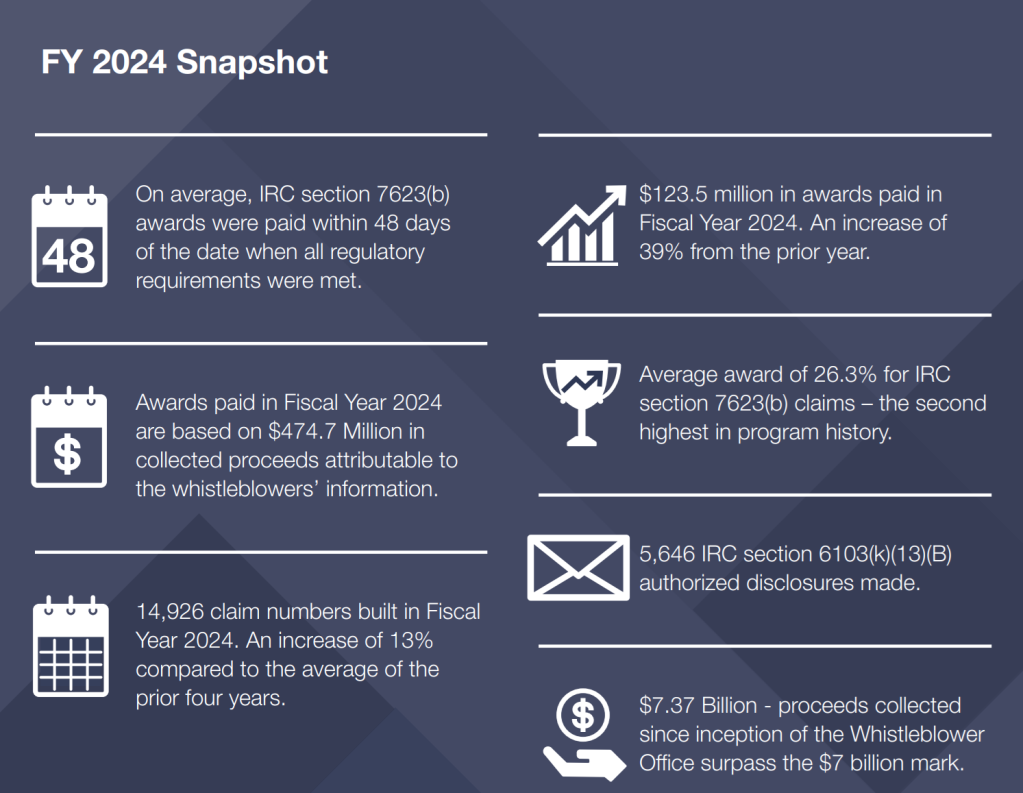

The IRS gave whistleblowers 105 awards totaling $123.5 million for information attributable to $474.4 million in tax revenue being collected in fiscal year 2024, the agency’s Whistleblower Office said in its latest annual report.

The total dollar amount of awards paid increased substantially from $88.8 million in FY 2023. The total number of awards in FY 2024, however, decreased from 121 in FY 2023 to 105 in FY 2024.

- Related article: IRS Paid Out $88.8M to Whistleblowers in FY 2023

“Although the number of awards decreased in FY 2024, the claim numbers related to those awards was 700, which is the third highest since the start of the current Whistleblower Program in 2007,” the report states. “The total dollar amount of awards paid in FY 2024 was also the third highest in the program’s history. Awards paid as a percentage of proceeds collected were 26.0% in FY 2024, which is similar to FY 2023’s 26.3% and significantly above the program’s historical average of 17.7%.

The FY 2024 report covers the period from Oct. 1, 2023, through Sept. 30, 2024.

Here are some other key findings from this year’s report, courtesy of the IRS Whistleblower Office:

The latest report goes on to say:

In FY 2024, IRC section 7623(b) [Awards to Whistleblowers] award payments were issued, on average, within 48 days of the date when all regulatory requirements were met. This is a 28% improvement over FY 2023 when the average was 67 days.

Overall average claim processing time (the time from the date a claim is received to the date an award is paid) for IRC section 7623(b) award payments made during FY 2024 decreased by 3.7% from the prior year and average claim processing time for IRC section 7623(a) award payments decreased by 5.5%. The overall time for paying a claim is heavily dependent on compliance actions taken with a taxpayer (criminal investigations and/or civil tax examinations), the taxpayer’s exercise of their right to request assistance from the Independent Office of Appeals or to litigate, the time it takes to collect any proceeds attributable to the whistleblower, and the time for a final determination of tax.

In FY 2024, the Whistleblower Office received 5,660 submissions and built (established) 14,926 claim numbers. In FY 2023, we received 6,455 submissions and built 16,932 claim numbers. In FY 2024, new submissions were processed in an average of 14 days from the date received by the Whistleblower Office, improving from the FY 2023 average of 15 days.

In FY 2024, the Whistleblower Office made 5,646 authorized disclosures to whistleblowers as required by the Taxpayer First Act of 2019 (TFA 2019). In FY 2023, we made 5,876 authorized disclosures. The TFA 2019 provided an exception to the non-disclosure rules in IRC section 6103 to require notifications to whistleblowers when a claim is referred for examination, when a taxpayer makes payments related to a tax liability attributable to information provided by the whistleblower, and generally requires the IRS to share information on the status and stage of a taxpayer case related to a whistleblower claim.

“Whistleblowers serve as an invaluable deterrent against non-compliance with tax laws and are critical in our efforts to reduce the tax gap,” Erick Martinez, acting director of the IRS Whistleblower Office, said in a statement. “The IRS Whistleblower Office is committed to improving the efficiency and effectiveness of the IRS Whistleblower Program through improved service, responsiveness, and modernization efforts.”

As the Trump administration’s Treasury Department looks to improve the IRS and make it a more efficient operation, the whistleblower program is key to that effort and its success, said Dean Zerbe, a partner at the tax whistleblower firm of Zerbe, Miller, Fingeret, Frank & Jadav.

“The IRS whistleblower program is a proven way for the IRS to make efficient use of limited audit and examination resources,” he said in a statement. “The IRS Whistleblower Program not only benefits honest taxpayers by bringing revenues into the Treasury from those seeking to evade tax, as important, the IRS Whistleblower Program helps target IRS examination and investigators on known tax cheats. This better targeting of IRS exam resources, thanks to the IRS Whistleblower Program, means that the vast majority of honest taxpayers are not bothered by unnecessary calls and letters from the IRS.”

IRS Whistleblower Office releases operating plan

Last April, the IRS Whistleblower Office released its first-ever multiyear operating plan, which outlines guiding principles, strategic priorities, recent achievements, and current initiatives to advance the whistleblower program.

The plan reflects a multiyear approach to improving processes and operations, expanding collaboration and outreach, and integrating valuable stakeholder feedback, the IRS said.

The operating plan is framed around six strategic priorities:

- Enhance the claim submission process to promote greater efficiency.

- Use high-value whistleblower information effectively.

- Award whistleblowers fairly and as soon as possible.

- Keep whistleblowers informed of the status of their claims and the basis for IRS decisions on claims.

- Safeguard whistleblower and taxpayer information.

- Ensure that our workforce is supported with effective tools, technology, training and other resources.

Within these six strategic priorities, there are 38 initiatives addressing short-term and long-term focus areas to advance the program. Some of the initiatives will require completion of detailed, specific activities while other initiatives are broad. The plan identifies areas of significant importance while allowing flexibility to address other concerns that may arise, the agency said.

“A strong tax whistleblower award program brings dollars in directly but as much, if not, more dollars indirectly through improved compliance by taxpayers,” said Stephen Kohn, founder and president of the National Whistleblower Center and founding partner at the whistleblower law firm of Kohn, Kohn and Colapinto.

Photo credit: wildpixel/iStock

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs