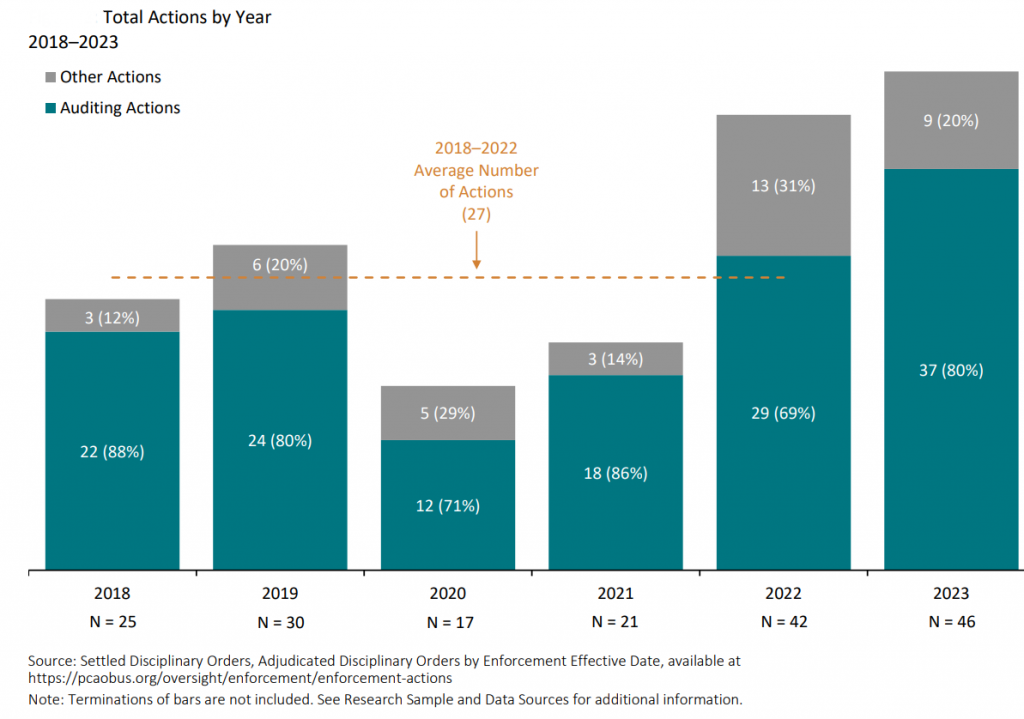

2023 definitely was a banner year for the enforcement division of the Public Company Accounting Oversight Board (PCAOB) as total enforcement activity reached its highest level since 2017 and monetary penalties doubled compared to the record set in 2022, according to a new study from Cornerstone Research.

The PCAOB disclosed 46 total enforcement actions in 2023, 37 of which related to the performance of an audit, up more than 28% from 2022. Twenty-nine of the 37 auditing actions were revealed during the second half of 2023, matching the total number of auditing actions for all of 2022.

In addition, monetary penalties last year totaled $19.7 million, nearly doubling the previous record of approximately $10.5 million in 2022. Of that $19.7 million, $18.8 million were imposed on audit firms, nearly twice the $9.5 million imposed on firms in 2022, according to Cornerstone Research. Fifteen percent of firms sanctioned by the PCAOB were required to hire an independent consultant to review their quality control policies and procedures and recommend improvements.

“More than two-thirds of the PCAOB’s record-setting monetary penalties were imposed on non-U.S. respondents in 2023, even though non-U.S. respondents accounted for less than half of the auditing actions during the year,” Russell Molter, a principal at Cornerstone Research and report co-author, said in a statement.

Last year, there were 34 PCAOB auditing enforcement actions against firms versus 19 against individuals, a notable shift from previous years when there were more actions taken against individuals than firms. For example, individuals were sanctioned more by the U.S. audit regulator than firms (26 vs. 17) in 2022.

The vast majority—79%—of auditing actions in 2023 included alleged violations of auditing standards. Sixty percent of those actions included additional allegations related to ethics and independence standards, quality control standards, or both. And for the first time, the PCAOB included allegations related to critical audit matters in enforcement actions, with three actions including such allegations, the study says.

Other key trends noted in the study include:

- The PCAOB settled four actions involving three China-based firms after securing access to inspect and investigate Chinese firms in 2022.

- For the second consecutive year, there were no enforcement actions related to a company’s disclosure of a material weakness in internal control. In contrast, Securities and Exchange Commission enforcement actions that referred to an announced restatement and/or material weakness in internal control reached their highest levels in recent years.

- Violations of quality control standards were alleged in more than half of the actions involving firm respondents.

- Nearly 80% of the total monetary penalties in 2023 were assessed on just six defendants.

- The proportion of individual respondents who were barred increased from 64% in 2022 to 85% in 2023.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs