IRS Corrected 14 Million Tax Returns with Average Refund of $1,232

Many of the 12 million refunds come from a change in the way unemployment insurance was taxed.

Many of the 12 million refunds come from a change in the way unemployment insurance was taxed.

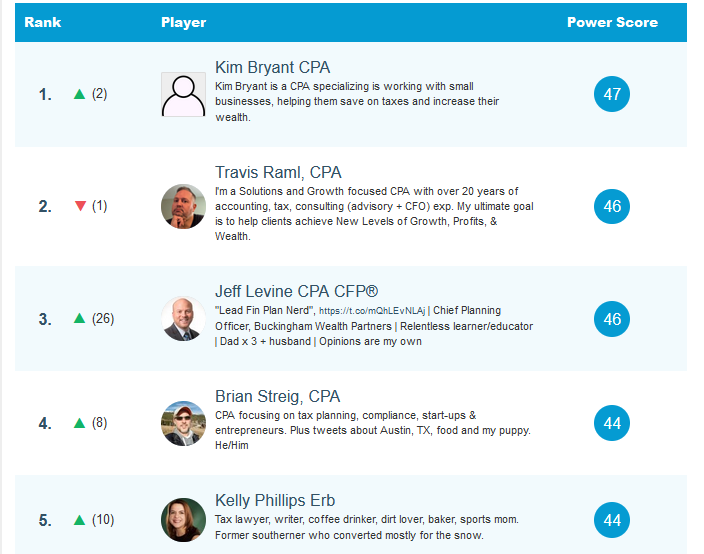

As trusted advisors, CPAs have the knowledge and expertise to provide our clients with accurate and timely advice on a wide range of tax and financial matters.

The Accounting Top 100 social media leaderboard scores and ranks users based on five separate metrics, each of which is weighted according to its perceived value.

The sports betting organization they managed evaded tens of millions of dollars in excise taxes for three years.

Brian Tankersley, CPA, CITP, CGMA and technologist Randy Johnston provide their expert commentary on 2022’s fall conference season.

Low-income wage-earners taking the earned income tax credit had a higher-than-expected audit rate, report says.

These cases include IRS Criminal Investigation’s most prominent and high-profile investigations in the past year.

Arnold Group provided go-to-market strategy development for clients in the technology sector the last 20 years.