By David Lightman

McClatchy Washington Bureau

(TNS)

WASHINGTON — The Senate on Thursday rejected plans from Republicans and Democrats to ease soaring health care costs, making it more likely many people face health insurance premiums that could double shortly.

COVID-era credits for people with Obamacare-inspired health care policies will expire at the end of this month.

Senate Democrats proposed extending the subsidies for three years. That effort was blocked as it received 51 votes, when 60 were needed to proceed.

A Republican alternative was also thwarted. All 47 Democrats and one Republican, Sen. Rand Paul, R-Ky., blocked consideration, which also needed 60 votes.

Recommended Articles

The debate was largely a parade of senators accusing the other party of acting irresponsibly.

“Don’t let health coverage lapse for millions of Americans. This isn’t a game. We’re three weeks away from the catastrophic spike of cost in health insurance for so many,” said Sen. Alex Padilla, D-Calif., in a floor speech. “The fact of the matter is our Republican colleagues don’t have a serious plan.”

Yes we do, countered Senate Majority Whip John Barrasso, R-Wyo. Barrasso, a physician, said the Democrats simply want to continue a faulty health care system.

“They want to send taxpayer dollars directly from the federal treasury to insurance companies to prop up Obamacare,” he told Senate colleagues. “Obamacare has failed. It has failed so badly that Democrats continue to use taxpayer dollars to hide its failures.”

The GOP plan would provide funds usable for deposits into Health Savings Accounts for consumers who now buy bronze level plans on the Affordable Care Act marketplace, which tend to be less expensive but have higher deductibles, or marketplace catastrophic coverage.

Eligible would be people who earn less than 700% of poverty level, or $225,050 for a family of four. People 18 to 49 could have $1,000 deposited in their accounts, and those 50 and over could receive $1,500.

“Republicans want to put MORE money in your pocket so your family can afford health care. Democrats want to give money to large insurance companies to increase their profits. Is this really a debate?” tweeted Sen. Bill Cassidy, R-La., one of the plan’s chief architects.

Senate Minority Leader Chuck Schumer, D-N.Y., dismissed the plan as useless.

“They used scotch tape and glue to come up with this ridiculous proposal that can’t be taken seriously. The Republican plan does nothing—nothing—to extend the tax credits for even a day,” he said.

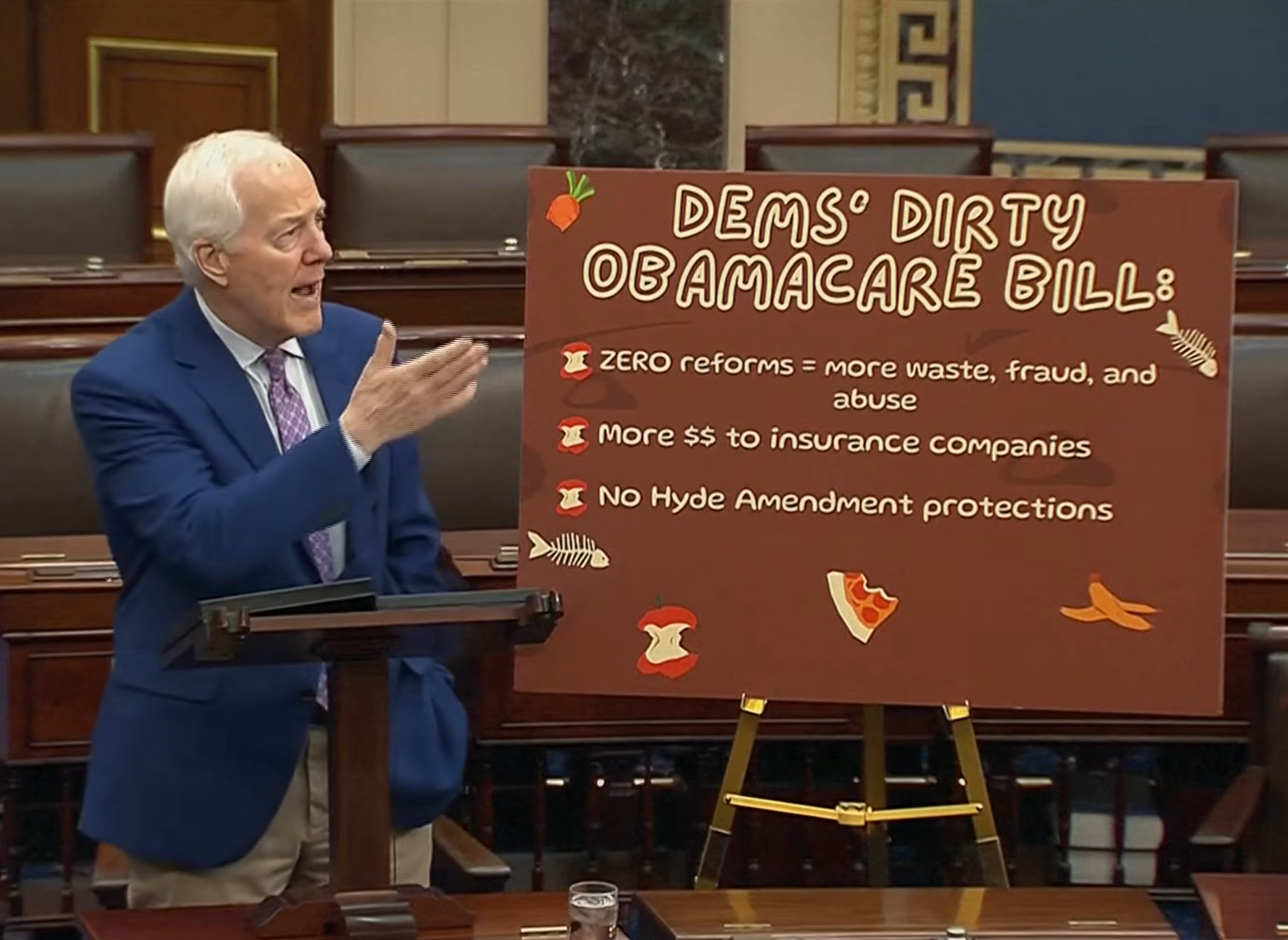

Photo caption: Sen. John Cornyn (R-TX) spoke on the Senate floor in opposition of a bill to extend Affordable Care Act tax credits on Dec. 11.

_______

©2025 McClatchy Washington Bureau. Visit at mcclatchydc.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs