Paying bills can be a real pain point for small businesses, whether they’re the payee or payer. Intuit has been hard at work helping small businesses get paid faster, but what about all of the bills that get manually paid and then manually recorded back into QuickBooks Online? Bill.com and QuickBooks have come together to launch Bill Pay for QuickBooks, a deeper integration that makes it easier for users to pay their bills online and have a clearer picture of their bottom line.

“The integration with QuickBooks Online and Bill.com helps small business owners know what’s safe to spend,” said Gretchen Salyer, Director Strategic Partnerships, Small Business Group, Intuit. “When their bills are tucked away in a box or filing cabinet waiting to be paid, they don’t have an accurate picture of their cash flow, not to mention the risk of overdue bills and manual entry errors. This integration embeds bill pay into the QuickBooks Online workflow and automatically reconciles their data, saving users time and providing a clearer picture of their current cash flow.”

Previously, users had to manually enter bills into QuickBooks Online, pay them outside of the solution and later manually record them as paid within QuickBooks Online. Embedding Bill.com’s bill pay functionality directly into QuickBooks Online alleviates manual entry and reduces chances of error, as transaction data is automatically entered into QuickBooks Online. The integration will save small businesses 50 percent of their time spent paying bills.

“Prior to this integration, our customers couldn’t pay their bills electronically through QuickBooks Online,” said Salyer. “That’s 30 million bills that are manually entered every month that customers have to then manually track and mark as paid. Because of this, small business owners and their accountants can never be 100 percent sure if outstanding bills are truly unpaid or just haven’t been entered as paid yet.”

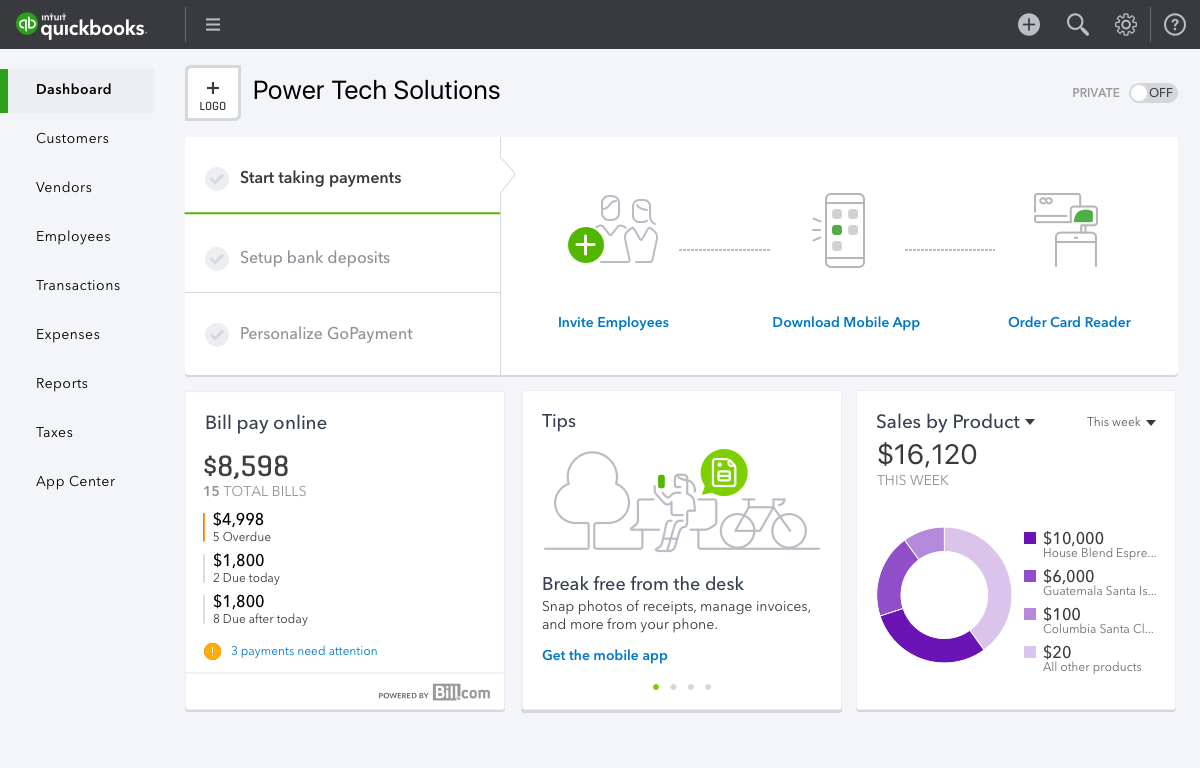

As part of the new integration, QuickBooks Online users will get a real-time view of their business to see the status of bills – pending, outstanding or paid. Vendors will also be able to send bills directly to QuickBooks Online, where small businesses can then view the invoice and pay online. Other features to be rolled out include a paperless inbox invoice, dashboard widget and a more complete overview of their business’ overall health and cash flow, allowing users to see the status of their bills right from the QuickBooks Online dashboard.

“Our integration with Bill.com is the perfect textbook example of how we want to work with third-party apps and we are really excited about how our partnership is shaping up,” said Salyer. “As a leader in electronic accounts receivables and accounts payables, Bill.com is really focused on customers and solving their key pain points. We worked closely with them to identify how this integration should work to make it foolproof for our customers.”

Bill Pay for QuickBooks Online offers significant benefits for accountants as well. Because this integration will provide a more accurate view of their clients’ cash flow, it will allow accounting professionals the ability to become a more trusted advisor. Time spent following up with clients to make sure their bills are complete and up-to-date can be spent having meaningful conversations on topics such as the best ways to invest available cash flow. This empowers accounting professionals to be true partners to their clients.

“We know that we can’t build everything ourselves, so we want to partner with the best solutions out there to solve the most important pain points for our small business and accountant customers,” said Salyer. “The developers that are the most successful align with our strategy, understand the customers we jointly want to serve and innovate around the integrations that actually benefit users.”

The integration was first rolled out to a select group of customers in January. Since then, more than $7 million in payments have been processed through the digital bill pay integration. All QuickBooks Online users can now sign up for a free 30-day trial at apps.intuit.com/billpayqbo. After the trial, users can continue to access Bill.com bill pay service directly through QuickBooks Online for $9.99 per month plus transaction fees.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs