Taxes

IRS Direct File Pilot Reaches Final Testing Phase

The program is moving forward despite pushback from makers of for-profit software such as TurboTax and H&R Block.

Mar. 04, 2024

By Sam Becker, Fast Company (TNS)

Direct File is going direct.

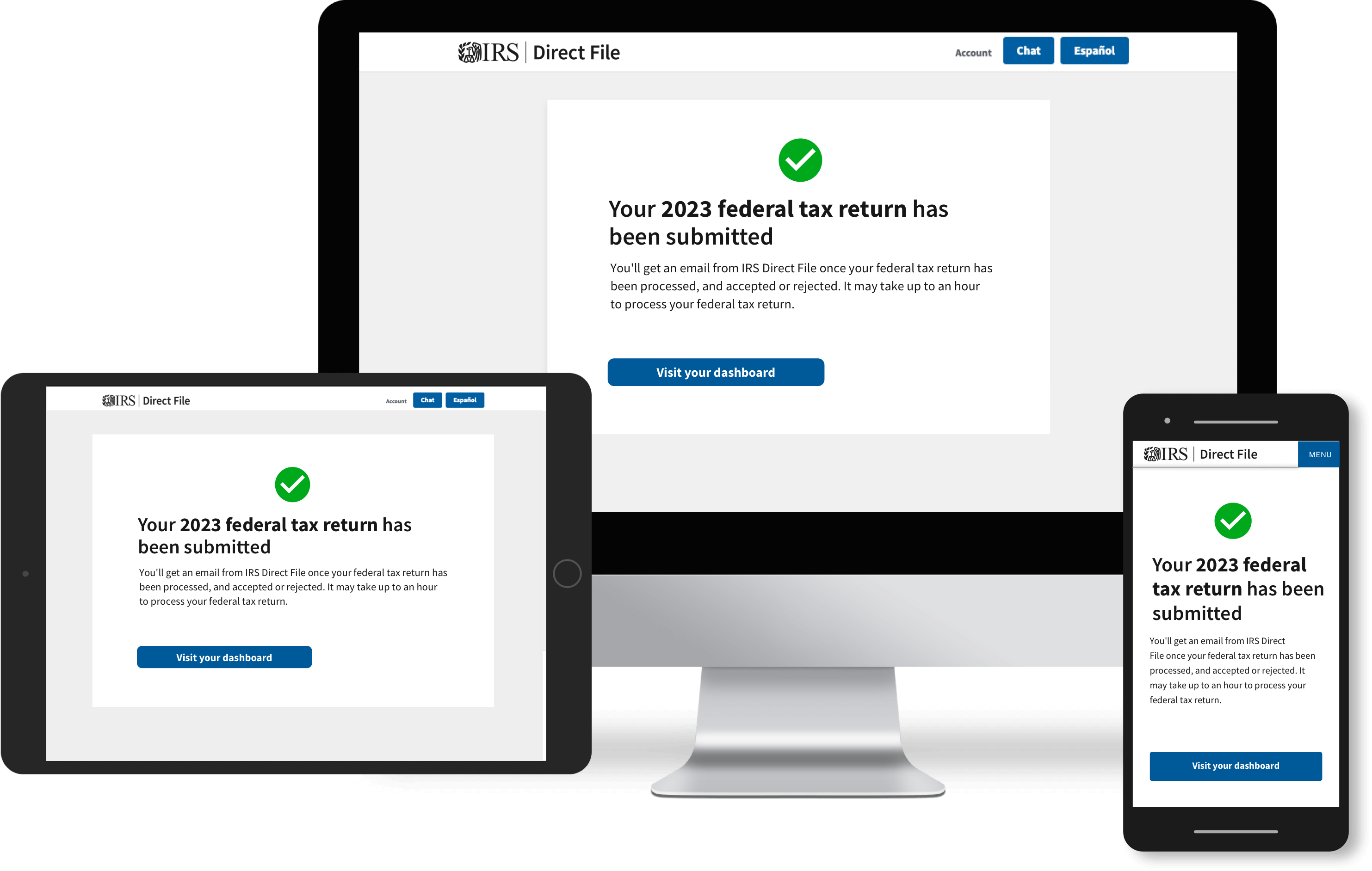

Last week, the Internal Revenue Service (IRS) announced that its Direct File pilot program—which allows some taxpayers to file their returns online for free—would become available to new users in the 12 states where it’s being tested on Monday, March 4, as it enters its final testing phase.

Taxpayers can now learn if they’re eligible to use the Direct File pilot program to file their 2023 tax return on the IRS website, which contains an easy step-by-step guide to help walk them through the process.

Currently, only taxpayers in Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Wyoming, Arizona, California, Massachusetts, New York, and Washington are likely to be eligible. Note, too, that taxpayers hoping to participate will also need to have a relatively simple tax return and specific types of income.

The final testing phase should reach completion on March 12, after which, “Direct File is planned to fully open to all eligible taxpayers in the 12 pilot states,” according to an IRS update. The Direct File program is distinct from the IRS’s Free File program, in which eligible taxpayers can file for free using third-party software.

For background, the Direct File program is designed to be a free, online tax-filing option that might serve as an alternative to tax-prep software such as Intuit’s TurboTax and H&R Block, among others. While 2024 is the first year that Direct File is being tested, it’s been met with resistance from tax-prep incumbents, as Fast Company reported last November.

For instance, a statement from TurboTax called Direct File “a thinly veiled scheme,” and a “half-baked solution” that “has the potential to become a financial nightmare for tens of millions of taxpayers.”

While we don’t know if that nightmare will come to fruition, there are concerns as to whether the IRS can get the Direct File program off the ground, and expand it nationwide. Answers should come this year, after the initial pilot program concludes and the IRS can gauge its success or failure.

But for now, the program is heading into its final testing phases, and interested taxpayers who meet the eligibility criteria in certain states should be able to give the program a try in the coming weeks.

______

Fast Company © 2024 Mansueto Ventures LLC. Distributed by Tribune Content Agency LLC.