IRS

Long IRS Delays in Assisting Identity Theft Victims Are ‘Unconscionable,’ National Taxpayer Advocate Says

Nearly 500,000 taxpayers with cases pending at the IRS waited almost 19 months for their identity theft issues to be resolved.

Jan. 10, 2024

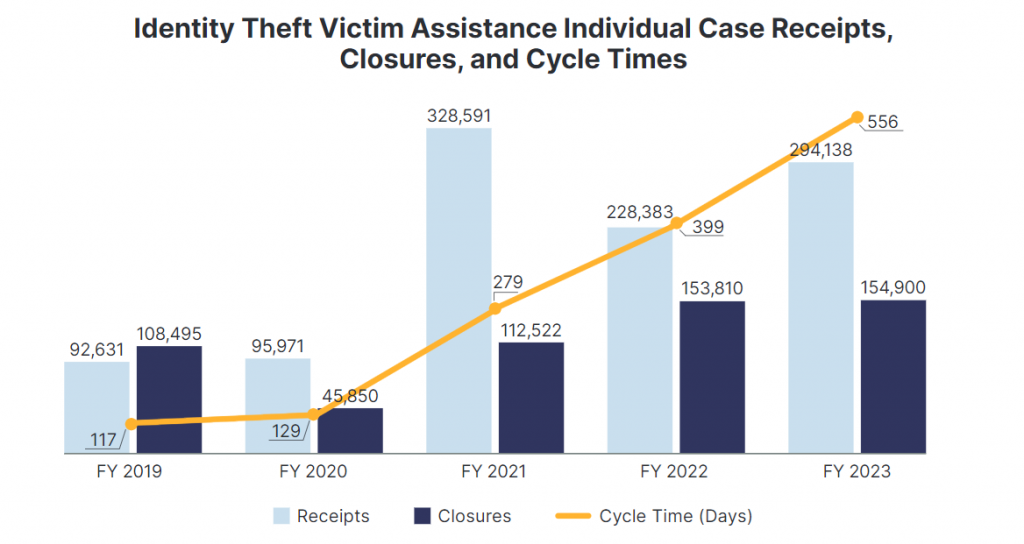

At the end of fiscal year 2023, nearly half a million taxpayers with cases pending in the IRS’s Identity Theft Victims Assistance (IDTVA) unit were waiting an average of almost 19 months for the agency to process their tax returns and send them their refunds, according to National Taxpayer Advocate Erin Collins.

“I’ll restate that for emphasis: Victims of identity theft have to wait more than a year and a half for the IRS to resolve their cases and receive the monies they are owed,” Collins wrote in her 2023 Annual Report to Congress, which was released on Jan. 10.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

She called the delays “unconscionable” and added this would be headline news if it weren’t for the significant number of challenges affecting larger groups of taxpayers, “and it should be.”

“Many taxpayers depend on their tax refunds to meet their living expenses, particularly low-income taxpayers who receive earned income tax credit (EITC) benefits that may approach $7,000 for tax year 2022,” Collins wrote. “IRS data shows that 69% of taxpayers whose identity theft cases the IRS resolved had adjusted gross incomes at or below 250% of the federal poverty level.”

The report shows the IRS closed FY 2023 with an inventory of about 484,000 of these cases with delays approaching 560 days.

When a taxpayer notifies the IRS that he or she has been a victim of identity theft, the IRS creates a case that it works in its IDTVA unit. The 556-day waiting period currently affecting victims falls far outside the 120-day time period the IRS typically strives for when resolving IDTVA claims, the report says.

During the pandemic, the IRS’s policy decisions to prioritize other areas, such as redeploying employees (572 of them in 2023) who previously had been handling identity theft cases to answer telephone calls, contributed to these “unreasonable” processing delays that continued throughout 2023 and are expected to continue into 2024, Collins wrote.

“Perhaps this trade-off was understandable so taxpayers could obtain the answers they needed during filing season, but we are now more than three years from the beginning of the pandemic. The IRS should be able to figure out how to provide taxpayers with the customer service they need without siphoning it from other critical programs,” she said. “The continuation of these extraordinary cycle times is unreasonable, burdens taxpayers, and compromises taxpayer rights.”

Other problems plaguing identity theft victims when dealing with the IRS include:

- IRS systems for detecting and preventing identity theft have struggled with high false detection rates (62% in 2020, 61% in 2021, and 47% in 2022), subjecting taxpayers who filed legitimate returns to refund delays;

- Taxpayers receive only one letter asking them to authenticate their identity when the IRS suspects an identity thief may have filed a tax return, and taxpayer response rates to these letters are low; and

- Some taxpayers are having to wait too long to receive their Identity Protection Personal Identification Numbers (IP PINs), delaying access to an underutilized tool for preventing tax-related identity theft.

“Taxpayers who avail themselves of one of the most effective ways to protect themselves from tax-related identity theft may have to wait more than 120 days for the IRS to complete their initial IP PIN request if they submit their request by mail,” Collins wrote.

The national taxpayer advocate made the following seven recommendations to the IRS:

- Refrain from having IDTVA employees perform other duties unrelated to working identity theft cases until the average cycle time for resolving IDTVA cases is less than 90 days.

- Program identity theft filters to consistently have a false detection rate below 50%.

- Conduct a pilot where the IRS sends taxpayers authentication letters using different versions of plain language and tests sending multiple letters in close proximity of one another to determine if these changes improve the taxpayer response rate.

- Track when the IRS receives authentication letters returned as “undeliverable” and develop procedures to have IRS employees conduct research to verify a taxpayer’s most recent address.

- Provide a process by which taxpayers can electronically submit Form 15227, Application for an Identity Protection Personal Identification Number, and ensure the process routes the forms to the appropriate unit within 48 hours of receipt.

- Conduct outreach to private-public stakeholders making them aware of the availability of IP PINs and how taxpayers can request them.

- Provide taxpayers who voluntarily opt into the IP PIN program a means by which they can opt out of the program.

“The IRS should do everything possible to timely assist these victims and provide them with the peace of mind that the IRS is looking out for their best interests and protecting their rights,” Collins said.