By Joseph Morton

The Dallas Morning News

(TNS)

WASHINGTON – Professional poker players might prefer to call the “big, beautiful bill” the “bad beat bill,” thanks to a surprise provision threatening a significant tax hit for those who make their living at card tables.

Republicans’ nearly one thousand-page bill included significant tax cuts along with funding for border security and immigration enforcement, partially offset with changes to programs such as Medicaid.

Tucked into the bill was one change that apparently went unnoticed by just about everyone, including most senators, until after the measure passed and was signed into law by President Donald Trump.

That change reduces from 100% to 90% the amount of losses gamblers can deduct on their income taxes.

U.S. Sen. Ted Cruz, R-Texas, has joined with Nevada Democrats on legislation to restore the full deductibility of losses, saying it’s a matter of basic fairness for professional players who depend on their winnings to pay their bills.

- Related article: Bill Introduced to Combat ‘Anti-Gambling’ Measure in Trump Tax Bill

“It makes no sense,” Cruz said. “People should pay taxes on money they actually made. That’s the way our entire system operates.”

He illustrated the issue by describing a hypothetical poker player who wins $130,000 over the course of the year, but loses $100,000. The player previously owed taxes only on their $30,000 of net profit.

Under the new law, the player would only be able to deduct $90,000 of losses and therefore would owe taxes on $40,000.

A player who broke even by winning $100,000 and losing the same amount would pay taxes on $10,000 despite having zero net profit. Players who win and lose amounts in the high six or seven figures could see much larger tax hits.

- Related article: If You’re a Fan of Sports Betting or Casino Gambling, You Won’t Be a Fan of a New Trump Tax Law Provision

While Texas doesn’t have the casinos and robust gambling scene of states such as Nevada, there are poker players from the state who travel the country to earn their living, Cruz said.

His interest in addressing the change intersects with his love of poker.

Cruz said he enjoys playing for low stakes with buddies and has become friends with some well-known professionals such as Phil Hellmuth.

Like many Americans, Cruz said he enjoys watching high-profile events such as the World Series of Poker.

“It’s fascinating to watch the poker pros calculating the odds and even more interestingly trying to read each other and trying to ascertain who’s bluffing, who’s got the nuts,” Cruz said.

Cruz holds a regular campaign fundraiser in Vegas featuring poker.

He participated a few years ago in a Texas Hold ‘em charity event that included Hellmuth and Lone Star poker legend Doyle Brunson.

The game was broadcast in installments on a show called Poker After Dark.

Cruz said the change to gambling deductions was apparently included to comply with arcane Senate rules governing the reconciliation process Republicans used to pass the bill, which allowed them to bypass a filibuster by Senate Democrats.

That process requires sections of the bill to have a budgetary impact, even if small. The money involved in the change is a tiny fraction of the trillions impacted by the overall bill.

“It’s a very small provision so nobody noticed it,” Cruz said. “After the fact, people scratched their heads and said well how the heck did that get in there? That doesn’t make any sense.”

Cruz said he has not heard any senator defend the change as a good idea. One challenge to getting it fixed is that other senators will look to use legislation that’s moving to get their own priorities included.

U.S. Sen. Catherine Cortez Masto, D-Nev., recently sought to restore the 100% loss deduction by passing the fix through unanimous consent, but U.S. Sen. Todd Young, R-Ind., blocked it.

He said he agreed with Masto but wanted the Senate to consent to an unrelated proposal.

- Related article: Gambling Tax Repeal Bill Blocked in Senate

American Gaming Association President and CEO Bill Miller submitted comments last month to the House Ways and Means Committee responsible for tax policy. Miller praised several aspects of the legislation but objected to the change on gambling loss deductions.

“The result creates an unfair precedent by taxing phantom income and uniquely penalizing a legal, heavily regulated activity,” Miller said.

Cruz said there’s a robust industry around professional poker that could be lost if the tax issue is not addressed.

“If we don’t change this, the effect will be to drive those poker pros out of the U.S. We will force them to go elsewhere,” Cruz said. “That would be really a tragic outcome.”

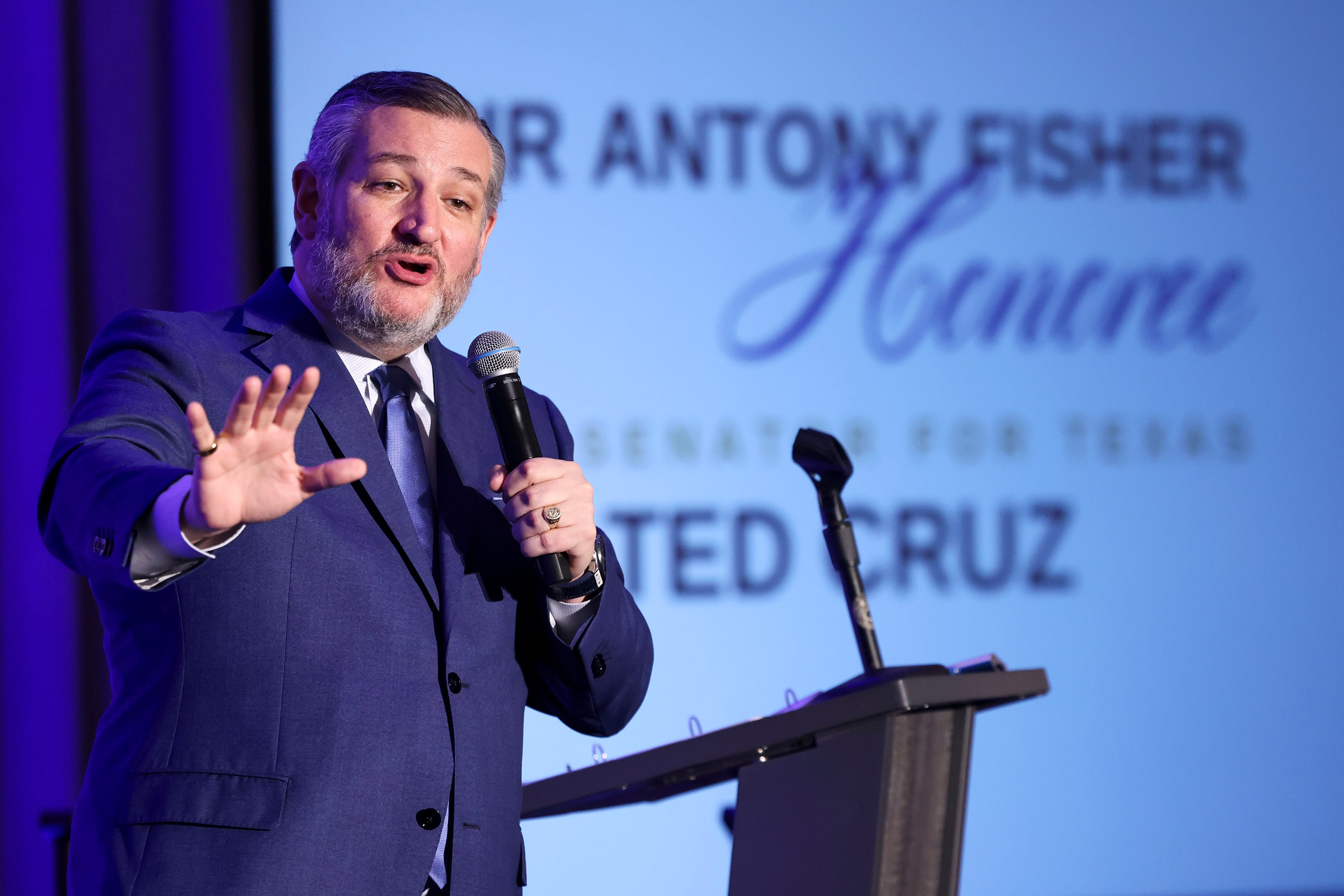

Photo caption: Texas Sen. Ted Cruz shares his remarks as the keynote speaker during the Goodman Institute Dinner on April 16, 2025, in Dallas. (Shafkat Anowar/The Dallas Morning News/TNS)

________

©2025 The Dallas Morning News. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: casinos, gambling, Income Taxes, Legislation, obbba, Senate, Taxes, Trump tax cuts, Trump tax plan