Taxes

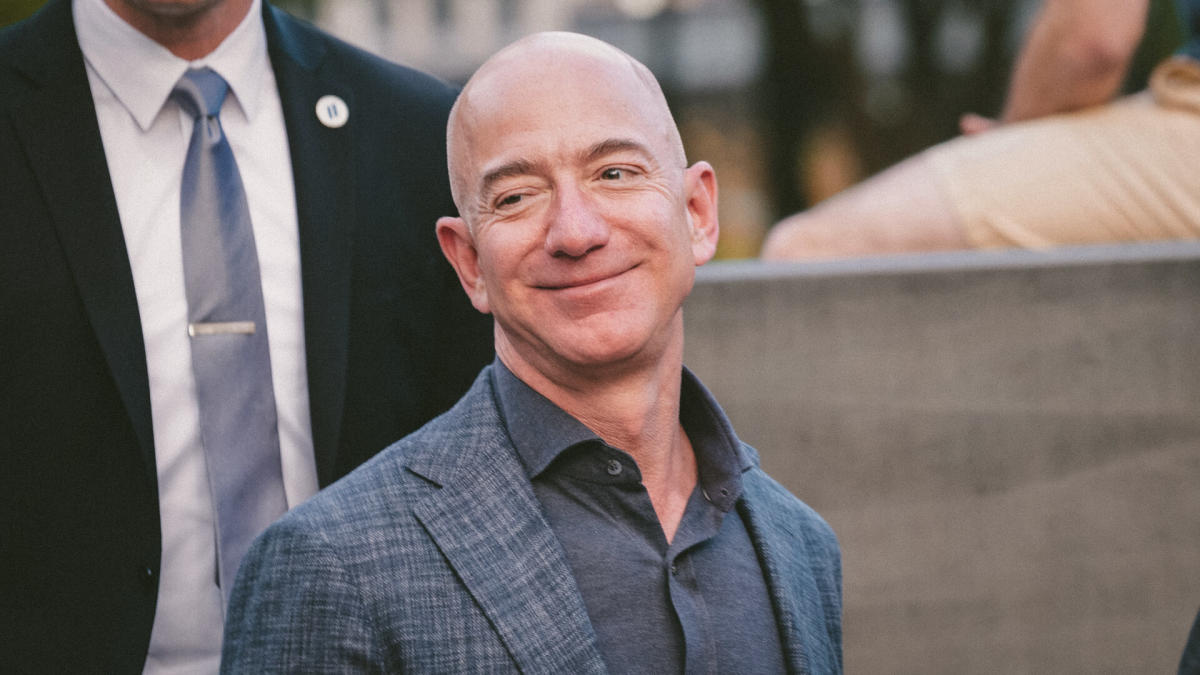

Jeff Bezos Will Avoid Capital Gains Tax Thanks to His Move to Florida

The billionaire avoided Washington state's 7% capital gains tax on a recent sale of $2 billion worth of Amazon stock.

Feb. 13, 2024

By Bruce Gil, Quartz (TNS)

Jeff Bezos, the world’s second richest person at the moment, could end up saving nearly $600 million because of his recent move to Miami, Florida—a state with no capital gains tax.

Last week, Bezos announced in a U.S. Securities and Exchange Commission (SEC) filing that he plans to sell about 50 million shares of Amazon stock estimated to be worth $8.4 billion. It’s a move that could secure his spot as the No. 1 wealthiest person in the world.

As part of the plan, Bezos has already sold 12 million shares worth about $2 billion. If he still lived in Washington state, where a 7% capital gains tax was enacted in 2022 and upheld in November, that transaction alone would have cost Bezos $140 million in taxes.

Now that he lives in Florida, he has managed to avoid this tax. If he completes his proposed sale of all 50 million shares, he could end up saving nearly $600 million.

Bezos takes Miami

Bezos announced his move to Miami from Seattle, where Amazon is based, in an Instagram post in November.

He said he was moving back to the city where he attended high school to be closer to his parents and the operations of his aerospace company, Blue Origin.

His relocation came two and half years after he stepped down as CEO of Amazon. He now lives on an exclusive island known as “Billionaire Bunker” where he bought two adjacent mansions worth $68 million and $79 million, respectively. His neighbors include Ivanka Trump, Tom Brady, and activist investor Carl Icahn.

Bezos didn’t mention Washington state’s new capital gains tax as a reason for his move. However, the billionaire didn’t sell any Amazon stock in 2022 or 2023 while he was still living there and the new tax was enacted, Fortune reported.

______

©2024 Quartz Media Inc. All rights reserved. Distributed by Tribune Content Agency LLC.