While only 6% of company executives recently polled by Deloitte have already implemented generative AI solutions to support finance and accounting processes, considerably more of these decision-makers say they’re actively discussing use cases (15.4%) or have future plans to adopt the technology (27.8%), according to the Big Four firm.

What does the C-suite believe are the biggest opportunities for GenAI within their organization’s accounting department? According to the Deloitte Center for Controllership poll, 23.7% of the more than 1,430 executives surveyed said cash-flow forecasting would be the top benefit of using GenAI, followed by scenario planning (21.1%), expense reporting (18.1%), and financial controls management (14.1%).

“Just as in any industry, there are areas within accounting and finance that could be ripe for generative AI experimentation,” Court Watson, a partner in Deloitte Risk and Financial Advisory’s Digital Controllership practice, said in a statement. “Processes that depend on estimations for which organizations have robust, algorithm-ready data sets—such as cash-flow forecasting and scenario planning—might be ideal areas for finance and accounting teams to begin testing generative AI use.”

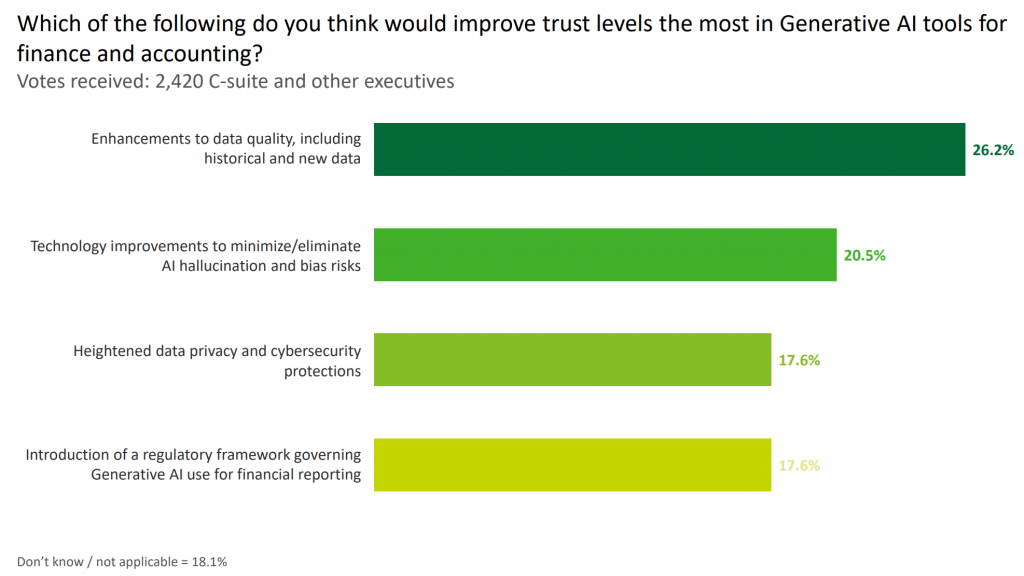

Data, which is the main input for GenAI models, is the single greatest pain point, respondents said. Nearly one-quarter (24.4%) of polled executives say that enhancements to data quality would improve their trust levels in GenAI tools.

“Across the board, we continue to hear from organizations that the lack of clean, model-ready data is a significant challenge to incorporating generative AI into finance and accounting workstreams,” Watson said. “Implementing a robust data strategy and process to prepare finance and accounting data for use within generative AI models—as well as with automation and other technologies—is a crucial first step to help organizations truly reach actionable insights and outcomes.”

As interest in GenAI solutions within finance and accounting increases, so are considerations concerning the technology’s implications on governance strategies, Deloitte said. According to the poll, more than one-third of executives (38.7%) say their company already has or will have a GenAI strategy—protocols to guide its adoption and use—in place for finance and accounting within the next 12 months. However, a similar number (39%) report no future plans to develop a strategy.

“Generative AI is expected to transform finance and accounting processes, inclusive of actual financials, making governance a significant piece of the puzzle. Treating AI governance like any other finance transformation effort will be key to bringing the technology safely into an organization’s finance operations,” said Dave Stahler, a Deloitte Risk and Financial Advisory partner and controllership digital finance leader. “For many, that will mean taking an enterprise-wide approach that includes a well-governed data strategy, accuracy and reliability safeguards, alignment with financial regulations and standards, close strategic collaboration across business functions and—critically—management support.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs