Small Business

New California Law Bans ‘Junk Fees’ on Hotel Bills, Concert Tickets, and More

You know the ones: A hotel bill that ends with a vague "resort fee." Or those concert tickets that double in price once it's time to type in your credit card information.

Oct. 10, 2023

By Carly Olson, Los Angeles Times (via TNS).

Californians can soon say goodbye to so-called junk fees, those startling charges that appear in a transaction only when a customer is about to hit “purchase.”

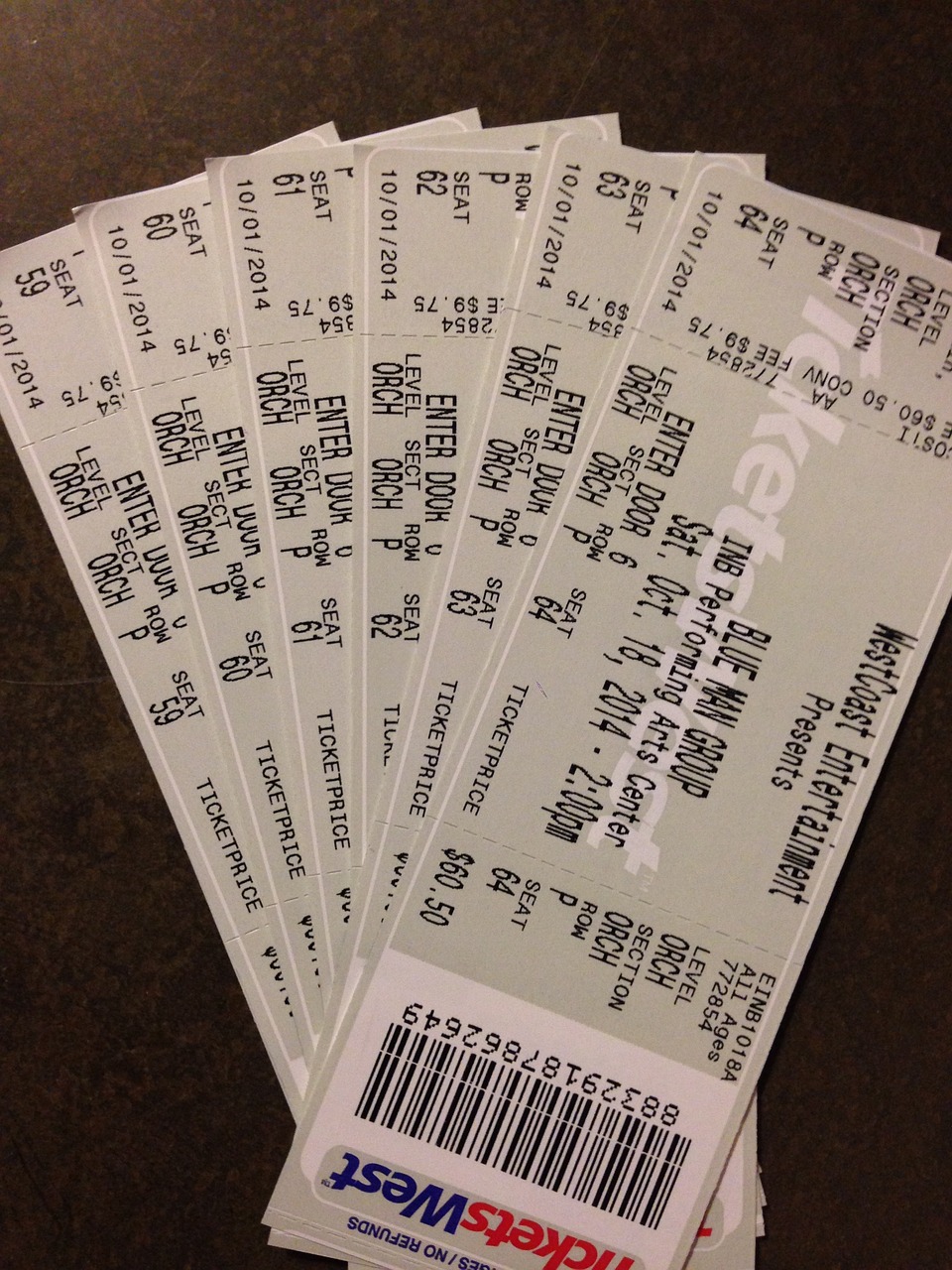

You know the ones: A hotel bill that ends with a vague “resort fee.” Or those concert tickets that double in price once it’s time to type in your credit card information.

On Saturday, Gov. Gavin Newsom signed into law Senate Bill 478, which bans “offering a price for a good or service that does not include all mandatory fees or charges other than taxes or fees imposed by a government on the transaction.”

Also known as hidden fees or surprise fees, junk fees obscure the total cost of a transaction until it’s often too late, or too frustrating, to back out.

The new law, which will go into effect July 1, 2024, won’t necessarily make things cheaper. Businesses are allowed to set prices as they wish, but the final total must be disclosed upfront.

The bill, introduced by state Sens. Bill Dodd (D-Napa) and Nancy Skinner (D-Berkeley), categorizes junk fees as a form of “bait and switch advertising” and a “deceptive” business practice.

“With the signing of SB 478, California now has the most effective piece of legislation in the nation to tackle this problem. The price Californians see will be the price they pay,” California Atty. Gen. Rob Bonta, who has backed the bill since it was introduced earlier this year, said in a statement. He added that junk fees are “bad for consumers and bad for competition.”

The use of junk fees stifles fair market competition, the bill says. Tacking on charges only at the final point of sale makes it harder for consumers to know the true price of what they’re buying, limiting their awareness when comparison shopping for the lowest price.

Ticketing companies in particular have come under fire for tacking on high junk fees that appear at the end of a transaction. A face-value “Platinum” ticket for Blink-182’s June 16 show at BMO Stadium was listed on Ticketmaster at $290, The Times reported. But that was before an additional $47.90 in “service” and “processing” fees, which brought the total to $337.90.

SeatGeek and LiveNation, which owns Ticketmaster, in June pledged they would disclose fees at the beginning of each sale.

“Without knowing the true price of a product or service upfront, the process of comparison shopping becomes nearly impossible,” Jenn Engstrom, state director of the consumer advocacy group CALPIRG, said in a statement.

CALPIRG supports the new law. “In the 50 years that CALPIRG has been fighting for common-sense reforms to protect consumers, this is one of the biggest no-brainers,” Engstrom said. “We applaud the efforts of Gov. Newsom, Atty. Gen. Bonta and the other state leaders to protect Californians’ finances and ensure a fair marketplace.”

Hotel guests sued Marriott International in June over an alleged junk fee imposed at the hotel giant’s Los Angeles hotels. The “hotel worker protection ordinance costs surcharge” violates unfair competition laws, the lawsuit says.

“The cost for Marriott to comply with the ordinance at the Los Angeles Airport Marriott is far less than $3.6 million annually,” the lawsuit said, according to the Wall Street Journal. “Instead, the HWPO Fee is nothing more than a ‘junk fee’ that directly benefits Marriott at the expense of guests at Marriott’s hotels.”

The Biden administration has been a vocal advocate against junk fees, seeming to respond to voters’ economic anxieties. The president vowed in his State of the Union address to crack down on junk fees.

Under pressure from Biden, the Consumer Financial Protection Bureau in February “announced a proposed rule to cut most credit card late fees to no more than $8.”

“Junk fees are not a matter for the wealthy very much, but they’re a matter for working folks, like the homes I grew up in,” Biden said in June. “And they can add hundreds of dollars a month and make it harder for families to pay their bills. I think it’s just wrong.”

=====

©2023 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.