Payroll

CPA Practice Advisor Tax Correspondent

Ken Berry, Esq., is a nationally-known writer and editor specializing in tax and financial planning matters. During a career of more than 35 years, he has served as managing editor of a publisher of content-based marketing tools and vice president of an online continuing education company in the financial services industry. As a freelance writer, Ken has authored thousands of articles for a wide variety of newsletters, magazines and other periodicals, emphasizing a sense of wit and clarity.

Payroll

![divorce2_1_.58a1c88862581[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/04/divorce2_1_.58a1c88862581_1_.6078636acabd8.png)

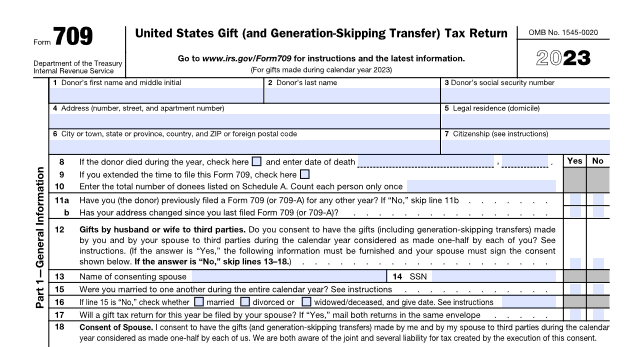

Taxes

Taxes

Taxes

Taxes

![ut_austin_house_for_rent_1_.5713d02d8e979[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/34677/use_for_rent_1_.5713d02d8e979_1_.5d5453fd9945a.png)

Taxes

Income Tax

Taxes

Taxes

Tax Planning

Taxes

Taxes