CCH Small Firm Services — Fixed Asset Manager for TaxWise & ATX

Nov. 02, 2011

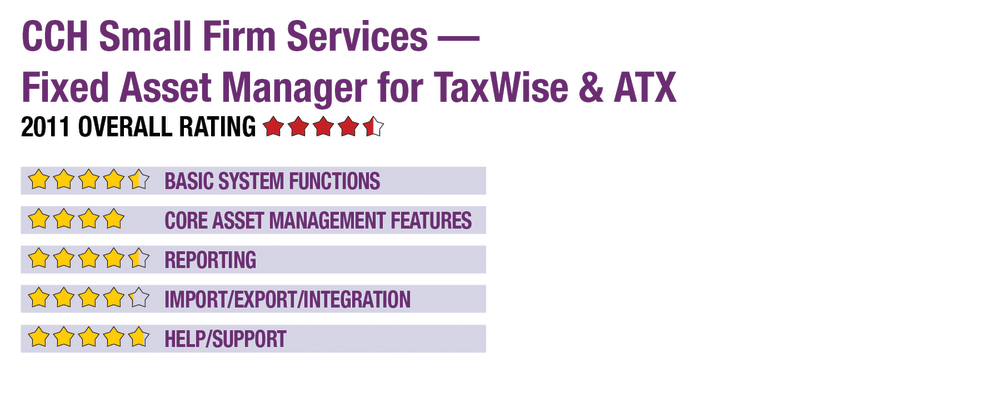

2011 Overall Rating 4.25

Best Fit

Small to medium sized firms that are looking for an easy-to-use asset management system that provides flexible reporting for clients with evolving asset management needs, including multi-departmental and geographical locations.

Strengths

- Easy to use

- Supports all common depreciation methods

- Customizable reporting, including output to Word, Excel, PDF and Crystal Reports

- Integration with TaxWise & ATX tax systems

Potential Limitations

- No RFID or barcode scanning integration

- No fully custom depreciation books

- Limited consolidation/mass asset action functions

Summary & Pricing

Fixed Asset Manager is a good addition to firms using either the ATX or TaxWise compliance systems, and can also be used as a complete stand-alone application. It provides basic depreciation management with support for all common methods, is easy to use and offers good reporting. The program costs $420 when purchased individually, but is also available in some of the ATX and TaxWise bundles.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Core Asset Management Features 4

Reporting 4.5

Import/Export/Integration 4.25

Help/Support 4.75