultra-wealthy individuals who received a tax cut through Trump’s budget bill.

Recommended Articles

Many leading Democrat state lawmakers have stayed quiet on the measure. Murphy the strategist said he hoped his poll would lead more elected officials to come out against it. “You have a lot of Democrat politicians who don’t like this thing, want to be against it publicly … but need to know what the score is,” Murphy said.

SEIU-UHW has in the past pushed ballot measures on wage increases for its members in order to get the attention of state officials and draw them to the negotiating table, according to reporting in The New York Times. But union officials and ballot measure proponents have so far held to the idea that they want voters to weigh in on the tax in November.

The ballot campaign is currently gathering signatures. As proposed the measure would impose a one-time, 5% tax on people with more than $1.1 billion in assets that were California residents at the beginning of this year.

The 48% polling response still represents a majority, as the poll found 14% of voters remained undecided and 38% were opposed to the measure. But, the pollsters found, after hearing pitches from both sides on the tax, opposition to the measure rose and support dropped.

After hearing both sides’ messaging, 46% of respondents remained in support of the tax while 44% opposed it. If the wealth tax reaches the ballot, a majority of voters will need to back it for passage. Ballot measure campaigners generally want to see their proposals polling in the upper 50th percentile or above 60% even before getting on the ballot, if they are to have a chance at surviving attacks from opposing campaigns, Murphy said.

The strategist said he and the wealthy individuals he was working with waited for the California Secretary of State released the official language that would appear on the ballot before conducting their poll, in order to get the clearest sentiment of voter sentiment.

Voters tended to agree with messages that the tax, if implemented, simply wouldn’t achieve proponents’ desired goals. High percentages of survey respondents said billionaires would leave California in the wake of the tax, plunging revenues from the state’s progressively-structured sales tax in the long run. They also said billionaires would tie the new law up in the courts for years or engage in creative accounting and business practices that would reduce the amount collected under the new tax.

Jimenez expressed confidence the ballot measure would continue to gain steam as SEIU-UHW’s campaign progresses. “Our internal polling shows that asking ultra-wealthy billionaires to pay a modest, one-time tax to ensure that all Californians have healthcare resonates with the vast majority of voters,” she said in the statement. “It’s interesting, of course, that a poll paid for by the opposition still shows the Yes vote leading even after manipulating the arguments presented to voters.”

The campaign has not released any public polling to date. Tax experts drafted the ballot measure to be enforceable and guard against billionaires who might begin trying to shift their assets elsewhere if the yes campaign gains steam, Jimenez said.

Photo credit: Nirian/iStock

_______

©2026 The Sacramento Bee. Visit sacbee.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: billionaire tax, billionaires, california, Income Taxes, Taxes, wealth tax, wealthy