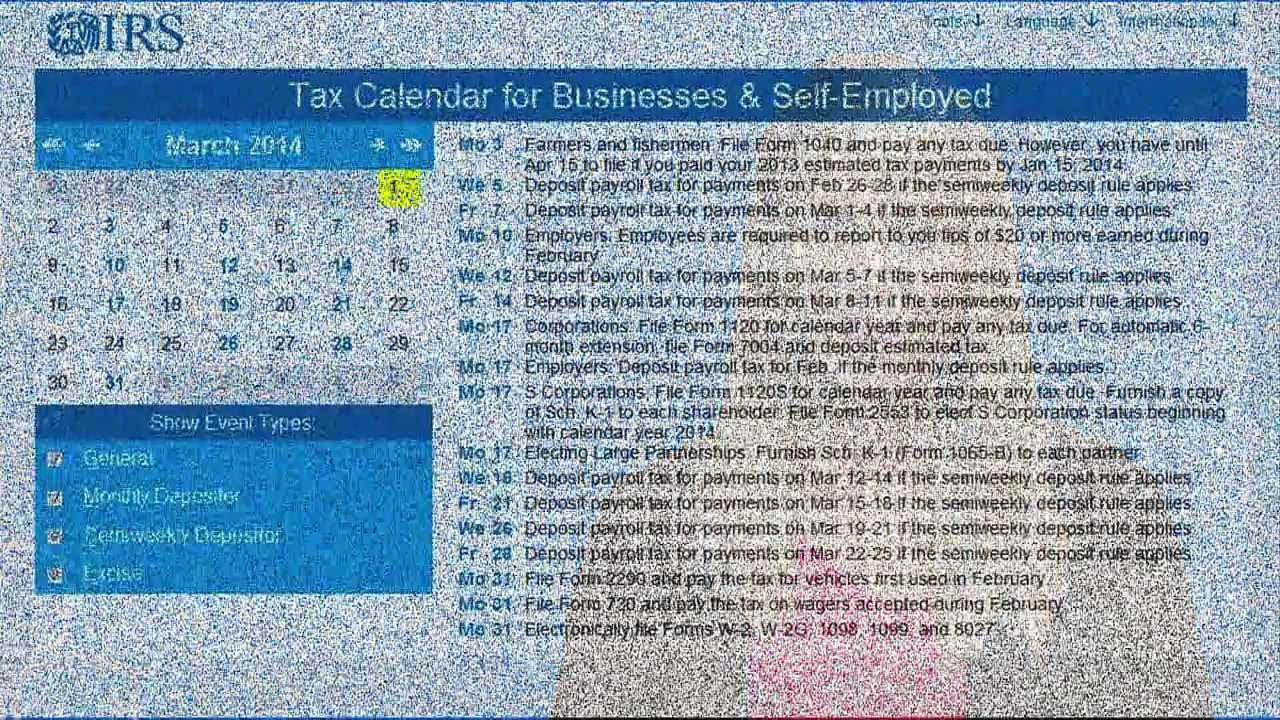

For small business owners and other self-employed individuals required to make regular tax deposits or payments, keeping track of them can be complicated. This video shows how these taxpayers can use the business due dates feature and other functions in the IRS online tax calendar.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, IRS, Technology