By Jake Sheridan

Chicago Tribune

(TNS)

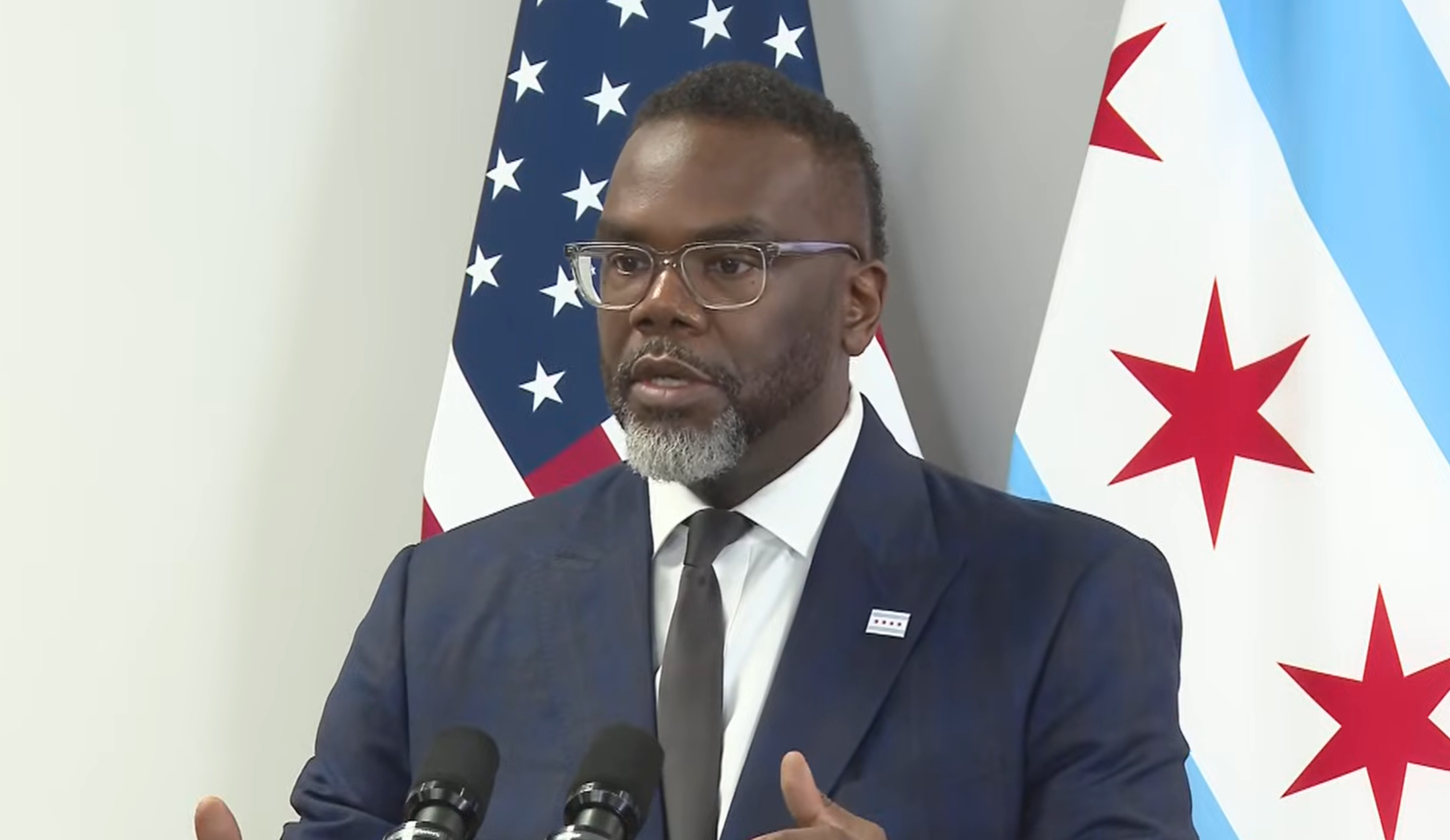

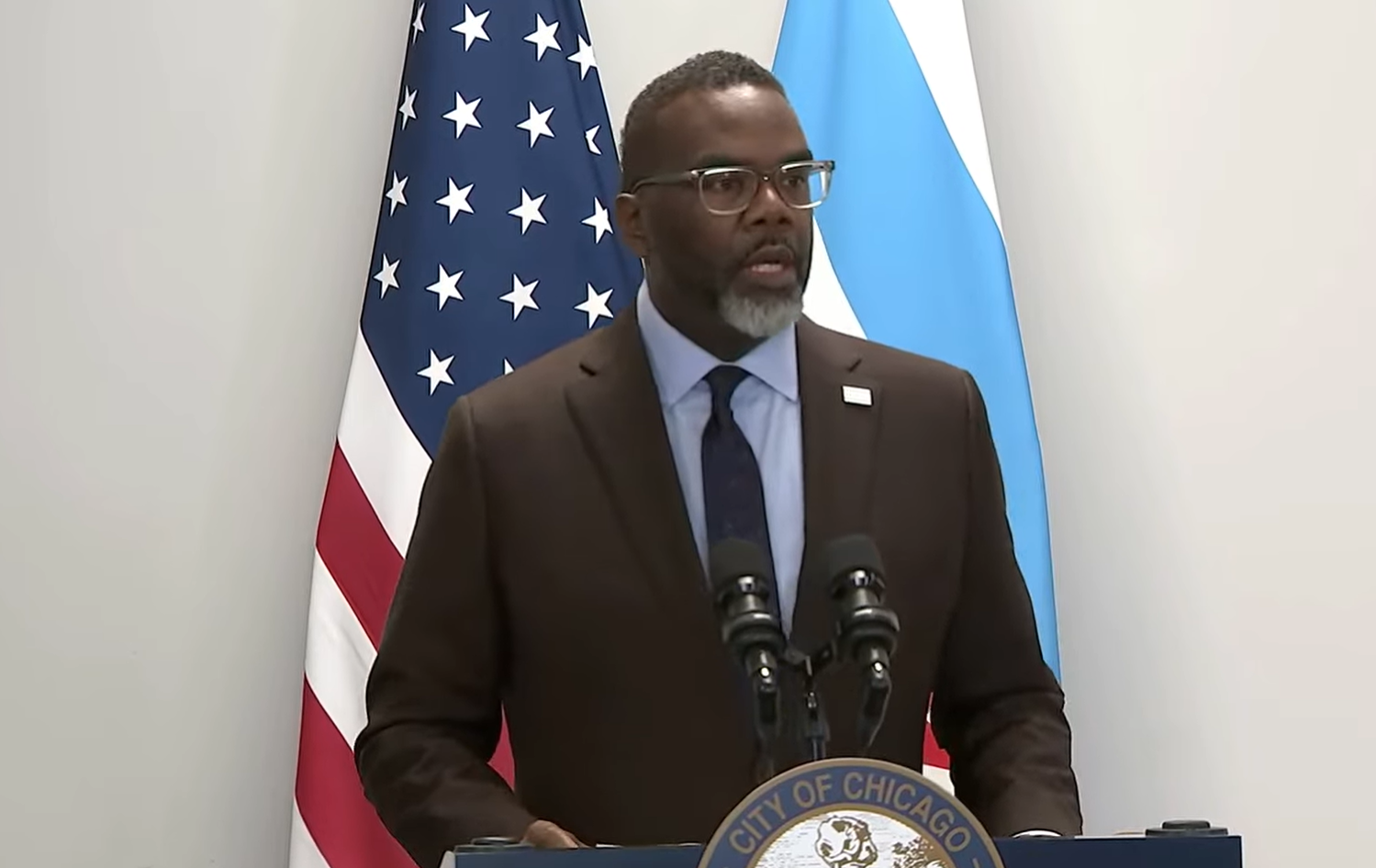

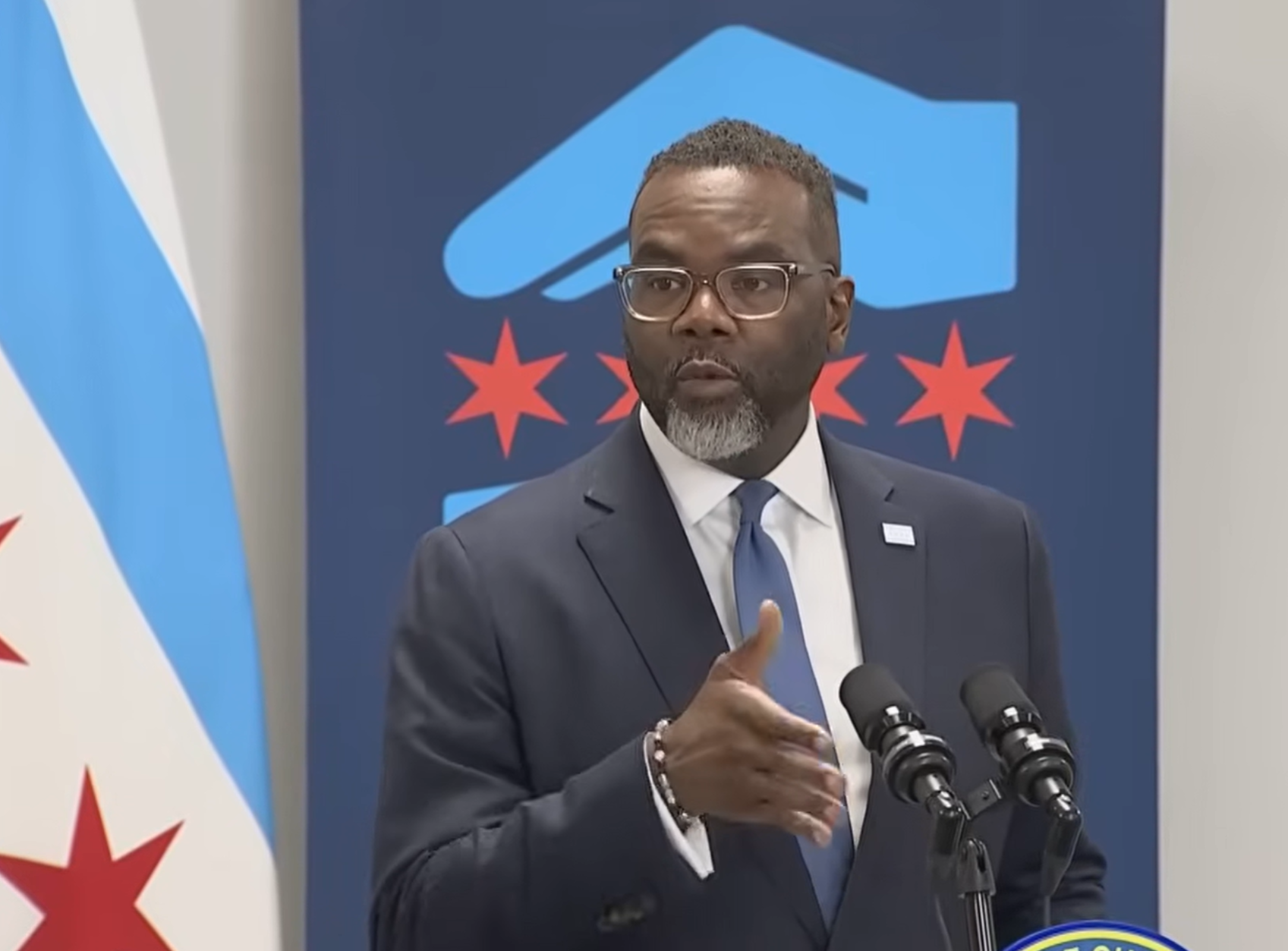

Mayor Brandon Johnson proposed a new version of his head tax Tuesday, altering the controversial measure to target bigger businesses for more money per employee as he seeks to get backing from enough aldermen to pass his budget before the end of the year.

Johnson is now pushing a $33-per-employee monthly tax on companies with over 500 Chicago employees. He included in his initial 2026 budget a $21-per-employee tax on companies with over 100 employees but has been unable to get a City Council majority to agree to it.

By making the change, Johnson hopes to win over on-the-fence aldermen who feared the tax’s previous iteration would harm smaller neighborhood businesses. City Council majorities repeatedly rejected the old proposal in official votes and petitions.

“We are not talking about your local retail shops. We are not talking about mom-and-pop restaurants,” Johnson said as he introduced the change at a news conference Tuesday morning.

The head tax debate has proven to be City Hall’s most contentious as the mayor and aldermen work to land a budget before a critical end-of-year deadline.

The aldermen most ardently opposed to the head tax stood their ground later Tuesday, arguing the mayor’s changes did nothing to address their concern that the measure will harm economic growth.

Recommended Articles

Taxes December 17, 2025

Citadel Leaves Chicago Tower as City Alarmed by ‘Job Killer’ Tax

Taxes November 18, 2025

Chicago Mayor’s Head Tax Plan Defeated in Council Committee Vote

Taxes November 12, 2025

Chicago Mayor Floating Change to Head Tax Proposal, Sources Say

Southwest Side Ald. Matt O’Shea called the mayor’s change “the latest gimmick” during a City Hall news conference, marking the second day in a row of dueling media appearances for Johnson and his opponents.

It “takes an already harmful idea and makes it even more burdensome for Chicago businesses and workers,” O’Shea, 19th, argued.

Downtown Ald. Brendan Reilly, 42nd, argued Johnson’s proposal would push away businesses capable of moving elsewhere or relying on remote work. Such a shift would shrink Chicago’s downtown commercial property tax base and ultimately place a greater tax burden on homeowners, he argued.

Johnson is failing to build consensus and only wants a “bare” majority, Reilly said.

“I think it’s for him less about the revenue now than it is about trying to take a chunk out of the hide of Chicago’s business community,” Reilly said.

A bloc of 26 aldermen signed a letter to Johnson proposing alternative budget ideas last month. Johnson on Monday dared them to move ahead with a vote, suggesting the majority of signatories to the letter won’t translate into a majority of council votes for the package.

But while the group Tuesday said they were willing to push forward their plan to replace the head tax with hiked liquor taxes and higher garbage fees, among other changes, they would not commit to a timeline on when they would introduce and attempt to vote on legislation.

Instead, they argued it is Johnson’s responsibility to come back to the bargaining table.

“We want the mayor to sit down with us. We want the mayor to engage, to govern, to lead,” O’Shea said. “The question is, does the mayor have the votes?”

For his part, Johnson said he is “ready to go now” on a vote, though he shared no information to suggest his new proposal had suddenly won over enough aldermen to move ahead.

“I believe that the budget that I presented was ready to go,” he said. “It’s not like much has changed. We’re really discussing one particular component of the budget, which I understand there’s a strong desire to protect the largest corporations and the ultra-wealthy.”

Progressive aldermen critical to any Johnson budget majority have said they take issue with other parts of the mayor’s budget, such as his plans to trim a previously planned advanced pension payment and to borrow money to pay for police settlements and firefighter backpay. The letter the council majority signed also suggested changing the payment and borrowing plans.

Johnson said the new version of the head tax would bring in $82 million. His team used data last updated over a decade ago—before former Mayor Rahm Emanuel ended a previous Chicago head tax—to make its projections, according to policy chief Jung Yoon.

The new plan would tax around 207,000 jobs in Chicago, according to an analysis by the Tribune.

But the cost of the reinstated levy would pale in comparison to the tax breaks that large corporations have gotten from President Donald Trump, Johnson argued. He said around 175 companies would be affected and listed corporate behemoths to drive his point: J.P. Morgan, Accenture, CitiGroup, Walmart, T-Mobile, Mondelēz.

“$30 a month is not going to change their bottom line. What they prioritize is a talent pool, which Chicago certainly has,” he said. “It worked in Chicago, and we know that it can work again.”

Photo caption: Chicago Mayor Brandon Johnson speaks to reporters about the city’s budget impasse on Dec. 8, 2025.

_______

©2025 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs