Payroll

APS, Inc. — APS OnLine

Aug. 10, 2011

888-277-8514

www.apspayroll.com

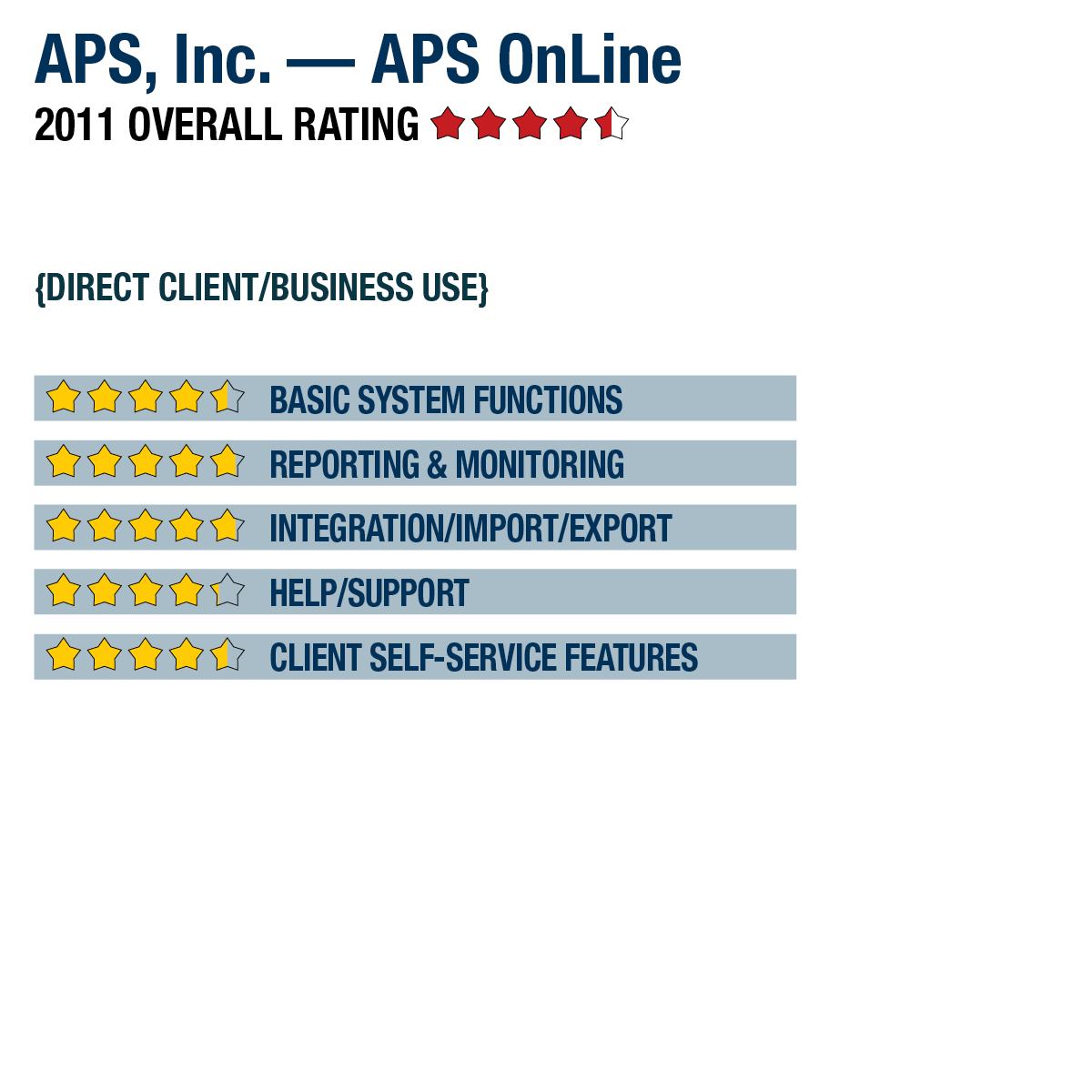

2011 Overall Rating

Best Fit

Firms who are looking for a web-based payroll solution that interfaces with most accounting applications, as well as companies with more than 100 employees.

Strengths

- Publisher indicates that they have over 100 integrations with timekeeping & GL applications.

- Multi-state payroll withholdings are allowed for employees.

- eSELFSERVE employee portal provided for all employees at no additional charge, permitting employees to enter routine requests (time off, etc.).

- Includes light human resources data tracking & secure document filing with different permission levels.

Possible Limitations

- May not be the best fit for extremely small employers or public practitioners who need after-the-fact payroll support.

Summary & Pricing

APS OnLine is primarily designed for the small to mid-size business market with 100 or more employees, but small businesses may realize benefits, as well. The service offers a core set of payroll and HR functions and has an easy-to-use employee web portal. Pricing for APS OnLine is dependent on the number of employees, associated payroll runs and additional services that may be needed. However, a 250-employee business requiring a bi-weekly payroll will generally be priced between $1 and $3 per employee, depending on required features, such as time & attendance and HR.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Reporting & Monitoring 4.75

Integration/Import/Export 4.75

Help/Support 4.25

Client Self-Service Features 4.5