Payroll

SurePayroll for Accountants

Aug. 12, 2011

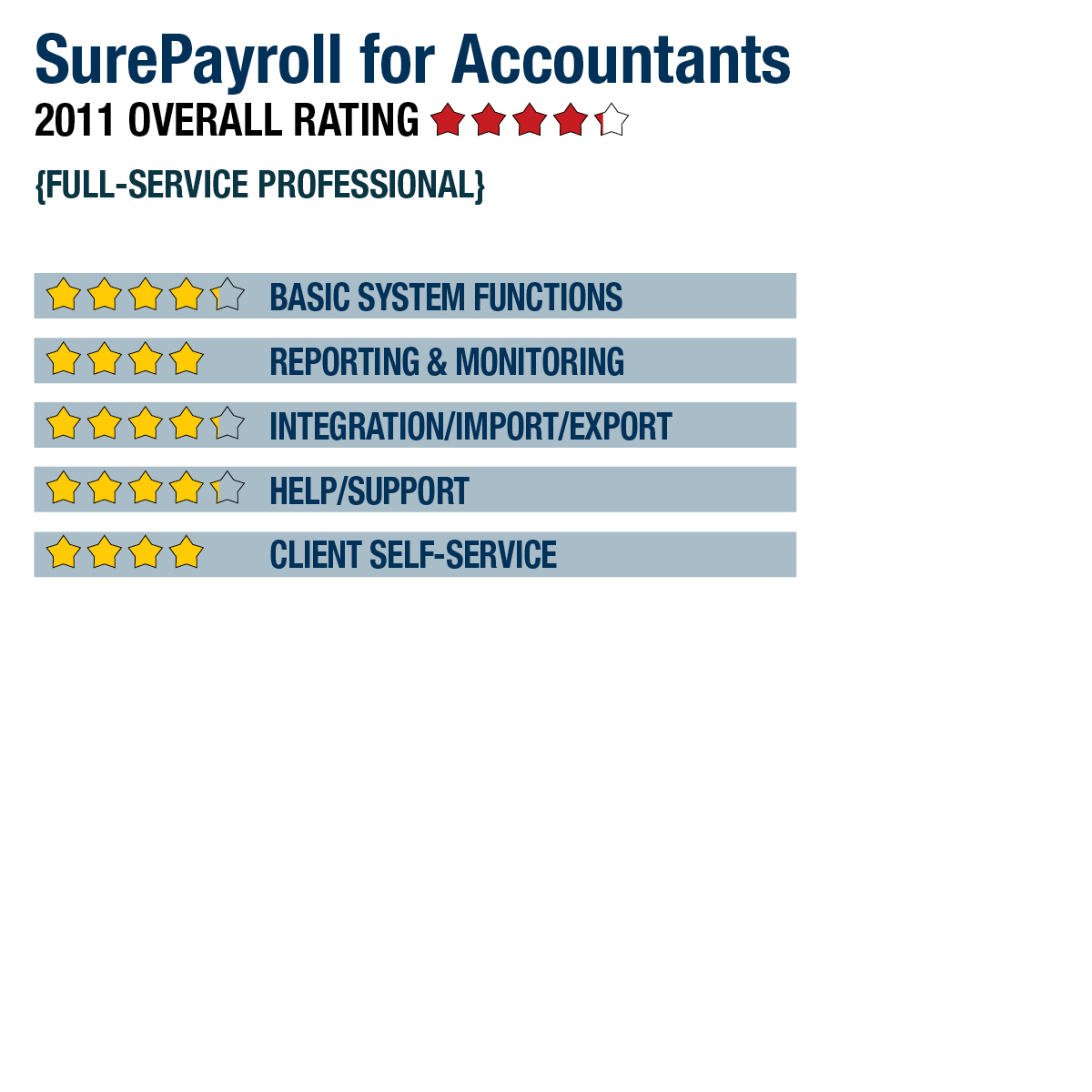

2011 Overall Rating

Best Fit

Clients or firms who want a robust, web-based payroll solution with strong features such as a mobile application, employee self-service portals and integration with numerous accounting software applications.

Strengths

- Interfaces provided for QuickBooks, Sage Peachtree, AccountEdge & Intacct (data transfer may require users to pay a fee).

- Included employee self-service portals allow access to historical data, but do not allow changes to address or time entry.

- Simple reminder function alerts users of upcoming payroll date or tax payments.

- Accounting firms can private-label SurePayroll with their own logo, or allow clients to pay SurePayroll directly.

- Basic HR functionality provided; SurePayroll resells third-party tools for tasks like background checks, behavioral assessments & skill testing.

Potential Limitations

- Does not support companies with more than 100 employees.

SUMMARY & PRICING

SurePayroll is a good fit for businesses that have basic payroll needs and desire a more paperless solution. It is also a good fit for accounting professionals looking for a resale opportunity. Billing for accounting professionals can be sent directly to the accounting professional or to the client with a built-in markup. Pricing for services is based upon the number of payroll runs and employees, and includes all payroll processing, direct deposits and associated reporting requirements. A bi-weekly or semi-monthly payroll starts at a base fee of $30.95 plus $1.85 for each employee. These costs will be incurred for each payroll run. Annual W-2 processing costs are currently $40 per company plus $4.25 per employee.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.25

Reporting & Monitoring 4

Integration/Import/Export 4.25

Help/Support 4.25

Client Self-Service Features 4