Accounting

Intuit Partners with Stripe to Simplify Taxes for Self-Employed Workers

Intuit has released a new integration with for marketplaces running on the Stripe online payment network. The features will allow “drivers”, "Rabbits" and "campaign creators" of sharing economy companies to automate tax reporting via the ...

Jan. 26, 2015

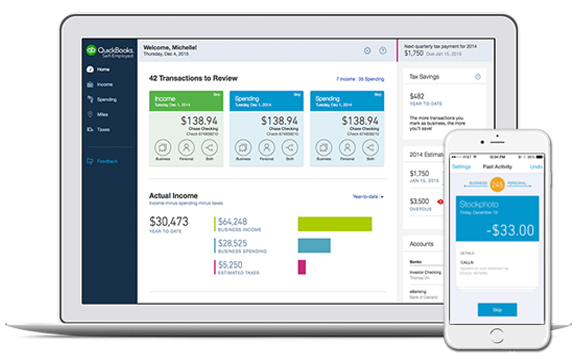

Intuit has released a new integration with for marketplaces running on the Stripe online payment network. The features will allow “drivers”, “Rabbits” and “campaign creators” of sharing economy companies to automate tax reporting via the new QuickBooks Online Self-Employed product. In addition to separating ‘real income’ from revenue, users can input tax write-offs like mileage and gas expenses in a few easy steps.

According to research conducted by Intuit and Emergent Research, 43 percent of the U.S. workforce will operate as a self-employed business by 2020, led by an increase in the on-demand economy, including ride-sharing, peer-to-peer rentals, project-based job platforms, and online retail platforms. While the on-demand economy offers benefits like flexibility, it can also leave independent contractors on their own to navigate complicated legal and financial tasks like managing tax withholdings.

Together, Intuit and Stripe are taking the guesswork out of the process, and helping freelancers better plan and understand business trends, saving them both time and money. Since launching in beta in the fall of 2014, QuickBooks Online Self-Employed has helped entrepreneurs track over $50 million in business expenses, helping them save money on their taxes and simplify their financial lives.

Intuit is also announcing a partnership with HourlyNerd, an on-demand consulting platform made up of over 7000 experienced professionals, which uses the Stripe platform. Independent contractors working on the HourlyNerd platform will receive:

- A free version of the new QuickBooks Online Self-Employed software, enabling them to easily categorize income data.

- The ability to seamlessly export their data from QuickBooks Online Self-Employed into TurboTax, speeding the process of completing year-end taxes.

“While the expanding on-demand economy is making it easier for millions of individuals to find work, it’s also exposing new hardships in the form of tracking net income, managing individual expenses, and paying quarterly taxes. The integration between QuickBooks Online Self-Employed and Stripe enables On-demand marketplaces to provide a tremendous and free benefit to their independent contractors to help ease this tax complexity,” said Alex Chriss, vice president and general managers of Self-Employed Solutions at Intuit. “Marketplaces are focused on creating efficient interactions between consumers and independent contractors – and now they can offer a product that is laser focused on solving the financial pain points of independent contractors.”

“We’re thrilled to see Intuit build such a powerful tool on top of the Stripe platform,” said Cristina Cordova, head of strategic partnerships at Stripe. “Marketplaces on Stripe can integrate in minutes, and unlock a beneficial service to their contractors without any additional hassle or involvement on their end.”

“We have thousands of consultants on our platform and always hear that one of their biggest pain points is organizing all of their income sources at tax time,” said Patrick Petitti, CEO and co-founder of HourlyNerd. “Stripe’s integration with Intuit introduces a robust business management tool and will save our consultants a ton of time and frustration.”

In addition to the free version, independent contractors will have the option of connecting additional bank and credit card accounts to benefit from the full feature set of QuickBooks Online Self-Employed all year round.

Key features include:

- Connect accounts: Import bank and credit card transactions to easily track income and expenses with no data entry required.

- Categorize expenses: Mark a transaction as “business” by simply clicking a button, or swiping a finger across a mobile app, letting entrepreneurs instantly categorized IRS Schedule C deductions.

- Stack up savings: Track deductions all year round to help entrepreneurs save time and money.

- Simplify taxes: Calculate estimated quarterly and year-end taxes so there are no surprises in April.

- Count on security: Be confident that bank-grade encryption protects information, keeping it safe and secure.