While debt related to mortgages, student loans, and credit cards grabs headlines, another class of debt often goes unnoticed, despite significant accumulation: tax debt.

Tax delinquency impacts a significant portion of United States taxpayers. “The Internal Revenue Service (IRS) reported that at the end of fiscal year 2018 there were 13.1 million delinquent taxpayer accounts. This is a staggering amount,” says Wade Schlosser, CEO of media company Solvable, “and given the rapid expansion of the gig economy, like ride-share drivers, freelancers, or other 1099 contractors, we expect this delinquent number will grow.”

A September 2019 IRS report pegged the national tax gap, or the difference between federal taxes owed and paid, for 2011 to 2013 (the most recent, fully analyzed years available) at $441 billion. After the IRS recovered $60 billion through enforcement efforts and late payments, the net tax gap amounted to $381 billion.

[This article first appeard on the LendEDU blog.]

Accounting for state taxes based on an analysis by Solvable**, the total tax gap figure for federal and state tax debt is an estimated $527 billion.

The consequences of tax debt can be severe, including things like wage garnishment, asset seizure, and international travel restrictions. Yet the significant amount of tax debt across the U.S. seems to fly under the radar.

To shine some light on the issue, LendEDU has teamed up with Solvable to analyze data from more than 75,000 cases of tax debt.

Using this dataset, we found the average amount of tax debt per tax debtor for each of the 50 states and Washington, D.C., in addition to the nationwide average. We also outlined the most common reasons people go into tax debt in each state.

With the first report of its kind, we hope to opens eyes to the significant, yet underreported, financial burden of tax debt that so many U.S. workers face.

Tax Debt Data

All data in this report was provided exclusively to LendEDU by Solvable. Solvable’s data includes more than 75,000 cases of tax debt from Solvable customers. LendEDU completed all calculations.

Table: Tax Debt by State

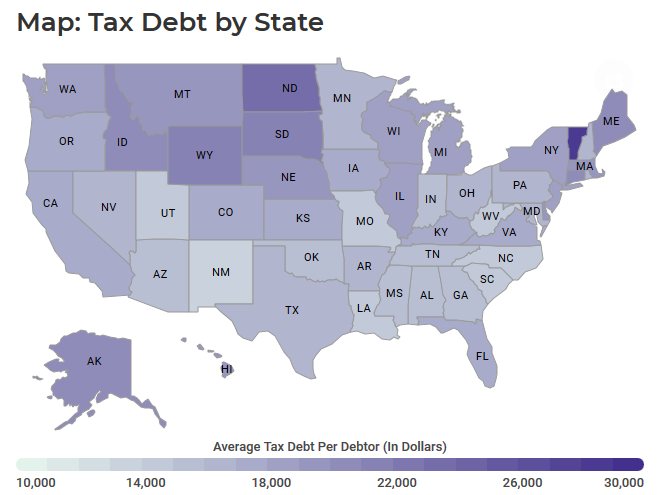

Map: Tax Debt by State

Table: Reasons For Tax Debt by State

Graph: Reasons For Tax Debt by State

Observations & Analysis

New Mexico Posts Lowest Average Tax Debt; Northeast States Have the Highest, While Southern States Owe Less Than Average

Tax debtors in New Mexico have the lowest average debt: $13,878.

Trailing close behind New Mexico are:

- West Virginia: $14,325 (2nd)

- North Carolina: $14,657 (3rd)

- Louisiana: $14,731 (4th)

- South Carolina: $14,772 (5th)

These and 16 other states fall below the national average tax debt of $16,849.

The remaining 29 states and Washington, D.C., each post average tax debt above the national average. Vermont registered the highest average tax debt per tax debtor: $28,862. That’s $14,984 higher than New Mexico’s and $5,191 higher than the next highest average tax debt, North Dakota at $23,671.

Most states in the Northeast corridor, an area of the U.S. known for high taxes and a high cost of living, had tax debt above the national average. These states included:

- Maine: $20,471 (47th)

- Connecticut: $20,399 (45th)

- Delaware: $19,783 (43rd)

- Washington D.C.: $19,586 (42nd)

- Massachusetts: $19,500 (41st)

- New Jersey: $18,741 (37th)

- New York: $18,489 (36th)

States in the Midwest and West also posted average tax debt figures on the higher end of the spectrum:

- North Dakota: $23,671 (50th)

- Wyoming: $21,095 (49th)

- South Dakota: $21,071 (48th)

- Idaho: $20,317 (44th)

- Nebraska: $19,241 (39th)

- Montana: $19,226 (38th)

In another regional trend, Southern states showed a propensity for low average tax debt, with 10 states in this region falling below the national average. This included:

- West Virginia: $14,325 (2nd)

- North Carolina: $14,657 (3rd)

- Louisiana: $14,731 (4th)

- South Carolina: $14,772 (5th)

- Oklahoma: $15,103 (9th)

- Alabama: $15,642 (11th)

- Georgia: $15,781 (12th)

- Tennessee: $15,916 (13th)

- Arkansas: $16,197 (16th)

- Texas: $16,378 (17th)

Back Tax Penalties & Owing More Than Expected Were Top Reasons for Tax Debt

The most common stated reasons for tax debt on a national scale included:

- Owe more than expected: 15.69%

- Back tax penalties: 14.38%

- Unfiled taxes: 14.22%

- Divorce: 10.79%

The same tax debt trends that apply to the U.S. as a whole also hold true at the state level.

