RedGear Technologies — TaxWorks Tax Planner

Oct. 05, 2011

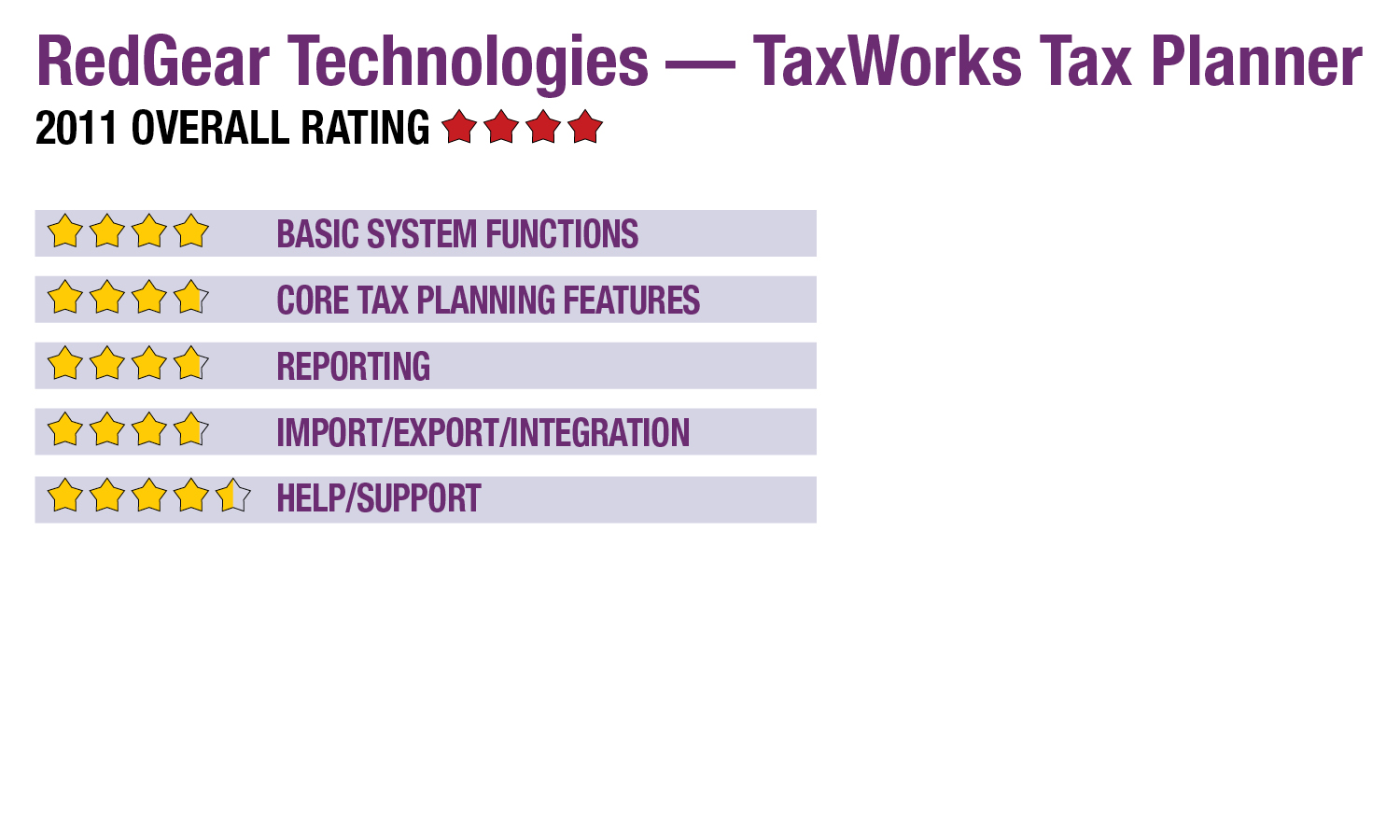

2011 Overall Rating 4

Best Fit

Firms using TaxWorks who want to expand into tax planning as a client service offering, or want a simple add-on tool for performing quick projections.

Strengths

- Easy to use

- Adjustable inflation projection

- Inexpensive

- Integration with TaxWorks

Potential Limitations

- Generally basic planning capabilities

- Limited report customization

- Little external integration

Summary & Pricing

The TaxWorks Tax Planner is a simple tool for quickly creating client scenarios for a few years, and is best suited to users of the TaxWorks preparation system. The Tax Planner system costs $295 for a site license that allows use by all staff in the same office.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4

Core Tax Planning Features 3.75

Reporting 3.75

Import/Export/Integration 3.75

Help/Support 4.5