By Ken Berry, J.D.

Over the last few decades, Congress has chipped away at the mortgage interest deduction, but the deduction can still be fruitful for homeowners who itemize. Now the new “One Big Beautiful Bill Act” (OBBBA) extends some cutbacks permanently, but it extends an olive branch to taxpayers.

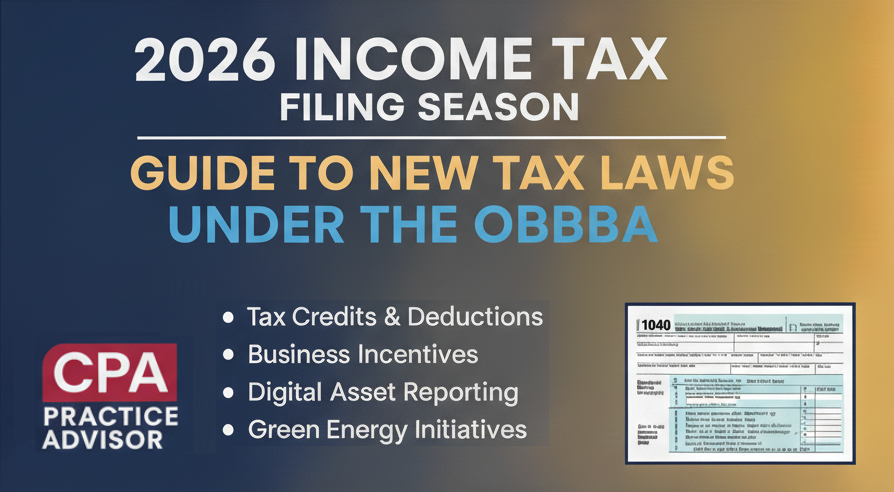

[This is part of a Special Series on the tax implications of the broad One Big Beautiful Bill Act, which was enacted in July 2025. It includes a wide range of changes to individual and corporate taxes, deductions, credits, forms and other topics, that affect tax filing starting this year into the future.]

Background: Prior to the Tax Cuts and Jobs Act (TCJA), you could deduct as an itemized deduction the interest paid on either acquisition debt or home equity debt, or both, within generous limits.

Recommended Articles

Taxes February 18, 2026

2026 Tax Filing and Form 1099-K – Know the New Rules This Tax Season

Tax Planning February 18, 2026

Planning for Charitable Contributions in 2026

Taxes February 17, 2026

Trump’s Tax Rules Still Unclear to U.S. Clean-Energy Industry

1. Acquisition debt: This is defined as a debt where you use the mortgage proceeds to buy, build, or substantially improve the home. Typically, acquisition debt represents the main part of a mortgage interest deduction. To qualify, the loan must be secured by a qualified residence, such as your principal residence or a second home like a vacation home. The interest was deductible on loans up to a $1 million threshold.

2. Home equity debt: When permitted by state law, you previously could deduct the interest on home equity loans or a home equity line of credit (HELOC) secured by a qualified residence, regardless of how the proceeds were used. With a home equity debt, deductions were limited to interest paid on the first $100,000 of debt. Furthermore, the loan amount could not exceed your equity in the home.

But the TCJA tightened up the mortgage rules, beginning in 2018. Notably, it imposed these changes.

- The threshold for deducting interest paid on acquisition debt was lowered from $1 million to $750,000. This applies to loans made after December 15, 2017 (or April 1, 2018, if there was a binding contract in place before December 16, 2017). Thus, some taxpayers who bought a home prior to the enactment date were “grandfathered in” under the old rules.

- The deduction for interest paid on home equity debt was suspended regardless of the amount or the date the residence was acquired.

Both TCJA changes were scheduled to revert to prior law after 2025. However, the OBBBA permanently extends these two key provisions for mortgage interest. You can no longer deduct any mortgage interest paid on home equity debt.

Tax loophole: If you incur a new home equity loan or line of credit and use the proceeds for significant home improvements, the debt may be treated as an acquisition debt, rather than a home equity debt. Reason: It is a debt being incurred to “substantially improve” a qualified residence. Therefore, you can add this mortgage interest to your deductible total if you still itemize deductions

Plus, the new law adds some icing on the cake.

Previously, a deduction for personal mortgage insurance (PMI) was temporarily allowed, subject to a phase-out for an adjusted gross income (AGI) above $100,000. This deduction, which was claimed separate and apart from the mortgage interest deduction, expired after 2021.

Now the OBBBA treats PMI payments as mortgage interest payments for tax return purposes. So, itemizers can deduct their PMI payments as part of the mortgage interest deduction, subject to the overall limits.

The upshot: Make sure your clients are fully apprised of the new rules. They may require your assistance regarding these issues before they take out a mortgage or incur any other homeowner loans.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs