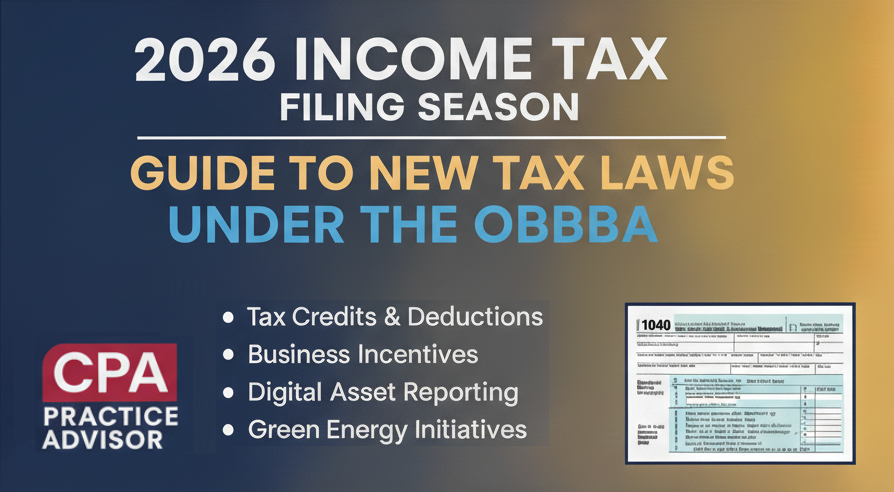

[This is part of a Special Series on the tax changes made by the One Big Beautiful Bill Act, which was enacted in July 2025. It includes a wide range of changes to individual and corporate taxes, deductions, credits, forms and other topics, that affect tax filing starting this year into the future.]

In recent years, Congress approved and modified two tax credits for making energy-saving expenses at home. Now the new tax law signed on July 4—the one Big Beautiful Bill Act (OBBBA)—terminates both tax credits at the end of this year. Homeowners will have to act fast to get in under the wire. Here is a brief rundown of the rules.

1. Efficient Home Improvement Credit: If individuals make qualified energy-efficient improvements to their home, they can qualify a tax credit of up to $3,200 for the tax year in which the improvements are made. Currently, the credit equals 30% of certain qualified expenses, including:

- Qualified energy efficiency improvements installed during the year such as exterior doors, windows and skylights, and insulation and air sealing materials or systems;

- Residential energy property expenses such as central air conditioners; natural gas, propane, or oil water heaters; natural gas, propane, or oil furnaces; and hot water boilers;

- Heat pumps, water heaters, biomass stoves and boilers; and

- Home energy audits of a principal residence.

Recommended Articles

The maximum credit that is available each year is $1,200 for energy property costs and certain energy efficient home improvements. However, there are specific limits on doors ($250 per door and $500 total), windows ($600) and home energy audits ($150) and $2,000 per year for qualified heat pumps, biomass stoves, or biomass boilers.

The Efficient Home Improvement Credit may be claimed only for qualified expenditures made to an existing home or for an addition or renovation of an existing home. Improvements to newly constructed homes don’t count. Finally, the credit is nonrefundable.

2. Residential Clean Energy Credit: Taxpayers who invest in energy improvements for their main home, including solar, wind, geothermal, fuel cells, or battery storage, may qualify for an annual residential clean energy tax credit. The credit can be claimed for certain improvements other than fuel cell property expenditures made to a second home lived in part-time if the home isn’t rented out.

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property installed in a U.S. home, including;

- Solar electric panels;

- Solar water heaters;

- Wind turbines;

- Geothermal heat pumps;

- Fuel cells; and

- Battery storage technology.

Clean energy equipment must meet the certain standards to qualify for this credit. It is allowed for qualified expenditures incurred for installing new clean energy property in an existing home or for a newly constructed home.

The credit has no annual or lifetime dollar limit except for fuel cell property. It was scheduled begin to phase out in 2033. Note: As with the Energy Efficient Home Improvement Credit, the Residential Clean Energy Credit is nonrefundable.

But the OBBBA shuts the door completely on both residential energy credits. Specifically, it terminates the Energy Efficient Home Credit for property placed in service after 2025 and the Residential Clean Energy Credit for expenses incurred after 2025, respectively. The current Congress is not expected to revive either credit.

Call to action: Clients that are interested in energy-saving measures in their homes may not know of the pending crackdown. Notify them immediately about the changes included in the new tax law. They may have to move fast to qualify for either of these credits before they expire om December 31.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs