Despite reporting lower optimism about the U.S. economy in the fourth quarter of this year, CPA business leaders’ confidence in their own companies’ prospects improved, according to the Q4 AICPA and CIMA Economic Outlook Survey.

This latest survey polled 241 CEOs, CFOs, controllers, and other CPAs at U.S. companies who hold executive and senior management accounting roles.

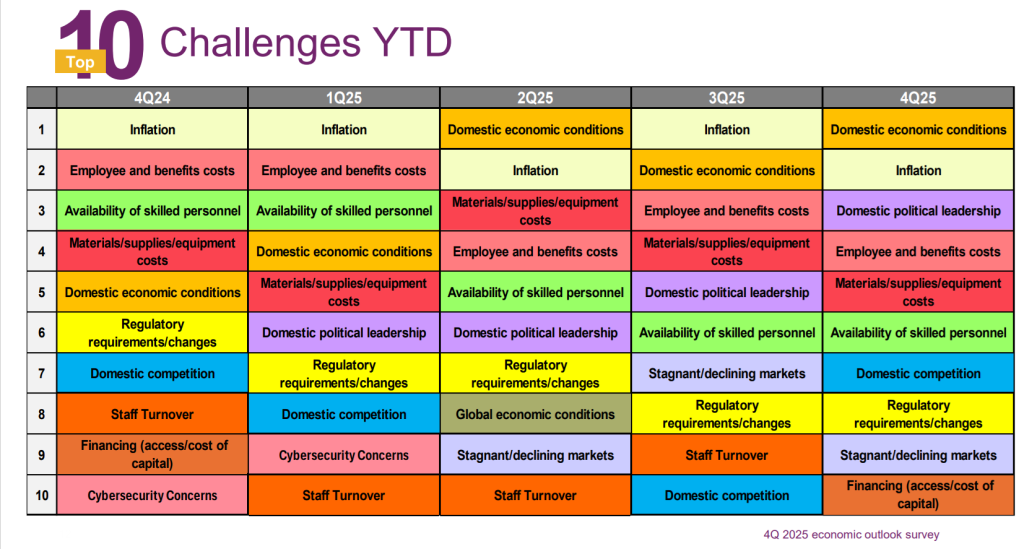

Twenty-eight percent of CPA business executives said they were optimistic about the U.S. economy’s outlook over the next 12 months, down from 34% in the past quarter. Domestic economic conditions (No. 1) and inflation (No. 2) were cited as top concerns, swapping spots from last quarter. Domestic political leadership rose to the third spot among concerns, its highest ranking since the second quarter of 2021.

Recommended Articles

Uncertainty tied to changing tariff schedules eased, with 49% of business executives reporting moderate to significant uncertainty in business planning, down from 58% last quarter.

Three out of four respondents said the 43-day federal government shutdown, which ended during the survey period, had no more than a minor impact on operations. Among those reporting an impact, the most common effects were softer consumer spending and delays in regulatory approvals.

Even with lower economic optimism, business leaders were more favorable about their own companies’ outlook than in the third quarter (41% versus 37%). Slightly more said they were expecting to expand their businesses than last quarter, as well (48% vs. 46%).

“Despite a small decrease in optimism in the economy at large we’re seeing a mixed picture below that topline figure that underscores some of the volatility companies are experiencing,” Tom Hood, CPA, CGMA, CITP, executive vice president of business engagement and growth at the Association of International Certified Professional Accountants, the alliance formed by AICPA and CIMA, said in a statement on Dec. 4. “The good news is business executives are feeling better about their own companies’ expected performance and that’s reflected in small improvements in profit and revenue projections.”

The AICPA survey is a forward-looking indicator that tracks hiring and business-related expectations for the next 12 months. In comparison, the U.S. Department of Labor’s November employment report looks back on the previous month’s hiring trends.

Other key findings of the survey include:

- The number of business executives who expect a recession by the end of 2026 dropped two percentage points from 54% to 52%, with 17% saying we’re already in one.

- The hiring picture remains largely similar to last quarter. A majority of business executives say they have the right number of employees. Some 32% said they have too few, a point lower than last quarter. But the number of business executives who said they have too many employees also dropped a point (13% vs. 14%).

- Profit and revenue growth both rebounded slightly. Projected revenue growth for the next 12 months is now expected to be 2%, a half percentage point increase from last quarter. Profit expectations are now expected to be 0.8%, up from 0.1% last quarter.

Methodology: The fourth quarter AICPA and CIMA Economic Outlook Survey was conducted from Nov. 3-26, 2025, and included 241 qualified responses from CPAs and Chartered Global Management Accountant (CGMA) designation holders in leadership positions or senior accounting roles, such as CFO or controller.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, AICPA, aicpa and cima, business executives, CPAs, economy, Hiring, revenue