Accounting

New Worldwide Private Company Database Addresses Challenges of Transfer Pricing

Thomson Reuters recently released a new database designed to provide transparent, detailed data to transfer pricing professionals.

Nov. 21, 2013

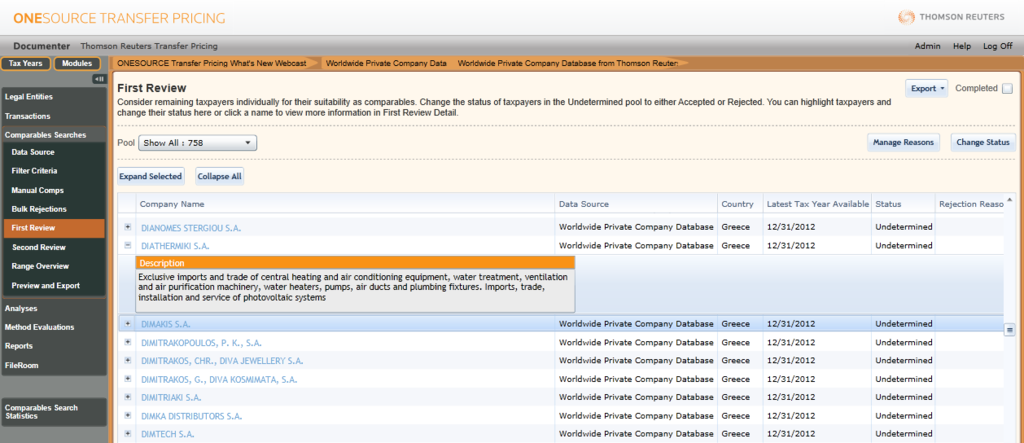

Thomson Reuters recently released a new database designed especially for transfer pricing professionals. The Worldwide Private Company Database from ONESOURCE Transfer Pricing provides the transparent, detailed data global firms need to comply with transfer pricing rules and reporting requirements established by tax authorities worldwide.

With the average audit taking 540 days and the number of audits conducted steadily increasing, transfer pricing is one of the most significant issues for global organizations and tax authorities. The consequences of noncompliance can affect both a company’s financial stability and reputation. As tax authorities introduce additional rules and require corporations to provide detailed documentation to defend their policies, multinationals must be certain they meet the requirements of the arm’s length standard – and provide the documentation to prove it.

“Tax authorities are no longer satisfied with weak documentation and comparables that don’t take local trade into account,” said Joe Harpaz, managing director of corporate tax for the Tax & Accounting business of Thomson Reuters. “Governments are demanding clear documentation with regional comparables to support transfer pricing methods.”

Through its relationships with tax authorities, corporations, and service providers, Thomson Reuters has identified the information transfer pricing professionals need to reduce risk and comply with global transfer pricing regulations. The new database not only provides the previously available public company data, but it now provides the private data companies need to ensure accuracy and compliance.

The private company information is compiled from a global network of local data providers. Users now have access to country-specific financial data and standardized financial line-items for complete transparency on how the data should be applied. This fills comparables gaps in regions where public data is limited and allows users to drill into the original data source for clarity and transparency. This kind of data is a key component of reducing risk and avoiding an extended audit.

“Using public local data is challenging in these markets, as there are only a limited number of public records available,” said Brian Tully, vice president and head of transfer pricing for ONESOURCE at Thomson Reuters. “Finding a good comparables set is critical to achieving the highest level of practical comparability.”

The Worldwide Private Company Database is available for purchase from Thomson Reuters and is already available to existing users who have access to the Documenter or Benchmark tool. Thomson Reuters also offers live support 24 hours a day, Monday through Friday, to help users with any questions they have regarding the solution or transfer pricing.