By Mitchell Roland

The Spokesman-Review, Spokane, Wash.

(TNS)

(Dec. 24) OLYMPIA — Gov. Bob Ferguson said Tuesday he supports a state income tax on those who make more than $1 million a year. The proposal, he said, would be tied to reducing sales taxes on baby and hygiene items, expanding the working families tax credit, increasing K-12 school funding, and lowering the key tax rate for small businesses.

The governor said he would also support writing the income level requirement into state law to ensure that the threshold would not be lowered in future years.

“From my standpoint, I think the issue is clear, I think the choice is clear for members of the Legislature, and I think the public is ready for this conversation,” Ferguson said during a news conference at the state capitol on Tuesday. “And so, I think the time is now. And I’m optimistic it will happen.”

Ferguson joins a growing list of Democratic legislators who have said in recent months the state should consider adopting an income tax, an idea around which he said there is a “fair amount of momentum.”

Ahead of the upcoming legislative session, some state lawmakers have called for the state to amend its tax code to reduce the burden on lower-income earners. Washington is one of nine states that does not have a state-level income tax.

While an income tax is not expressly prohibited under the constitution, the state Supreme Court ruled in 1932 that the state must impose a uniform tax among payers, rather than a graduated tax that taxes higher-income residents at a higher tax rate than those with lower incomes. Since the ruling, voters have been asked 10 times whether Washington should establish either a personal income tax or a corporate income tax, ideas that have never received more than 43% of the vote.

Critics have long called the state’s tax system among the most regressive in the country.

“This means that those who make the least amount of money pay much larger shares of their income than those with the most resources,” Ferguson said.

According to Ferguson, while families in the 20th percentile of income pay 13.8% of their income in taxes, those in the top 1% pay 4.1% of their income.

“That is untenable,” Ferguson said. “We are facing an affordability crisis. It is time to change our state’s outdated, upside-down tax system, to serve the needs of Washingtonians today.”

Ferguson’s comments came as he unveiled his supplemental budget proposal ahead of the upcoming legislative session. The governor’s supplemental budget, however, is not reliant on revenue from what Ferguson dubbed a “millionaires’ tax.”

According to Ferguson, revenue from the tax would not come into the state until 2029 at the earliest.

Ferguson said the tax would target those making more than $1 million a year in income and estimated fewer than 0.5% of state residents would be subject to it. The exact scope would depend on the final proposal.

The governor estimated the tax would bring in $3 billion a year in revenue based on a 9.9% tax rate.

Ferguson said he also supports tying the $1 million income requirement to inflation so the tax would never be paid by “99% of Washingtonians.”

“I want to be clear, I will not support an income tax for people who make less than $1 million a year,” Ferguson said.

While the governor said he’s optimistic about the proposal passing in the legislative session, it would likely be along party lines. Following Ferguson’s announcement, State Sen. Chris Gildon, R-Puyallup, the Republicans’ budget leader, said in an interview that he “would predict that it not get any Republican support.”

“To caveat that a little bit, if they wanted to remove the sales tax or property tax and swap it for this particular tax, then maybe we can have some discussions along those lines,” Gildon said. “But just as far as adding a new tax to Washington state, I think that’s just a nonstarter for Republicans.

The concern, Gildon said, is that the tax could be applicable on businesses with net revenue above a million dollars, but not profitable. However, the tax would only be applicable to individuals who make more than a million dollars a year in income, not businesses.

Gildon said he also worried the tax could motivate high-income earners to leave.

“If you put in policy that increases the tax burden on these highly mobile individuals, they might just leave,” Gildon said.

Should the Legislature adopt an income tax, it would also likely draw immediate legal challenges.

Ahead of the 2024 legislative session, more than 440,000 residents signed on to an initiative to the Legislature, which prohibited the state, cities and counties from adopting an income tax. The initiative subsequently passed by both chambers of the Legislature.

Ferguson said Tuesday he is confident the proposal could survive a lawsuit, and that voters will also have the opportunity to weigh in on the new proposal.

“I wouldn’t be supporting a proposal unless I felt confident that we could navigate that path, and also, there’s going to be a public conversation. If this goes forward, there’s going to be a public conversation, there’s no doubt about that, and the people will have their chance to weigh in on it as well,” Ferguson said.

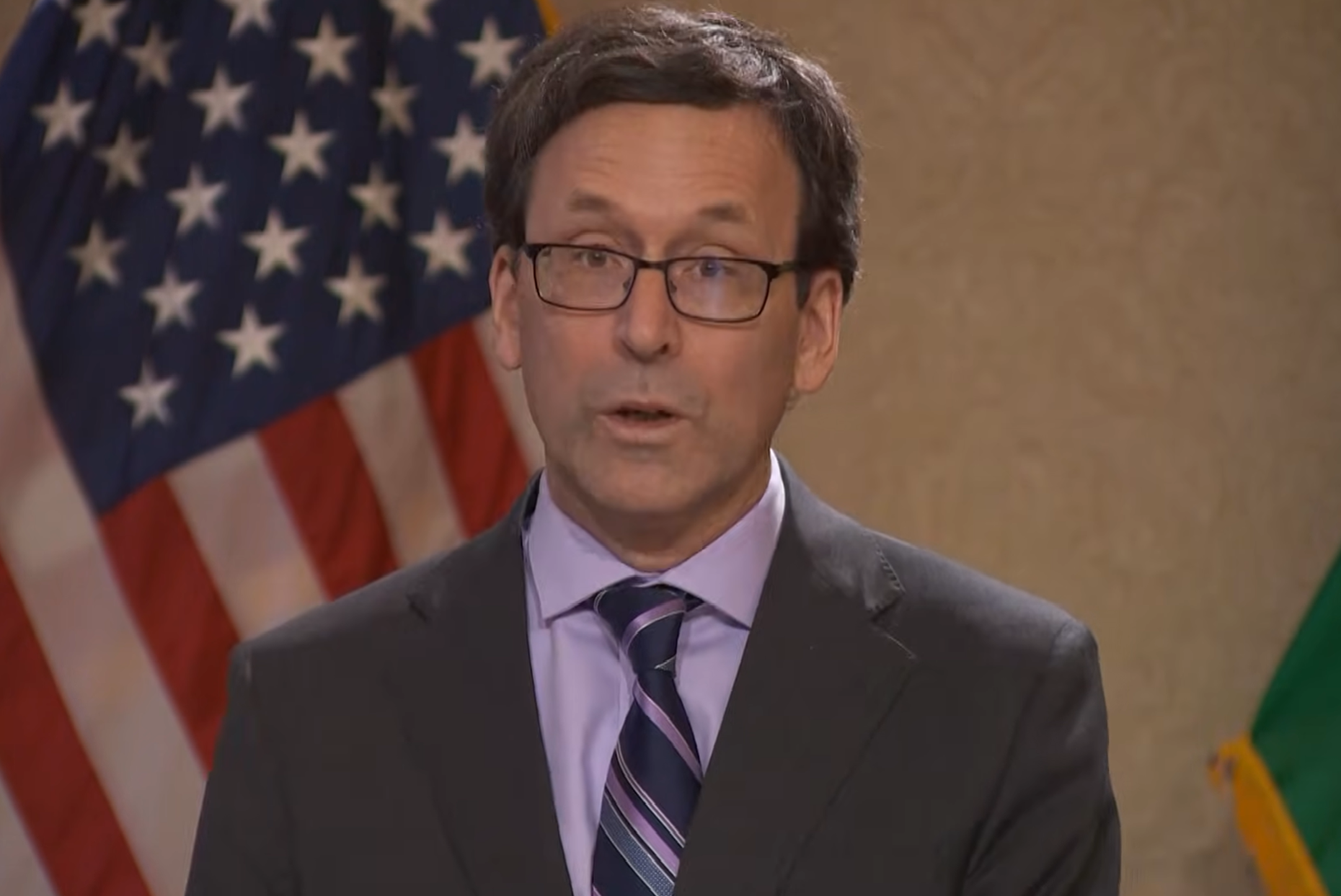

Photo caption: Washington state Gov. Bob Ferguson announced Dec. 23 his support for a state income tax on those who make more than $1 million a year.

_______

© 2025 The Spokesman-Review (Spokane, Wash.). Visit www.spokesman.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs