After several weeks of testing, the IRS said on Tuesday that eligible taxpayers in 12 states can now use its new Direct File service to submit their tax returns online for free directly with the agency.

The IRS said it has moved the Direct File pilot out of the testing phase after thousands of taxpayers have successfully used the system, allowing approximately 19 million eligible taxpayers to use the free filing software at any time.

“The early results from Direct File have shown taxpayers like the ease and convenience of the tool, and moving into the full-scale launch of the pilot will give more taxpayers the chance to use this free option,” IRS Commissioner Danny Werfel said in a statement. “Expanding Direct File as the tax deadline approaches will provide more taxpayers a way to file directly with the IRS for free, and it will give us more valuable information to assess this pilot.”

The 12 states participating in the Direct File pilot program this filing season are:

- Arizona

- California

- Florida

- Massachusetts

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Users can log in to Direct File to start their return and complete it any time before the April filing deadline.

After completing their federal returns, taxpayers in the states with a state-income tax—Arizona, California, Massachusetts, and New York—will be guided to a state-sponsored tool to complete their state tax return, the IRS said.

Werfel reiterated today what he has said in the past: Direct File is just one of many options that taxpayers have to file their taxes, including using a tax professional or filing software from one of the large tax preparation companies. As expected, Direct File has been met with resistance from tax-prep software providers like H&R Block and Intuit, which makes TurboTax. Intuit has called Direct File “a thinly veiled scheme,” and a “half-baked solution” that “has the potential to become a financial nightmare for tens of millions of taxpayers.”

Some lawmakers have also criticized the IRS for taking on the dual roles of both tax collector and tax preparer, arguing that the new service could create a power imbalance between taxpayers and the government.

One of the most vocal critics, House Ways and Means Committee Chairman Jason Smith (R-MO), said in a statement today: “[T]he IRS has not been able to provide information about the overall cost of the Direct File scheme, leaving many unanswered questions about how much the American taxpayers will be asked to fork over to develop and maintain a Direct File program. Twelve state attorneys general joined Ways and Means Committee Republicans in condemning the Biden administration’s efforts to unilaterally establish Direct File without authorization from Congress, and I look forward to working alongside them to stop this bureaucratic grab in its tracks. We have a duty to protect the American taxpayer from an already supercharged IRS that exerts too much control over their lives.”

Who’s eligible?

For the pilot program, Werfel said the IRS worked on a streamlined way for people with simpler tax situations to file directly with the agency.

“A team of experts from across government built and tested the Direct File pilot to give taxpayers an easy, accurate free way to file their taxes online directly with the IRS,” he added. “Our goal with the Direct File pilot is to help people meet their tax obligations as easily and quickly as possible. We developed Direct File from the beginning with taxpayers’ help, and we’ll continue to talk to taxpayers about their experience to learn more about what taxpayers want for future digital services.”

Users can get support from special IRS customer service representatives through Direct File’s live chat feature. Like other electronic filing options, Direct File allows taxpayers to typically get their refund in less than 21 days when the direct deposit option is chosen.

“We’ve gotten great initial feedback from the thousands of taxpayers who used it during testing,” Werfel said. “Many taxpayers we’ve heard from filed their taxes in less than 30 minutes using Direct File and praised it as an easy, no cost tax-filing experience.”

The Direct File service is an option for only those taxpayers who fall into the following categories:

- Report income earned from jobs that generate a Form W-2, including taxpayers with more than one job with W-2 wages;

- Claim an earned income tax credit, child tax credit, and the credit for other dependents;

- Claim the standard deduction and deductions for educator expenses and student loan interest;

- Lived in the same state for the entire calendar year 2023.

Interested taxpayers can go to directfile.irs.gov, where they can determine if they are eligible. Using Direct File requires identity verification through ID.me. Once their identity is verified and they’ve signed in securely to Direct File, they will be providing the tax information directly to the IRS, not a third party.

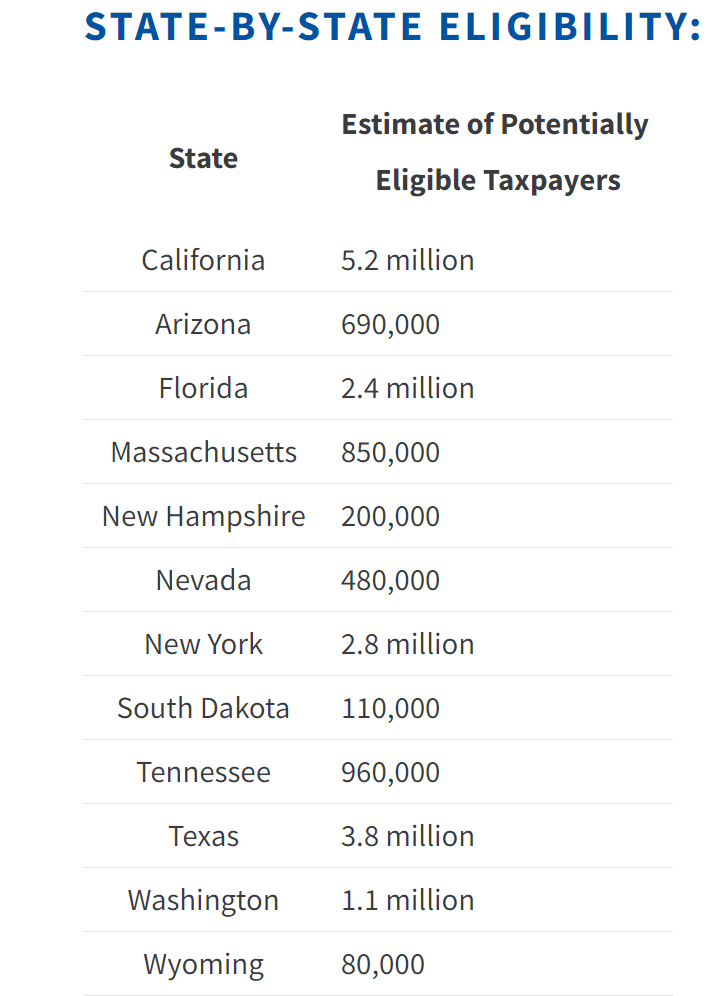

The Treasury Department estimates that one-third of all federal income tax returns filed could be prepared using Direct File, and that 19 million taxpayers may be eligible to use the tool this filing season. This includes 5.2 million in California, 3.8 million in Texas, 2.8 million in New York, 2.4 million in Florida, and 1.1 million in Washington.

The Inflation Reduction Act mandated that the IRS study interest in and feasibility of creating a direct e-filing tool taxpayers could use to prepare and file their federal income tax return. The IRS commissioned an independent study, which indicated broad interest in such a system, which the IRS detailed in a Direct File Report to Congress in May 2023.

“Thanks to President Biden’s Inflation Reduction Act, millions of American taxpayers have a free, secure option to file online directly with the IRS for the first time,” Deputy Secretary of the Treasury Wally Adeyemo said in a statement. “Direct File ensures taxpayers get their full refund by showing them the numbers and explaining credits they are eligible for. Our priority in launching this new service is to save taxpayers time and money they can spend on themselves and their families.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs