Balance helps things run smoothly, and no one knows this better than accounting professionals and small business owners. Having balanced books is key to effectively managing their cash flow as well as running their businesses. And for the 2.2 million QuickBooks Online customers worldwide, balancing their books just got a little easier.

Last month, Intuit launched a new Reconcile experience within QuickBooks Online, allowing users to reconcile their bank transactions with a few clicks. This new Reconcile is just the latest example of how Intuit continues to focus on removing pain points and adding improvements to the workflow for small businesses and their accountants.

“With this new release, we are focusing on the small business owner and accountant. Our team aimed to look at ways we could help accountants ‘get to zero’ and locate problem transactions to reduce the amount of time spent on reconciling transactions,” said Stuart Albright, Customer Experience Specialist, Small Business Care, Intuit.

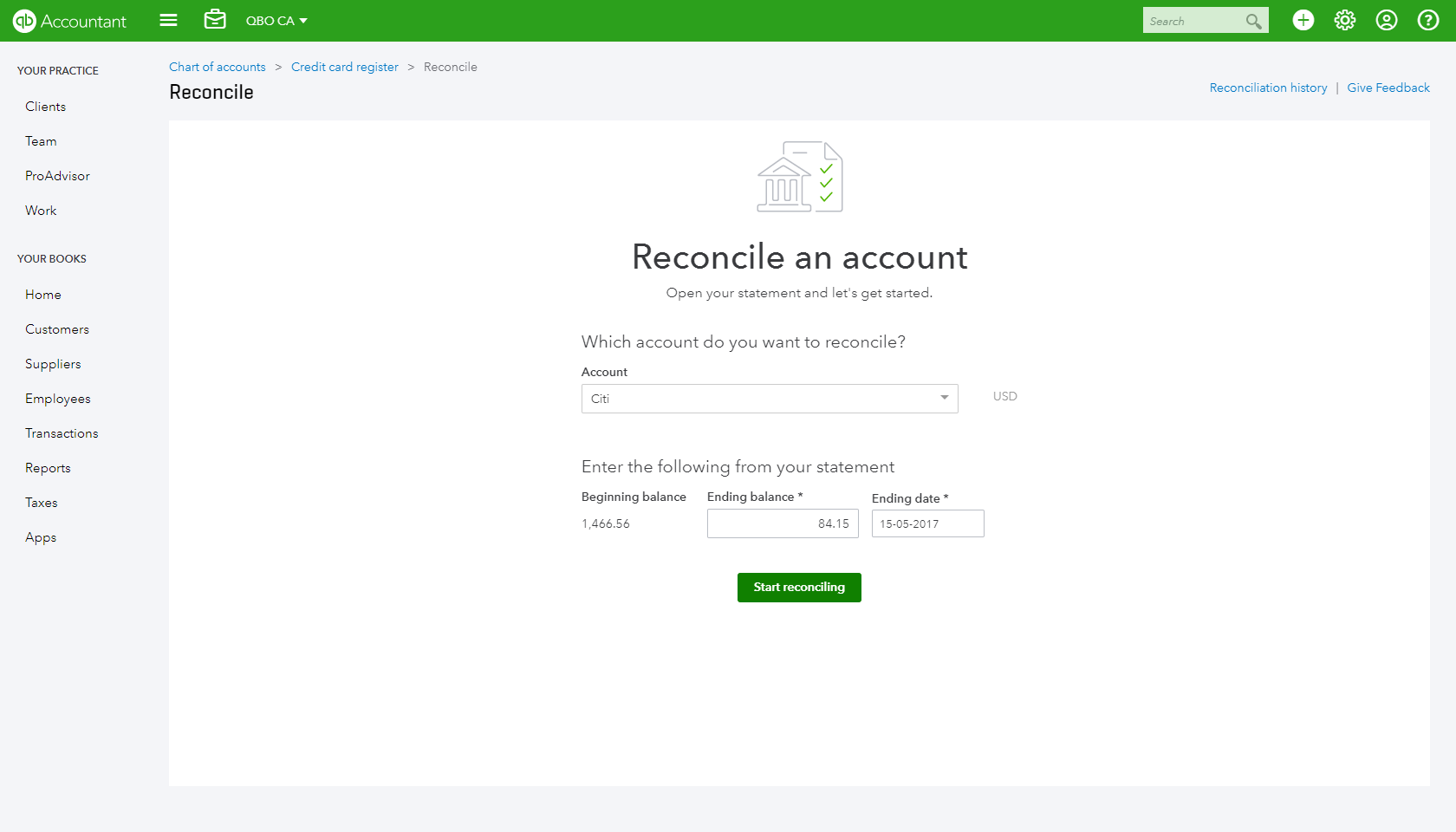

Reconciling transactions in Reconcile is intuitive and user friendly. Users simply begin by selecting an account and entering the statement ending balance and ending date. With a click of the “Start Reconciling” button, a table appears showing a list of transactions during that period. Users can filter the results between charges, payments or all transactions by clicking on the corresponding tabs. Advanced filtering options let users find transactions by memo, reference number, date range, cleared status and dollar amount. Intuit also added a memo field where users can enter payee information for manually entered and downloaded transactions to help better identify those entries.

The advanced filtering and sorting options, as well as the additional fields, all serve to help small business owners and their accountants dive deeper to see which transactions are preventing them from reconciling to a zero balance. Previously, accountants or their clients could spend hours looking for unmarked discrepancies that occurred when manually entering or altering a transaction. With the new Reconcile, a warning message appears automatically to let the user know the account’s beginning balance doesn’t match the ending balance of the previous reconciliation. This warning also provides a link to the discrepancy report that lists the transactions where the discrepancy occurred. While this makes it easier for accountants to resolve discrepancies without having to undo a reconciliation, they still have the ability to undo a reconciliation – which might be necessary if a client reconciles the wrong dates.

“Accountants like the new Reconcile because it’s going to save them a lot of time in finding reconciliation discrepancies, so they can spend more time being a trusted advisor to clients. In the past, accountants had to review the audit log for discrepancies or undo the reconciliation and start all over from scratch, which cost them a lot of time. Now, the system shows exactly what caused the discrepancies, allowing accountants to resolve them and move on,” said Albright.

Another addition is the introduction of the “Cleared Date” column. Many times, users may manually enter a transaction date that differs from the cleared date downloaded from the bank feed, which has led to issues during reconciliation. For example, if a statement period ends on May 31, and a transaction is manually entered with a date of May 30, but actually clears on June 1, that transaction would incorrectly show as being reconciled during the period ending May 31. With the enhancement, transactions that are manually entered within one statement period but clear within a different one will automatically appear unticked and no longer show as cleared. This not only helps ensure that transactions are reconciled within the correct statement period, but also saves users time from having to manually locate these problem transactions.

The new Reconcile was rolled out to existing QuickBooks Online customers in Australia, Canada, the UK and the U.S. last month. For more information, users can view help articles within QuickBooks Online or Intuit’s demo video at http://bit.ly/2rLYzrf.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs