Software

Drake Software — Drake Tax

Sep. 05, 2014

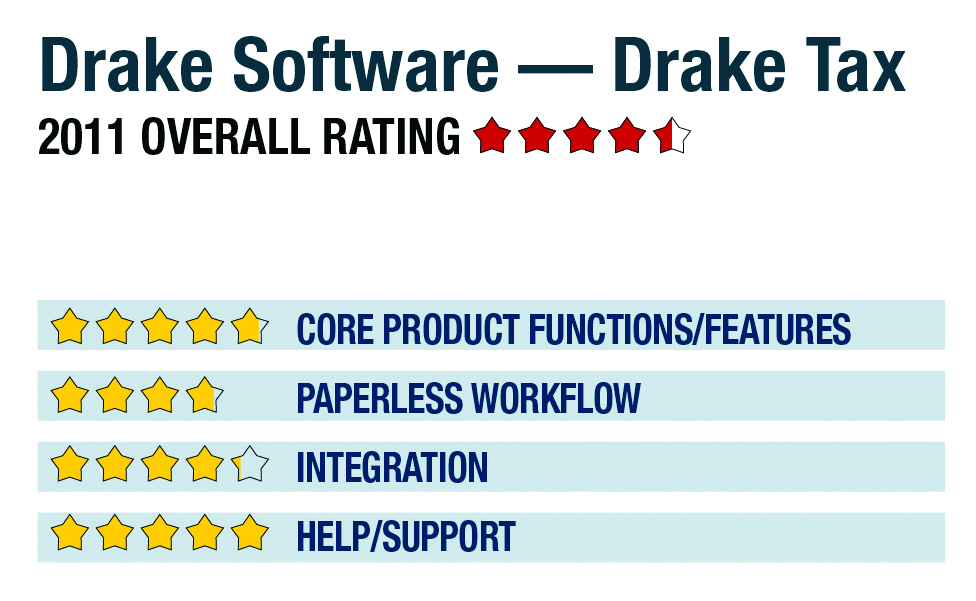

2011 Overall Rating 4.5

800-890-9500

www.DrakeSoftware.com

Best Firm Fit:

1040-focused practices looking to broaden their services with integrated write-up and tax planning options, as well as retail environments with multiple locations.

Strengths:

– Exceptional live support

– Affordable all-inclusive pricing includes all entities, states, e-filing, plus tax planning, document management & write-up with ATF payroll

– Multi-office manager sync system

– Free basic websites for firms

Potential Limitations:

– No client portals

– Limited document automation tools (scan & fill)

– Limited internal collaboration tools

Executive Summary & Pricing:

The Drake system provides virtually everything a tax practice needs at one simple cost, making it a good turnkey solution for new firms or those looking to enhance their tax services with planning, write-up, after-the-fact payroll and other offerings. The system is best suited to smaller and mid-sized practices primarily focused on 1040s, with some moderately complex returns, as well as a growing business client base. Drake also offers excellent program support and tax training options. The system costs $1,495, although various discounts are often available and early renewal pricing is under $1,095, making it one of the most affordable fully comprehensive professional tax suites on the market. Pricing includes any number of users within a practice. A pay-per-return model is also available, with each return costing $19, inclusive of federal and state e-filing.

4.75 – Core Product Functions/Features

product depth/multi-state

navigation/ease-of-use

support for special situations

electronic filing

3.75 – Paperless Workflow

paperless creation

paperless open items

access control for limiting access into returns

digital document storage/mgmt.

data import/export

4.25 – Integration

w/in Publisher’s own suite

w/tax research tools & guidance

w/other or external programs

w/external services

5 – Help/Support

online resource center

tech assistance availability

Downloadable program updates

Preferred SaaS route