Accounting

Yes, There’s a CPA Generation Gap. No, It’s Not Too Late to Recruit the Next Generation

The accounting profession is like many other industries: It’s currently facing a shortage of skilled employees ready to lead the profession forward. If left unchecked, CPA firms may be ill equipped to cope with the work that remains after some key ...

Oct. 26, 2016

The accounting profession is like many other industries: It’s currently facing a shortage of skilled employees ready to lead the profession forward. If left unchecked, CPA firms may be ill equipped to cope with the work that remains after some key departures occur. But that doesn’t have to be the case. There’s still time to dip into the talent pool for a diverse group of new workers while retaining and mining the knowledge of the talent you already have.

The talent gap in the CPA profession can be attributed to a few factors.

First, a steady stream of retiring Baby Boomers is contributing to a growing talent shortage. According to a survey conducted in May 2014 by the Global Accounting Alliance® (GAA), which is comprised of 11 of the world’s leading accounting institutes, about half of all U.S. CPA firms will likely lose at least one partner or principal to retirement in the next five years.

Second, the recent economic downturn, which forced many firms to reduce headcount, increased pressure on those who remain.

Finally, many experienced employees have the knowledge and expertise needed to navigate recent complex regulatory changes like the Affordable Care Act.

As the talent gap has widened, the nature of accounting work has evolved as well. Today, firms are looking for accountants who exhibit basic accounting principles and technical skills, and manage client relationships, communicate effectively and serve a more consultative, analysis-driven role. Yesterday’s CPAs simply needed to manage client relationships while performing fixed daily tasks with longer deadlines. Technical skills were more valued than “soft skills” and the average time to rise to the level of partner was shorter. Today’s CPAs must perform at a faster pace to meet multiple clients’ needs, which vary day-to-day. And strong interpersonal relationship skills have become critical.

So while the nature of the business is evolving, many firms still need a mix of talent to support the diverse demands of today’s clientele. They need to survey the entire talent landscape, including Millennials, Generation Xers and – yes – Baby Boomers to fill the gap. While some 50-something’s may be ready to retire, there’s a very committed population of mature workers who plan to remain in the workforce well past traditional retirement age.

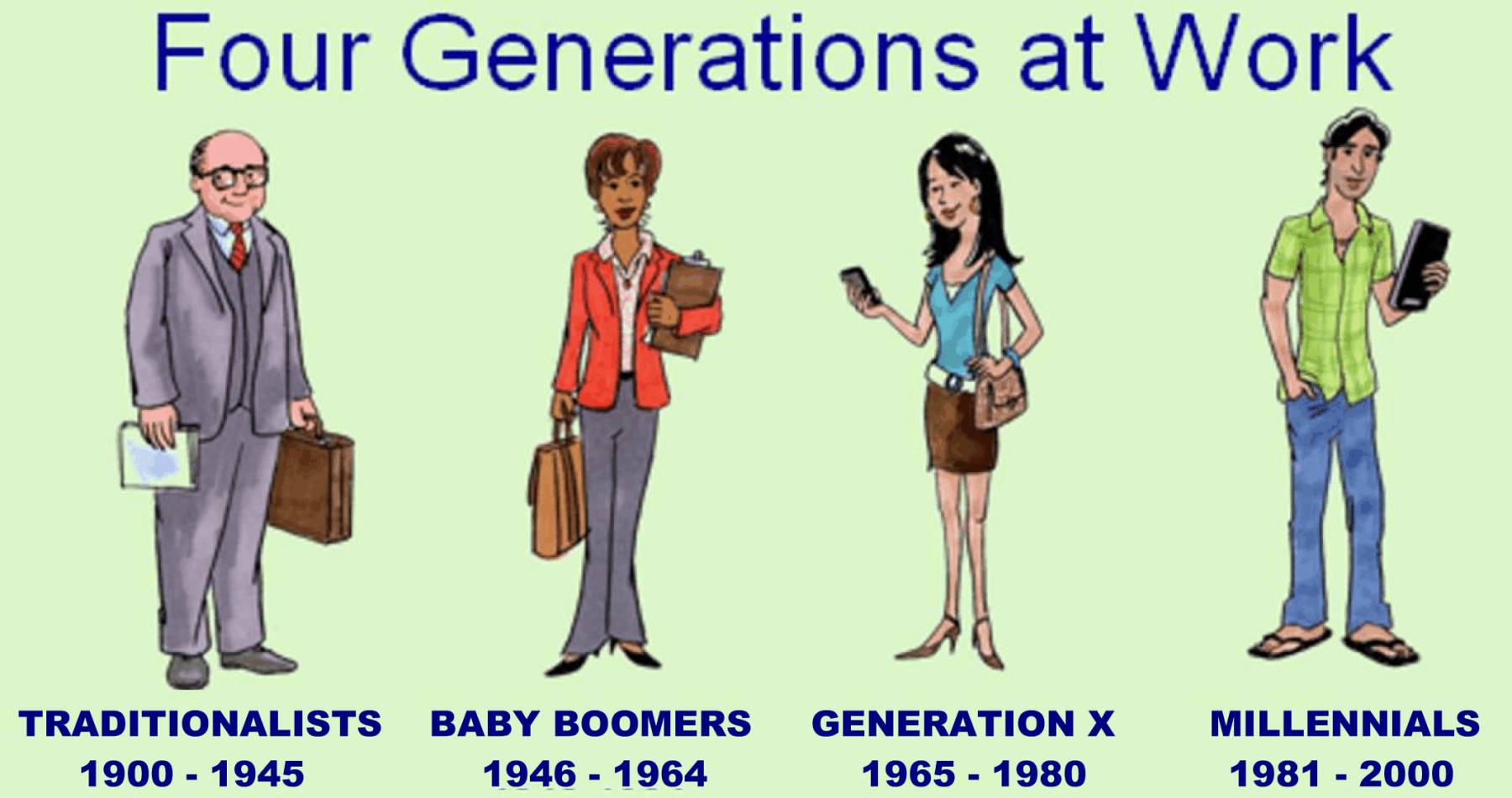

Recruiting and retaining these new employees requires an understanding of each generation’s workplace preferences. Here are three best practices for recruiting a broad slate of candidates, retaining your best talent, and creating a succession plan as your workforce evolves.

Understand generational differences.

According to the Bureau of Labor Statistics, Generation X makes up the majority of the accounting profession, with Millennials and Baby Boomers comprising less than 30 percent. Each group also has different workplace preferences. The Millennial employee, for instance, is looking for a job with strong work/life balance, flexible schedules, business-casual dress codes, a strong focus on a purpose or cause, ongoing training and development, and regular performance feedback. Similarly, Generation X is looking for a company that offers stability with job flexibility and work/life balance and opportunity for learning and development. They prefer hands-off management, want tools based on the latest technology, and seek opportunities for advancement. Finally, to attract and retain Baby Boomers, it’s important to remember that this generation values organizations that are solid financially, offer competitive wages and benefits, provide opportunities for advancement, care for employees, and have strong reputations in the community.

Find and continually nurture talent within your organization.

Of course, competitive salaries and benefits are important to retaining top talent, but firms must also explore new incentives for all generations. Just like job seekers, current employees are looking for engaging and collaborative work environments with flexible schedules to improve work/life balance. Employees also may remain engaged if you illustrate the promise of a bright future by demonstrating a pattern of growth for your business and people, and by offering ongoing education and training opportunities. To focus internally on training and development, you can offer mentorship opportunities and apprenticeships, along with effective and frequent communication about employees’ value and future. And, in addition to identifying rising stars with “partner potential,” look at “mid-level lifers” – those who may not climb the ranks but perform with loyalty, consistency and quality. These types of employees can help maintain the business while others focus on building it. Finally, ensure that your firm is keeping up with new technologies that are influencing how firms run and manage their practice.

Develop strong successions plans.

With so many CPAs nearing retirement, it’s crucial that firms have a succession plan in place to ensure a continuation of essential work. Preparing for the inevitable departure of some of your key contributors can smooth any impending transitions. It might help to encourage employees to communicate target retirement dates well in advance. This will give your firm advanced notice to set up a solid plan several years before that date. The succession plan should leave room for collaboration and training to equip employees for an expanded role. Firms should also consider mentorship programs to help ensure knowledge transfer, and focusing on internal training and development to fill any skills gaps of remaining employees. The transition process should then take effect three to five years before a CPA plans to retire. By preparing effectively in advance, a robust succession plan will help ensure all lines of business are covered and work continues smoothly.

An impending talent gap doesn’t have to be challenging. With a little planning and forethought growing CPA firms can continue their successful momentum as their workforce evolves.

————

Chris Rush is Division Vice President of Strategy for ADP Small Business Services.