South Dakota could attribute 21.82% of its tax debt cases to tax debt accumulated due to “back tax penalties,” followed by:

- Montana: 21.05%

- Maine: 18.95%

- Vermont: 18.52%

- Georgia: 17.90%

North Dakota (23.53%) led the way in tax debt brought on by “owing more than expected,” trailed by:

- Washington, D.C.: 21.05%

- Nebraska: 20.56%

- Wyoming: 19.05%

- North Carolina: 19.04%

“Unfiled taxes” accounted for 18.18% of tax debt cases in South Dakota, followed by:

- Mississippi: 17.17%

- Alabama: 16.62%

- Ohio: 16.36%

- New Mexico: 16.23%

Finally, 19.05% of tax debt cases in Wyoming were due to “divorce,” trailed by:

- Iowa: 15.25%

- West Virginia: 14.89%

- Massachusetts: 14.65%

- Idaho: 14.17%

More Information on Tax Debt

Most tax debt is composed of unpaid individual and corporate income taxes; followed by tax debt from employment, estate, and excise taxes. The IRS attributes the tax gap mainly to taxpayers who understate the amount of taxes they owe on timely filed tax returns, but also includes taxpayers who file tax returns late, and those who both file and pay late.

Generally, both the IRS and state tax agencies are willing to negotiate a tax settlement with a tax debtor for a portion of the money owed.

Solvable’s 5 Tips to Avoid Getting into Tax Debt in 2020

If you are unable to pay the full balance due after crunching your taxes for 2019, here are five steps to seek relief and avoid severe consequences.

1. File a Request for Extension with the IRS to Buy More Time

Filing an extension with the IRS can buy you six more months to get your personal finances in order to save the money you need to pay your tax bill. The IRS extension for 2020 will give you until Oct. 15 to file your tax return.

You can use this time to find part-time work by joining the gig economy like millions of others on Uber, Lyft, TaskRabbit, and DoorDash to save enough to pay your balance in full.

2. Request a Payment Plan

The IRS offers a payment plan called a “long-term installment agreement” for those who can’t pay their balance due in full within 120 days, as long as you owe less than $50,000, including penalties and interest.

To qualify, you must meet specific criteria, and the monthly payments you propose must pay off your entire tax debt, including interest and penalties, within three years.

3. Qualify for an Offer in Compromise

If you are unable to make minimum payments to pay off your tax debt within three years, you may qualify for an Offer in Compromise, an IRS program that reduces your tax liability. You must meet certain criteria based on your expenses, income, assets, and amount owed.

4. Request a “Currently Not Collectible” Status

While your account is in “Currently Not Collectible” status, the IRS agrees neither to collect your taxes owed, nor seize your assets or income. Your tax debt will still collect interest and penalties, and the IRS will likely apply tax refunds you earn during this period to your taxes owed.

5. Qualify for “Innocent Spouse” Relief

“Innocent spouse” relief from the IRS could relieve you of responsibility for paying taxes, interest, and penalties if your spouse (or former spouse) improperly filed a joint tax return without your knowledge.

Methodology

All data that can be found within this report derives from Solvable and was anonymized and provided exclusively to LendEDU for analysis. The dataset comprised 75,330 unique cases of tax debt. The tax debt cases reflect a date range from March 1, 2019 to August 31, 2019.

Included in the Solvable dataset were things like the amount of tax debt for each unique case, the reason for that tax debt, and the state where the tax debtor was from.

The total national tax debt figure (combined federal and state tax debt) was an estimate calculated by Solvable and reported by LendEDU. There is no citable figure that reports the cumulative state tax debt, so the figure in here of $146 billion must only be treated as a rough estimate.

** The total national tax debt figure of $527 billion that can be seen towards the top of this report is an estimate provided by Solvable and reported by LendEDU. While the federal tax debt figure of $441 billion is data provided by the IRS, there is no exact report on cumulative tax debt from state-based taxes. Solvable conservatively estimates that figure to be roughly around $146 billion. This estimate was found by extrapolating California’s reported 2018 tax gap figure that was between $20 and $25 billion to the rest of the U.S. states. Adding the estimated state-level tax gap to the net federal tax gap of $381 billion makes a total estimated tax gap of $527 billion.

=========

In his role at LendEDU, Mike uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs