A new study by financial information site Wallet Hub shows that, while an occasional mega corporation makes big news by having no taxes due for a particular year, most actually do pay significant taxes to the Internal Revenue Service and departments of taxation in the states they do business.

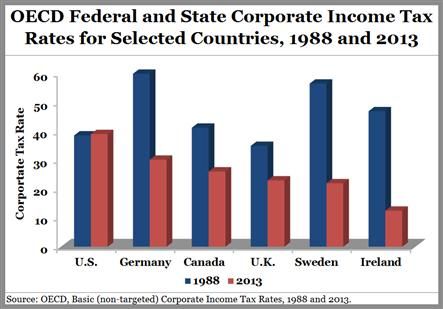

Taxes are always a political issue, of course, particularly the rate at which businesses are taxed in the U.S. According to the Tax Foundation, the corporate tax rate in America, at 35 percent, is the highest of the world’s developed economies. The rate, however, doesn’t really explain how much businesses actually pay. For example, just as individual American taxpayers may start in one IRS income tax bracket, various credits and deductions can drop them into a lower bracket, lowering their taxes. Ultimately, the amount actually paid in taxes after all of these credits and deductions, divided by the gross revenue equals the effective tax rate.

So what tax rate did most of the companies in the Standard & Poor’s 100 really pay?

Well, there were a few outliers, but the average effective tax rate for 2013 for this group of the largest and most established companies on the stock market was 29.5%, according to Wallet Hub. This average effective tax rate increased by 5.3 percent from 2012, led by an average increase in state taxes of 24 percent. Overall, these companies had an average tax rate about 15 percent higher than the top three percent of individual taxpayers.

Only one of the companies in this group had a negative effective tax rate for 2013, Ford Motor Company, which is due a tax refund. In 2012, six of the S&P companies received tax refunds.

In addition to federal and state taxes, these international corporations also face taxation across the globe. However, their international tax rates are approximately 22 percent lower than their U.S. taxes.

See the full report, including the tax rates for each of the 100 companies, at Wallet Hub.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs