Taxpayers who operate large trucks and buses have until Aug. 31 to file Form 2290, Heavy Highway Vehicle Use Tax Return, for vehicles first used on a public highway in July 2025, the IRS said on Tuesday.

The Heavy Highway Vehicle Use Tax applies to highway vehicles with a gross weight of 55,000 pounds or more that are registered or are required to be registered under law.

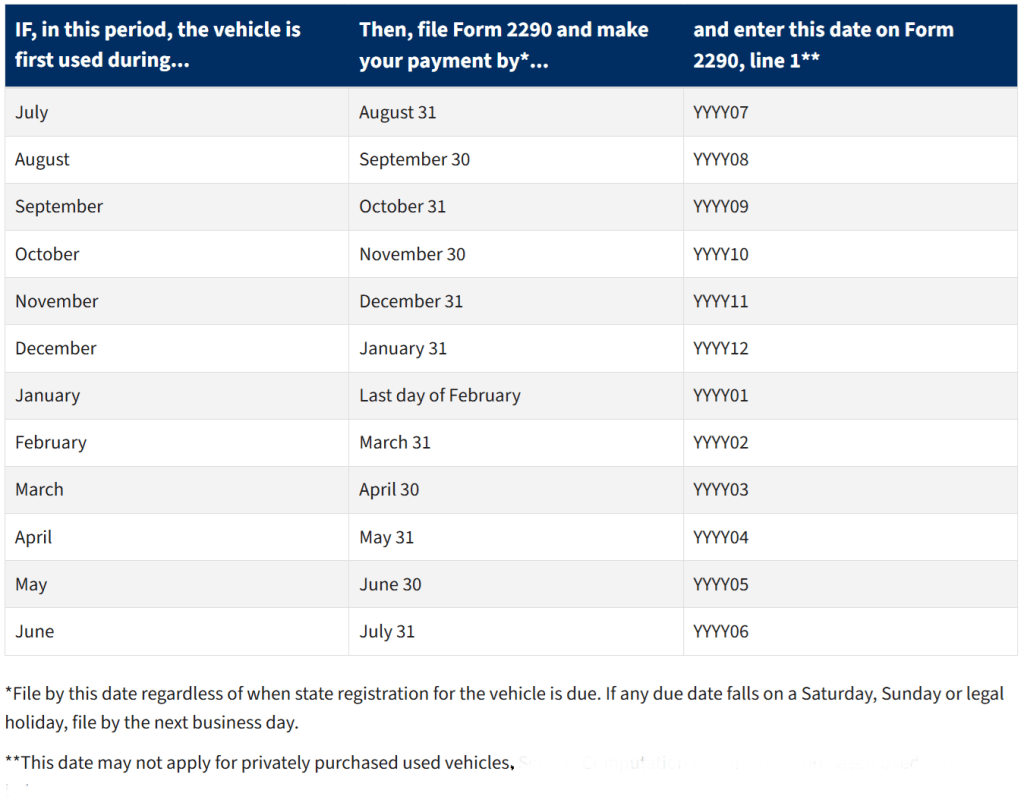

According to the IRS, “Taxpayers must file Form 2290 by the last day of the month following the month in which the taxpayer first used the vehicle on a public highway during the taxable period, regardless of the vehicle’s registration renewal date.”

The annual taxable period runs from July 1, 2025, to June 30, 2026.

Vehicles first used on a public highway during the month of July must file Form 2290 and pay the appropriate tax between July 1, 2025, and Aug. 31, 2025. For additional taxable vehicles placed on the road during any month other than July, the tax should be prorated for the months the vehicle is in service. The agency’s website has a table to help determine the filing deadline.

The IRS encourages taxpayers to e-file Form 2290 because “electronically filing through a provider participating in the IRS e-file program for excise taxes makes a stamped Schedule 1 (proof of payment) available in minutes once the return is accepted by the IRS.”

A stamped Schedule 1 is usually required when registering vehicles with a state or entering a Canadian or Mexican vehicle into the U.S.

While all taxpayers are encouraged to e-file, taxpayers who have 25 or more taxed vehicles registered in their name must e-file Form 2290. For vehicles with an expected use of 5,000 miles or less (7,500 for farm vehicles), a return is required, but no tax is due. If the vehicle exceeds the mileage use limit during the tax period, the tax becomes due, the IRS said.

Filing options include:

- All Form 2290 filers are encouraged to e-file, a list of IRS-approved e-file providers is on IRS.gov.

- E-file is required when reporting 25 or more vehicles on Form 2290.

- A watermarked Schedule 1 is sent to the e-file provider within minutes after acceptance of an e-filed return. Schedule 1 is available to the taxpayers either through their e-file account or email inbox as directed by the e-file provider.

- If filing by mail, ensure that the correct mailing address is used.

- Mail filers will receive their stamped Schedule 1 within six weeks after the IRS receives the form.

Payment options include:

- Credit or debit card or digital wallet.

- E-filing makes paying with electronic funds withdrawal an easy part of the process.

- Electronic Federal Tax Payment System requires advanced enrollment.

- Mail check or money order payments using Form 2290-V, Payment Voucher, to: Internal Revenue Service, P.O. Box 932500, Louisville, KY 40293-2500.

When filing a Form 2290, taxpayers should have available the following:

- Vehicle Identification Number(s).

- Employer Identification Number (EIN), not a Social Security number. It can take about four weeks to establish a new EIN. (See How to Apply for an EIN.)

- Name appearing on the EIN application.

- Taxable gross weight of each vehicle.

More information can be found at the IRS’s Trucking Tax Center.

Photo credit: vitpho/iStock

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs