Good news: The annual threshold for deducting medical expenses is finally set in stone. After several years of yo-yoing up and down, the Consolidated Appropriations Act (CAA) established a permanent threshold of 7.5% of adjusted gross income (AGI), more favorable to taxpayers than the previous high-water mark of 10% of AGI.

For example, if you have an AGI of $100,000 and incur $9,500 in unreimbursed medical expenses, you can now deduct $2,000. With a 10%-of-AGI threshold, it would be zero!

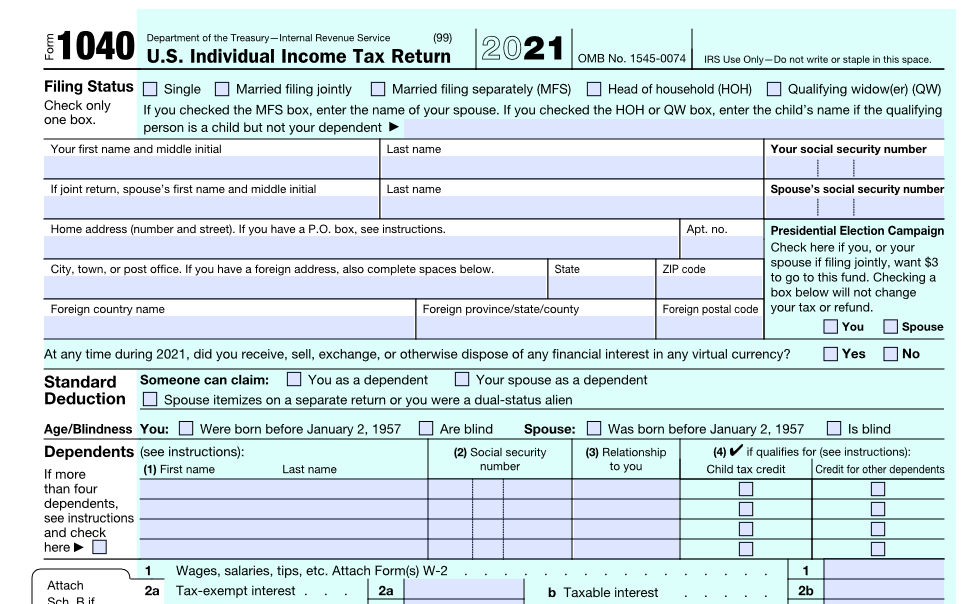

The CAA provision is effective for 2021 returns and beyond. So this may be the first year you qualify for the deduction or at least the first year in awhile. Of course, you can claim this deduction only if you itemize on your return. If you take the standard deduction instead, you get no tax benefit from your medical expenses—regardless of your AGI.

Given this situation, try to take full advantage of the lower threshold when you may qualify for a write-off. Comb your records to make sure you count all the expenses that qualify for the deduction.

More details: Generally, you can deduct payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body. This includes health insurance premiums and a portion of premiums paid for long-term care insurance (LTCI) policies based on the insured’s age.

Some other common deductible expenses are:

- Fees for physicians, dentists, surgeons, chiropractors, psychiatrists, psychologists and other medical practitioners

- In-patient hospital care or nursing home services, including the cost of meals and lodging charged by the hospital or nursing home

- Acupuncture treatments or inpatient treatment at a center for alcohol or drug addiction, for participation in a smoking-cessation program and for drugs to alleviate nicotine withdrawal if they require a prescription

- Expenses to participate in a weight-loss program for a specific disease or diseases, including obesity, diagnosed by a physician (but usually not for health food items or payment of health club dues for one’s general health)

- Insulin and prescription drugs

- Payments for false teeth, reading or prescription eyeglasses or contact lenses, hearing aids, crutches, wheelchairs, and for guide dogs for the blind or deaf

- Transportation needed to obtain necessary medical treatment such as fare for taxis, buses, trains and ambulances. If you use your own vehicle, you can deduct the portion of actual costs attributable to medical-based travel or use a standard rate. The standard rate for 2021, which is adjusted annually, is 16 cents per mile, plus related tolls and parking fees. (It is increasing to 18 cents per mile for 2022.)

Make sure you keep accurate records of these and other expenses as proof in case the IRS ever challenges your deduction.

Could the medical deduction threshold be raised again the future? There are no guarantees it won’t happen. Practical advice: Try to maximize deductions under the current rules.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs