Sage Peachtree Premium Accounting for Nonprofits 2012

Oct. 10, 2011

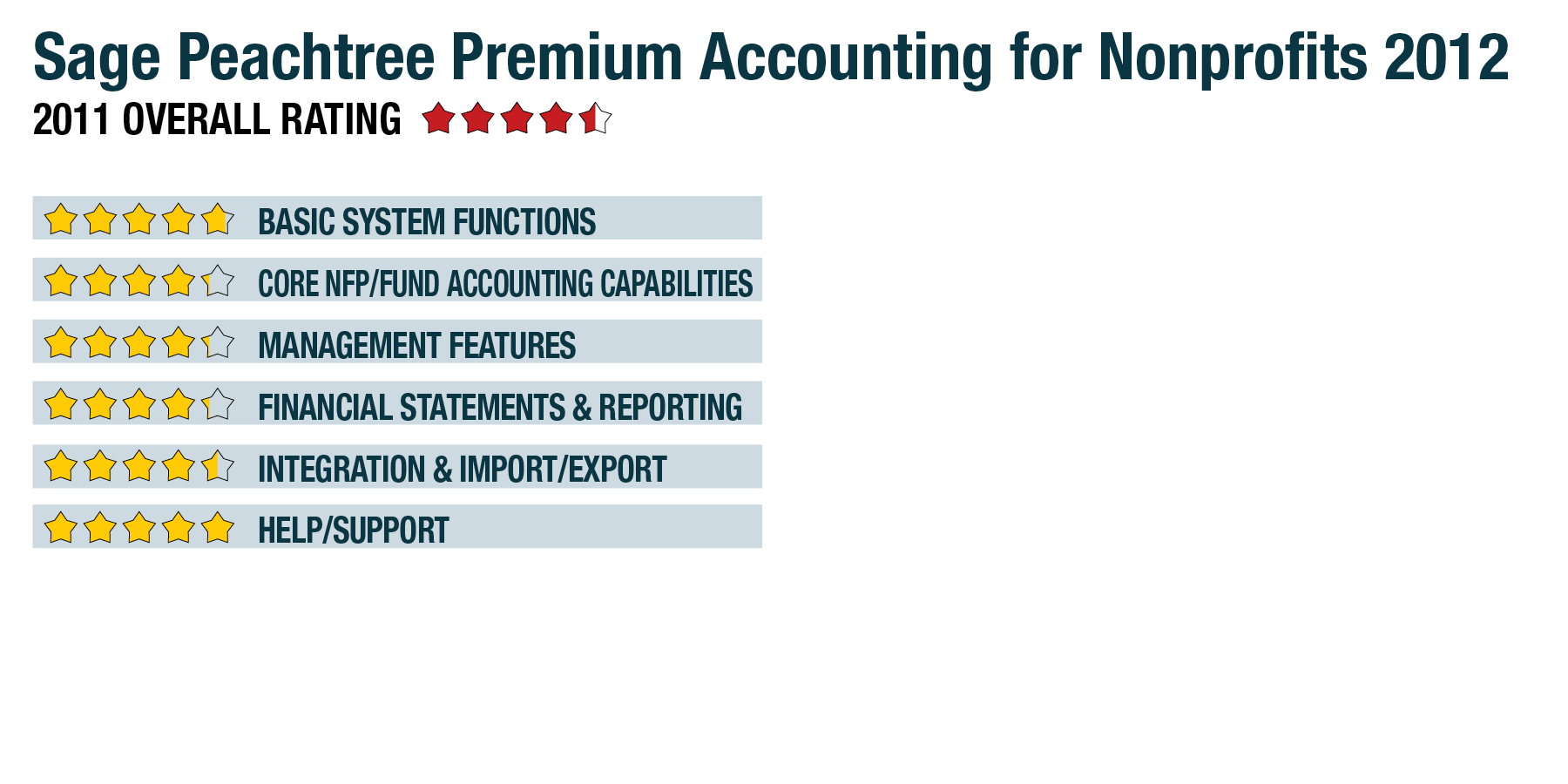

2011 Overall Rating 4.5

Best Fit

Sage Peachtree would work well with smaller nonprofit organizations that place affordability equal to functionality, and it is optimally designed for the one- to 10-person organization.

Strengths

- Easy to install & easy to navigate

- Good nonprofit reporting capability and advanced Business Intelligence for custom reporting and analysis in Microsoft Excel

- Excellent integration with Microsoft Word for producing donor & fundraising letters

- Solid dashboards & cash flow management tools allow employees to see how the organization is performing

Potential Limitations

- Limited growth capability

- Limited fundraising capability, but vendor notes that it is working on integration with Fundraising Online

Summary & Pricing

Sage Peachtree Premium Accounting for Nonprofits 2012 is available for $499 for a single-user system. It is an excellent option for the small nonprofit organization looking for solid nonprofit reporting at an affordable price point.

Product Delivery Methods

_X_ On-Premises

___ SaaS

_X_ Hosted by Vendor

Basic System Functions. 4.75

Core NFP/Fund Accounting Capabilities 4.25

Management Features 4.25

Financial Statements & Reporting 4.25

Integration & Import/Export 4.5

Help/Support 5