New research from top 10 accounting firm BDO USA finds that the use of advanced technologies in the audit has crossed from cautiously experimental to increasingly mature, but as tech adoption increases, the role of the auditor in providing judgment, professional skepticism, and the ability to interpret complex data is becoming more critical than ever before.

According to BDO’s second annual Audit Innovation Survey, released on Nov. 17, advanced audit technology is enhancing quality, efficiency, transparency, and risk management across finance and accounting departments.

“Finance and accounting teams are adopting data-driven technologies that blend artificial intelligence, predictive analytics, and cybersecurity risk analytics to improve accuracy, efficiency, and risk awareness,” the report states. “Yet, technology alone does not create this value; this technology is only as effective as the people who interpret, apply and govern these tools.”

Finance leaders report using AI strategically for audit applications like data management and transformation (61%), risk detection and management (54%), automated data entry (50%), fraud detection (45%), and predictive trend analytics (43%).

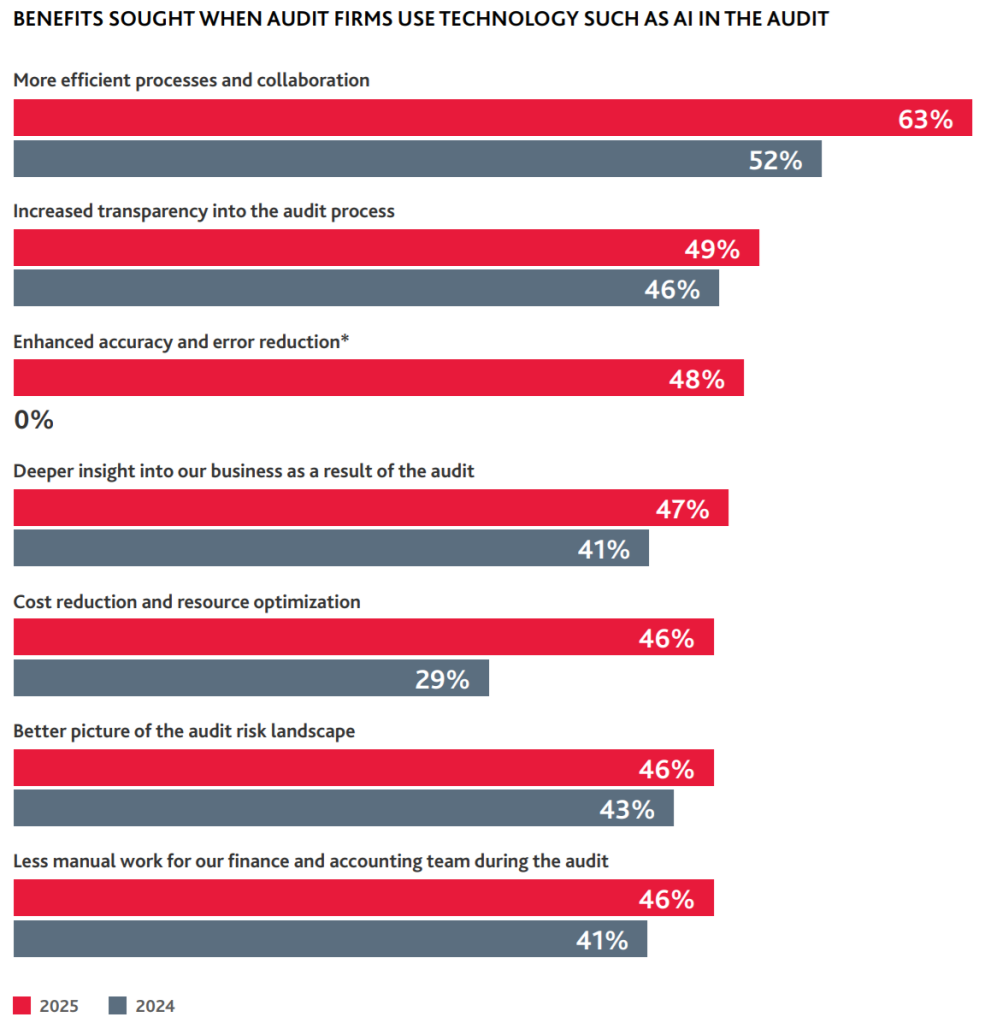

The report also finds that technology is helping facilitate a smoother audit engagement experience. This year, 63% of finance leaders said they believe using technology in the audit leads to more efficient processes and collaboration, an 11-point jump from last year.

The data also suggests that auditor and client technology is increasingly aligned, as 93% of finance leaders report that their auditor’s technology sophistication now matches their own (up from 89% in 2024), and 85% say their auditor’s technology meets or exceeds expectations, an eight-point jump from 77% the previous year.

Recommended Articles

“Audit technology has reached an inflection point,” Brian Miller, assurance managing principal of digital transformation and innovation at BDO USA, said in a statement. “Finance leaders no longer ask if their auditor uses advanced technology—they expect it. But while technology is an enabler of today’s audit, people remain the most critical factor. Curious professionals who leverage innovative tools and thoughtfully interpret results are creating greater stakeholder value, with more transparency and accuracy, than ever before. The audit firms that are investing in their people, data, and technology are defining the next era of audit quality.”

BDO’s report reveals that four in five finance leaders (81%) report greater trust in audit firms that use advanced technologies, an 18% increase from the previous year. The research also finds that most finance leaders (97%) are willing to pay more for audits underpinned by advanced technologies. Finance leaders increasingly believe that technology in the audit delivers cost reductions (from 29% in 2024 to 46% in 2025), suggesting that leaders believe there is a strong return on investment in audit technology.

Finance leaders’ data governance confidence drops

Despite the value leaders place on advanced technologies, their data governance confidence has declined from 55% rating it “mature” in 2024 to just 46% in 2025. This may suggest growing awareness that new technologies raise the bar for what constitutes strong governance.

In addition, while 92% of finance and accounting teams have either implemented AI or plan to do so in the next 12 months, just 43% of organizations say they have a formal AI governance framework in place. This is particularly concerning given the risks finance leaders associate with AI: 82% cite cybersecurity concerns, 80% worry about data privacy, and 71% fear AI-generated inaccuracies.

“Without robust governance frameworks, these risks can undermine the very trust that advanced technology is meant to reinforce,” BDO said.

Uncertainty around compliance complicates adoption efforts

Many finance leaders (74%) are concerned about regulatory risks when using AI for the audit. BDO’s report suggests that many companies are caught between the desire to innovate and concerns about creating compliance risks.

“As technology continues to evolve, its value is increasingly shaped by the pace and clarity of regulatory change. The challenge is not only the burden of adapting to new regulatory requirements, but also the impact of regulatory lag and lack of clarity, which remains a key barrier to realizing the full benefits of innovation,” the report states. “There is hesitation to adopt new technologies without clear, proactive guidance from regulators, fearing compliance risks and misalignment with evolving standards. Recent and proposed updates to standards are beginning to provide more clarity on the use of technology in audits, which will influence how finance and accounting teams design and implement these technologies within their financial systems.”

Despite the challenges associated with limited regulatory guidance, 48% of finance leaders believe that audit innovation technology like AI leads to enhanced accuracy and error reduction. As regulatory frameworks evolve to keep pace with innovation, finance leaders are calling for proactive standards that support responsible adoption rather than reactive compliance.

Technology integration and enablement still pose a challenge

Last year’s research revealed challenges with technology integration and enablement, and while progress has been made, challenges persist. Data extraction challenges, lack of expertise in interpreting AI-driven outputs, and compatibility with auditor technology are all still key issues preventing teams from realizing the full value of advanced technologies in the audit.

The report suggests there is a need to invest more in training and upskilling across the accounting profession with the understanding that it’s people—trained, empowered, and aligned—who will define the future of finance and audit.

“As regulatory expectations continue to evolve, organizations should anticipate changes in audit procedures, expanded documentation requirements, and closer scrutiny of technology-enabled processes. To realize the full value of audit innovation, it is essential for both regulators and organizations to prioritize clear guidance, timely updates, and practical frameworks that support responsible technology adoption. Organizations must also invest in upskilling, collaboration, and change management to ensure that regulatory updates translate into improved quality and efficiency for both audit firms and finance and accounting departments,” the report says.

“The potential value of audit technology can be diminished by regulatory uncertainty and lag, but this risk can be mitigated. By prioritizing clear, timely, and practical regulatory guidance, and by investing in the skills and collaboration needed to adapt, organizations and regulators can ensure that technology adoption drives real improvements in audit quality and efficiency. Proactive engagement, ongoing enablement, and a commitment to clarity will help transform regulatory change from a barrier into a catalyst for innovation.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs