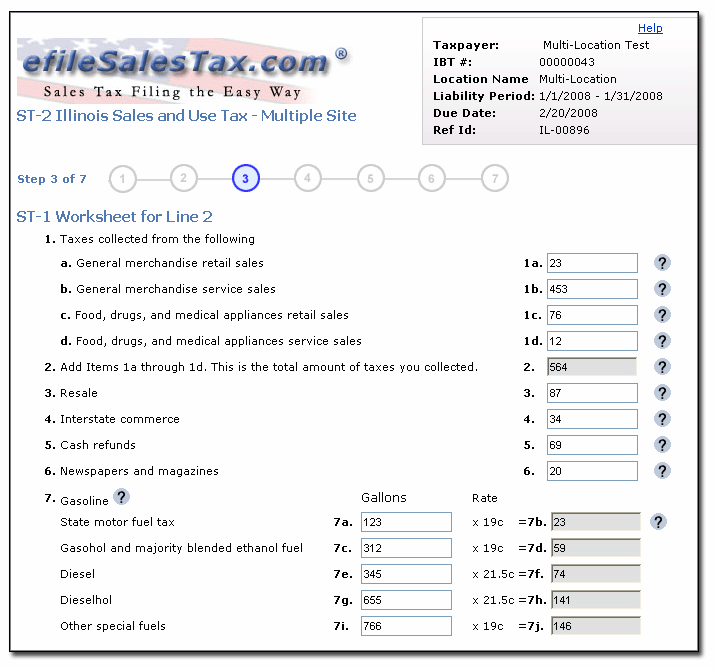

Illinois Sales Tax Filing Software

Approved by the Illinois Department of Revenue Choice of e-file or Paper File Automatically calculates and validates the return QuickBooks Import option Option to import ST-2 from a text file Illinois Sales & Use Tax forms supported: ST-1, ST-2, PST-2, ST-1x, and ST-2x Business owners – it’s easy and fast, most users file in under […]