The fee tax professionals pay to renew or apply for a preparer tax identification number will be reduced from $11 to $10 starting in mid-October, according to interim final regulations and proposed rules issued by the IRS on Sept. 29.

Including an $8.75 fee paid directly to a third-party contractor, the total annual amount to renew or apply for a PTIN will be $18.75.

The IRS said in a media release on Monday that its return preparer office conducted a biennial review of the PTIN user fee in 2025 and determined that the full cost of issuing or renewing a PTIN should be reduced.

This newly established $10 user fee will be effective for the start of the next PTIN renewal cycle beginning on Oct. 16, 2025. The PTIN fee is nonrefundable. Failure to have and to use a valid PTIN may result in penalties.

In the interim final regulations, the IRS explains how the $10 PTIN fee was calculated:

The IRS used projections for FYs 2026 through 2028 to determine the direct and indirect costs associated with the PTIN program that are includable in the PTIN user fee calculation. Direct costs are incurred by the Return Preparer Office and include staffing and contract-related costs for activities, processes, and procedures related to administering the PTIN program. Staffing costs included in the PTIN user fee calculation relate to the compliance activities of investigating ghost preparers, handling complaints regarding the improper use of a PTIN, use of a compromised PTIN, or use of a PTIN obtained through identity theft, and composing the data to refer those specific types of complaints to other IRS business units. The PTIN user fee also takes into account indirect costs for support activities related to the provision of PTINs and maintenance of the PTIN database.

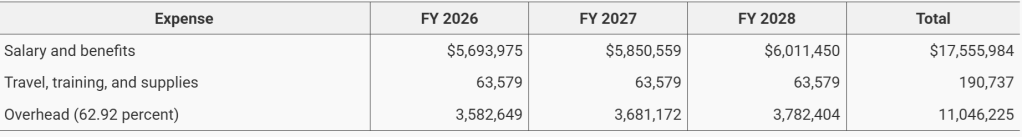

The salary and benefits for the work performed related to the PTIN program is projected to be $17,555,984 in total over FYs 2026 through 2028. In addition to salary and benefits and overhead expenses, the IRS projects incurring travel, training, and supplies costs of $63,579 in each of FYs 2026 through 2028. The total salary and benefits, travel, training, and supplies, and overhead expenses projected are shown below:

The total cost for FYs 2026 through 2028 is therefore projected to be $28,792,946. The number of users is based on FY 2024 numbers adjusted by a projected increase in applications in FYs 2026, 2027, and 2028. Dividing this total cost by the projected population of users for FYs 2026 through 2028 results in a cost per application or application for renewal of $10 as follows: $28,792,946 (total cost) divided by 2,829,524 (number of applications) equals $10.18 (cost per application or application for renewal).

Taking into account the full amount of these costs, the amount of the PTIN user fee per application or application for renewal is $10.

The IRS estimates that more than 900,000 individuals will apply for an initial or renewal PTIN during each of the next three PTIN renewal cycles.

Anyone who prepares or helps prepare a federal tax return or claim for refund for compensation must have a valid PTIN from the IRS and needs to include the PTIN as their identifying number on any return or claim for refund filed with the IRS. All enrolled agents must also have a valid PTIN to maintain their active status, the IRS said.

PTINs expire on Dec. 31 of the calendar year for which they are issued. Paid tax return preparers and enrolled agents who need to apply for an initial PTIN or renew a PTIN expiring on Dec. 31, 2025, should use the online portal, which takes about 15 minutes to complete.

A paper option, Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, along with the instructions, are also available for PTIN applications and renewals. However, the paper form can take approximately six weeks to process, the IRS noted.

Photo credit: brightstars/iStock

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs