Taxes

How Not to Let the ‘Widow’s Tax Penalty’ Blindside You

If one spouse passes away, the surviving spouse could pay nearly double the amount of income taxes. Are your clients planning for this?

Nov. 06, 2023

By Joe F. Schmitz Jr., CFP, ChFC, Kiplinger Consumer News Service (TNS)

The “widow’s penalty” occurs when a person’s tax filing status goes from married filing jointly to single. This change can cause the surviving spouse to have to pay nearly double the taxes compared to what they were paying.

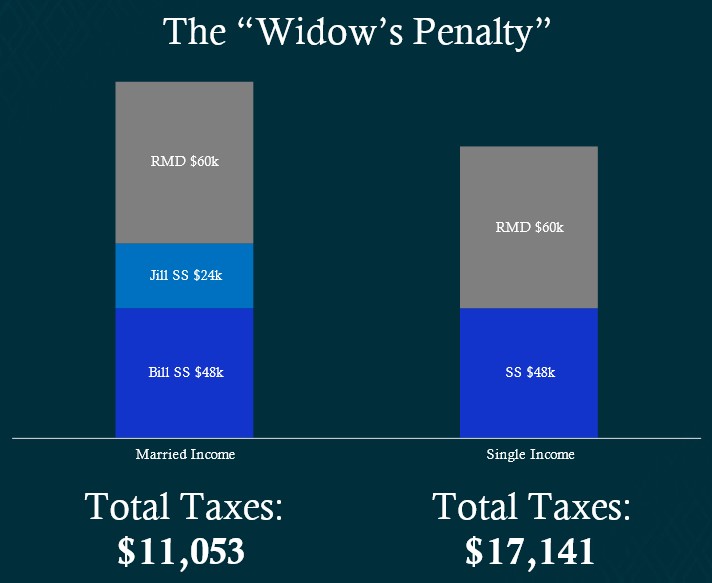

I am going to share an example of a client of ours (we’ll call her Jill) whose spouse (we’ll change his name to Bill) passed away prematurely before Jill started working with us. Their situation is illustrated in the graphic below. Let me walk you through the impact of the widow’s penalty and how severe it was for Jill.

As you can see with this chart, while Bill and Jill were together, they filed their taxes jointly, each received Social Security, and both were older than 73, which means they were forced to take required minimum distributions (RMDs) from the money they had saved in IRAs over all their working years. All their income combined resulted in a tax bill of $11,053. To me, that is a lot of money to have to pay the government, considering Jill and Bill are no longer working. Unfortunately, it gets worse.

When Bill passed, Jill was required to continue the same RMD amount because she was the beneficiary and received all the investments. However, there were two major changes that occurred. The first was that Jill’s Social Security fell off. When one spouse passes away, their Social Security income goes away, and the higher of the two remains. It is great that Jill can take the higher of the two but unfortunate that she will have a loss of income from what she was used to.

This is less of concern since it is typically correct that most surviving spouses will not need 100% of what they needed while their spouse was living, so we can manage that loss. The second change was that Jill’s tax status went from married filing jointly to single.

I have already indicated how severe this is and how it can cause the surviving spouse to pay nearly double the amount of taxes. Let’s explore the tax brackets to understand why this is the case.

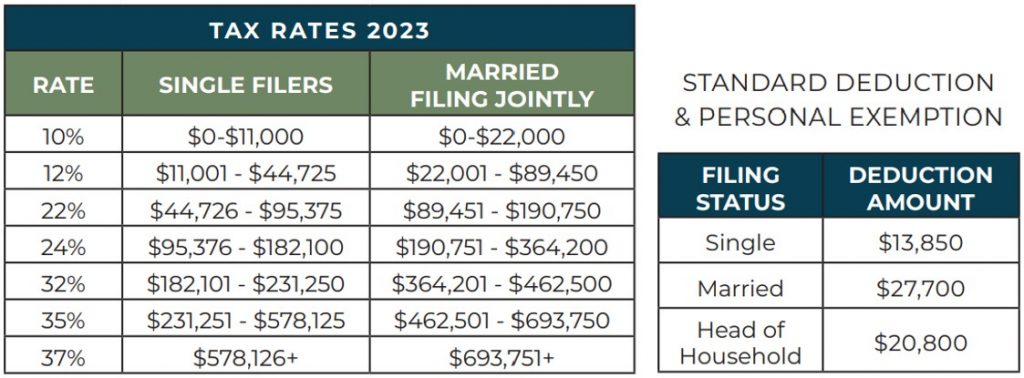

As you can see from these charts, two things fuel the fire for the widow’s penalty:

- The standard deduction gets cut in half. This means the surviving spouse will be left with less tax-free income.

- The tax brackets are smaller. For example, if you have $85,000 of taxable income and you are married filing jointly, then you are in the 12% tax bracket, but if you are single with $85,000 of taxable income, then you will be in the 22% tax bracket. See how this can be an issue? This is how that near doubling of taxes can occur.

It bothers me that not only will the surviving spouse have less income, but they will also have to pay more taxes, which leaves them with less money during the time when they need it the most.

How do we plan for this? By utilizing the married filing jointly tax brackets while you can. One spouse is likely to pass away first, so be prepared when that happens.

Also, consider that tax rates may be the lowest we’ll see because they are among historical lows, and most experts expect them to increase due to our country’s current debt crisis and overspending. Now may be the best time to pay taxes on those tax-deferred vehicles like your IRA and 401(k) while this tax “sale” is here and while you are still in the more generous married filing jointly tax brackets. You could utilize strategies like a Roth conversion to maximize these types of opportunities.

What else you can do

Another consideration is optimizing when you take Social Security to ensure your spouse will be left with the highest benefit when you pass away. Lastly, if you are going to be drawing larger RMDs in the future, now is the time to start reducing that potential liability, to leave your spouse with less taxable income in the future when it matters the most.

To close, it truly bothers me how severe the widow’s penalty is. Jill was penalized $30,000 per year ($24,000 from the loss of income and $6,000 from the increased tax bill). This is something that can be devastating to surviving spouses, especially when one spouse passes away early—and for those who have done a great job saving. In sum, the tax code penalizes those who have saved and those who have had a spouse pass early.

Unfortunately, you can change only what you can control. We cannot control the tax code or laws, but we can control how we plan for it. So, let’s get planning now and make sure our loved ones can continue on with the plan they deserve.

ABOUT THE AUTHOR

As founder and CEO of Peak Retirement Planning Inc., Joe Schmitz Jr., CFP, ChFC, has built a comprehensive retirement planning company focused on helping clients grow and preserve their wealth.

_______

All contents copyright 2023 The Kiplinger Washington Editors Inc. Distributed by Tribune Content Agency LLC.