IRS Gives Colorado Flood Victims Extension for Claiming Damages

Taxpayers in Colorado who suffered property damage during last year's flooding are being given additional time to decide on when they will claim those losses against their taxes.

Taxpayers in Colorado who suffered property damage during last year's flooding are being given additional time to decide on when they will claim those losses against their taxes.

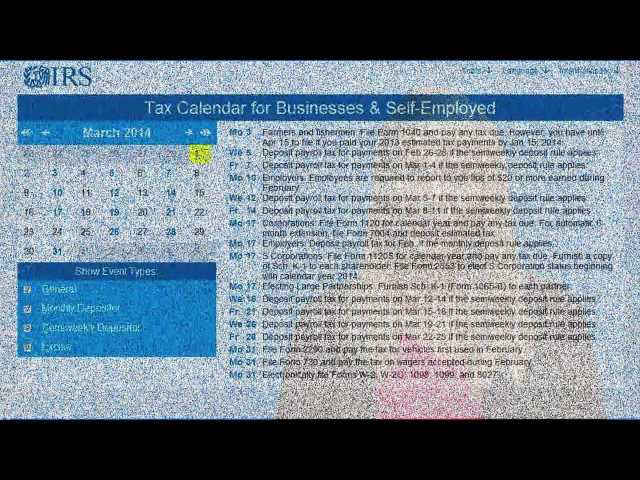

View business due dates with the IRS's online tax calendar.

The Internal Revenue Service seeks civic-minded volunteers to serve on the Taxpayer Advocacy Panel (TAP), a federal advisory committee that listens to taxpayers, identifies major taxpayer concerns, and makes recommendations for improving IRS services.

Income tax filing deadlines for most small business are coming up soon, and the Internal Revenue Service is reminding small employers who offer health insurance to their employees to check out the small business health care tax credit and then claim it if they qualify.

Someone just asked TaxMama if there is a way to get her father’s earnings information from back in 1977-78. She needs it because his income in those years is not on his Social Security record.

With about a month to go before the open enrollment period for Obamacare ends – the official deadline is March 31, 2014 – the federal government continues to tweak the rules for the landmark healthcare legislation.

According to a new report prepared on behalf of the Urban Institute for the Robert Wood Johnson Foundation, the impetus for covering more taxpayers under Obamacare could come from an intriguing source: Tax return preparers.

Fudge a few numbers on a tax return? It's illegal and could set a taxpayer up for some serious fines and penalties but ... 14 percent of Americans say it's not a big deal. Yet at the same time, a vast majority think tax preparer standards of competency are highly important.