It was another weak quarter for initial public offerings (IPOs) as 34 deals raised a combined total of $7.4 billion between April 1 and June 30, according to a recent analysis from Audit Analytics. The 2023 second quarter IPO output is the lowest in the past five Q2s:

- 2023: 34 ($7.4 billion)

- 2022: 46 ($5.3 billion)

- 2021: 181 ($85.7 billion)

- 2020: 62 ($18.5 billion)

- 2019: 79 ($32.7 billion)

And the 34 IPOs in Q2 is down from the 46 that occurred in the first quarter of this year.

Of the 34 companies that went public, 28 did so via traditional means, raising $6.4 billion, while six special purpose acquisition company (SPAC) IPOs raised total proceeds of $980 million, according to Audit Analytics.

Kenvue Inc., originally formed as a subsidiary of Johnson & Johnson, was the top traditional IPO during Q2, raising more than $3.8 billion in May. PwC is the company’s audit firm, according to Kenvue’s Form 8-K.

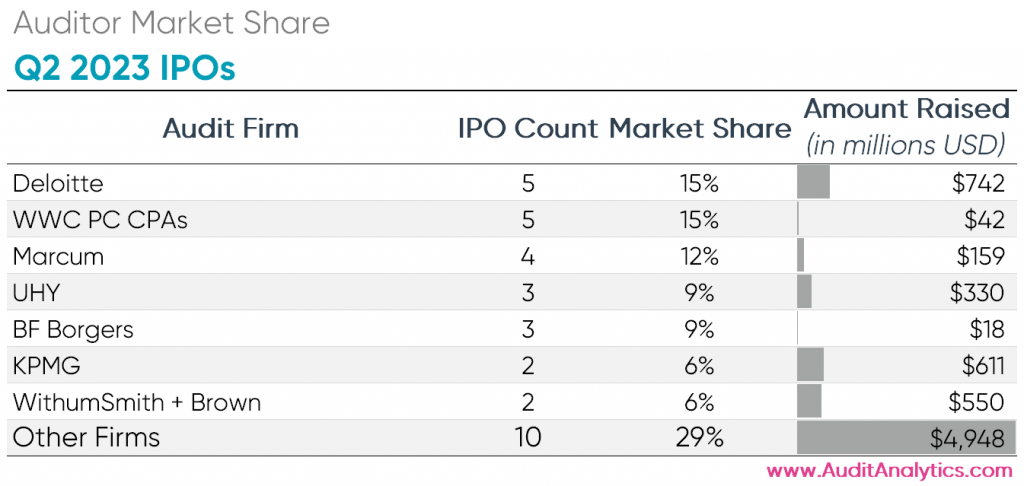

But PwC was not among the leaders in IPO audit market share in the second quarter. Fellow Big Four firm Deloitte and San Francisco-based accounting firm WWC PC CPAs tied with five IPO audit clients each, according to Audit Analytics. Deloitte’s clients also raised the most total proceeds of any individual firm at $742 million. In total, 15 different firms audited the 34 newly listed companies in Q2.

Only three accounting firms audited the six SPAC IPOs completed during Q2. UHY led the market share, auditing three SPAC IPOs during the quarter. However, Withum’s two clients raised the most total proceeds ($550 million). Withum audited Ares Acquistion Corp. II, the largest SPAC IPO seen in Q2, which comprised 82% of the total amount raised. Marcum audited the other SPAC IPO in the second quarter.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Auditing, Firm Management